Answered step by step

Verified Expert Solution

Question

1 Approved Answer

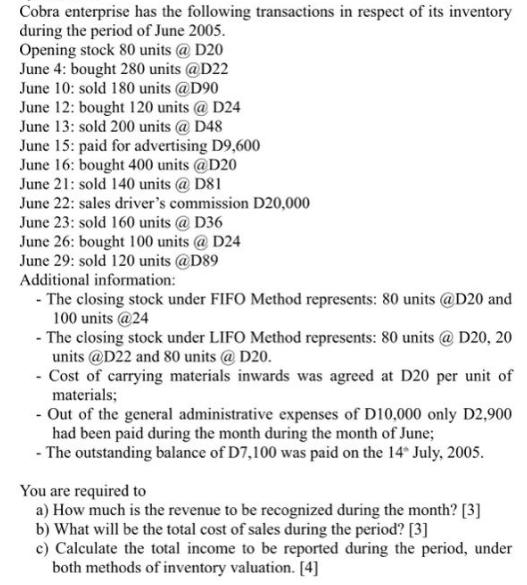

Cobra enterprise has the following transactions in respect of its inventory during the period of June 2005. Opening stock 80 units @ D20 June

Cobra enterprise has the following transactions in respect of its inventory during the period of June 2005. Opening stock 80 units @ D20 June 4: bought 280 units @D22 June 10: sold 180 units @D90 June 12: bought 120 units @ D24 June 13: sold 200 units @ D48 June 15: paid for advertising D9,600 June 16: bought 400 units @D20 June 21: sold 140 units @ D81 June 22: sales driver's commission D20,000 June 23: sold 160 units @ D36 June 26: bought 100 units @ D24 June 29: sold 120 units @D89 Additional information: - The closing stock under FIFO Method represents: 80 units @D20 and 100 units @24 - The closing stock under LIFO Method represents: 80 units @ D20, 20 units @D22 and 80 units @ D20. - Cost of carrying materials inwards was agreed at D20 per unit of materials; - Out of the general administrative expenses of D10,000 only D2,900 had been paid during the month during the month of June; - The outstanding balance of D7,100 was paid on the 14 July, 2005. You are required to a) How much is the revenue to be recognized during the month? [3] b) What will be the total cost of sales during the period? [3] c) Calculate the total income to be reported during the period, under both methods of inventory valuation. [4]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Revenue to be recognized during the month Sales on 4 June 180 units D90 180 x 90 D16200 Sales on 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started