Answered step by step

Verified Expert Solution

Question

1 Approved Answer

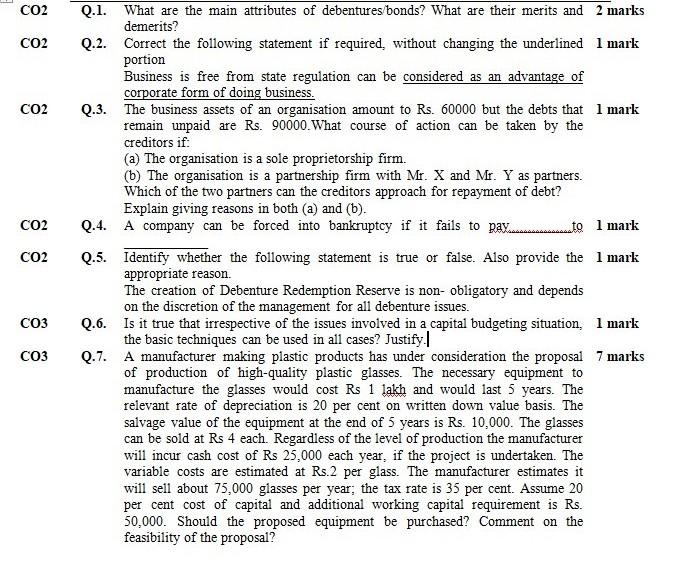

CO2 CO2 CO2 CO2 CO2 Q.1. What are the main attributes of debentures bonds? What are their merits and 2 marks demerits? Q.2. Correct the

CO2 CO2 CO2 CO2 CO2 Q.1. What are the main attributes of debentures bonds? What are their merits and 2 marks demerits? Q.2. Correct the following statement if required, without changing the underlined 1 mark portion Business is free from state regulation can be considered as an advantage of corporate form of doing business. Q.3. The business assets of an organisation amount to Rs. 60000 but the debts that I mark remain unpaid are Rs. 90000. What course of action can be taken by the creditors if: (a) The organisation is a sole proprietorship firm. (b) The organisation is a partnership firm with Mr. X and Mr. Y as partners. Which of the two partners can the creditors approach for repayment of debt? Explain giving reasons in both (a) and (6). Q.4. A company can be forced into bankruptcy if it fails to pay............ to I mark Q.5. Identify whether the following statement is true or false. Also provide the l mark appropriate reason. The creation of Debenture Redemption Reserve is non-obligatory and depends on the discretion of the management for all debenture issues. Q.6. Is it true that irrespective of the issues involved in a capital budgeting situation, 1 mark the basic techniques can be used in all cases? Justify. Q.7. A manufacturer making plastic products has under consideration the proposal 7 marks of production of high-quality plastic glasses. The necessary equipment to manufacture the glasses would cost Rs 1 lakh and would last 5 years. The relevant rate of depreciation is 20 per cent on written down value basis. The salvage value of the equipment at the end of 5 years is Rs. 10,000. The glasses can be sold at Rs 4 each. Regardless of the level of production the manufacturer will incur cash cost of Rs 25,000 each year, if the project is undertaken. The variable costs are estimated at Rs.2 per glass. The manufacturer estimates it will sell about 75,000 glasses per year, the tax rate is 35 per cent. Assume 20 per cent cost of capital and additional working capital requirement is Rs. 50,000. Should the proposed equipment be purchased? Comment on the feasibility of the proposal? CO3 CO3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started