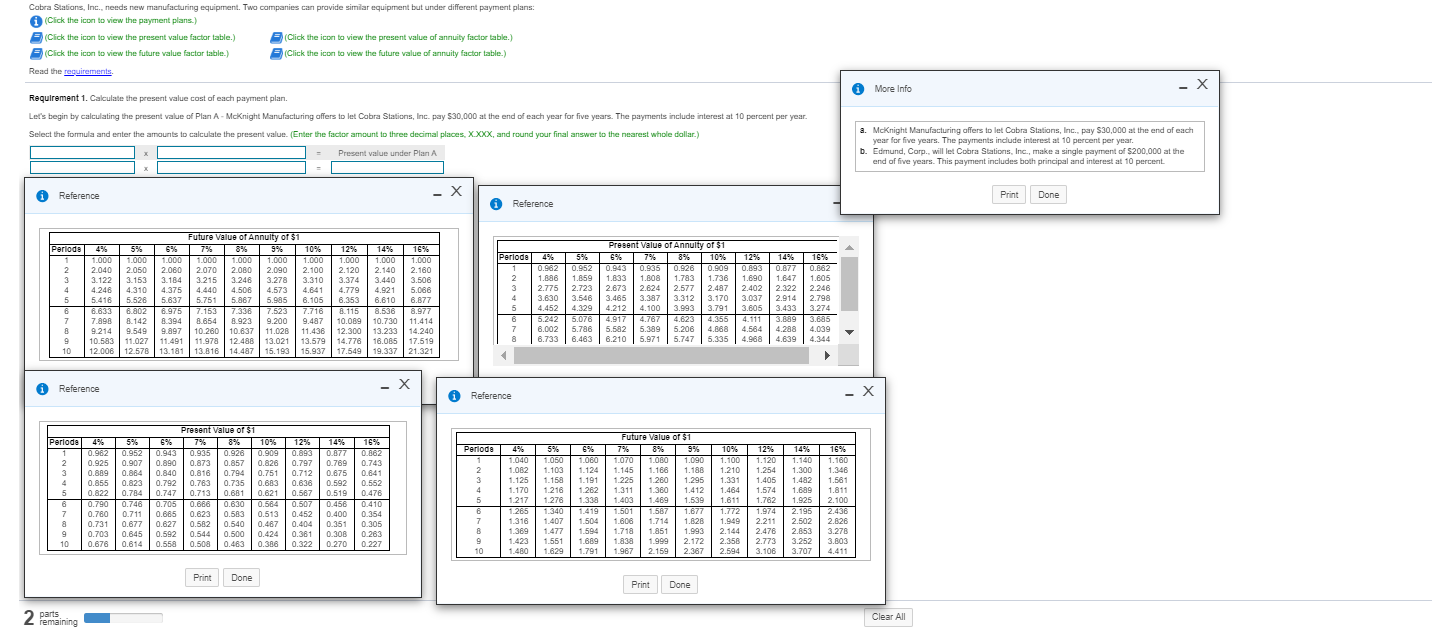

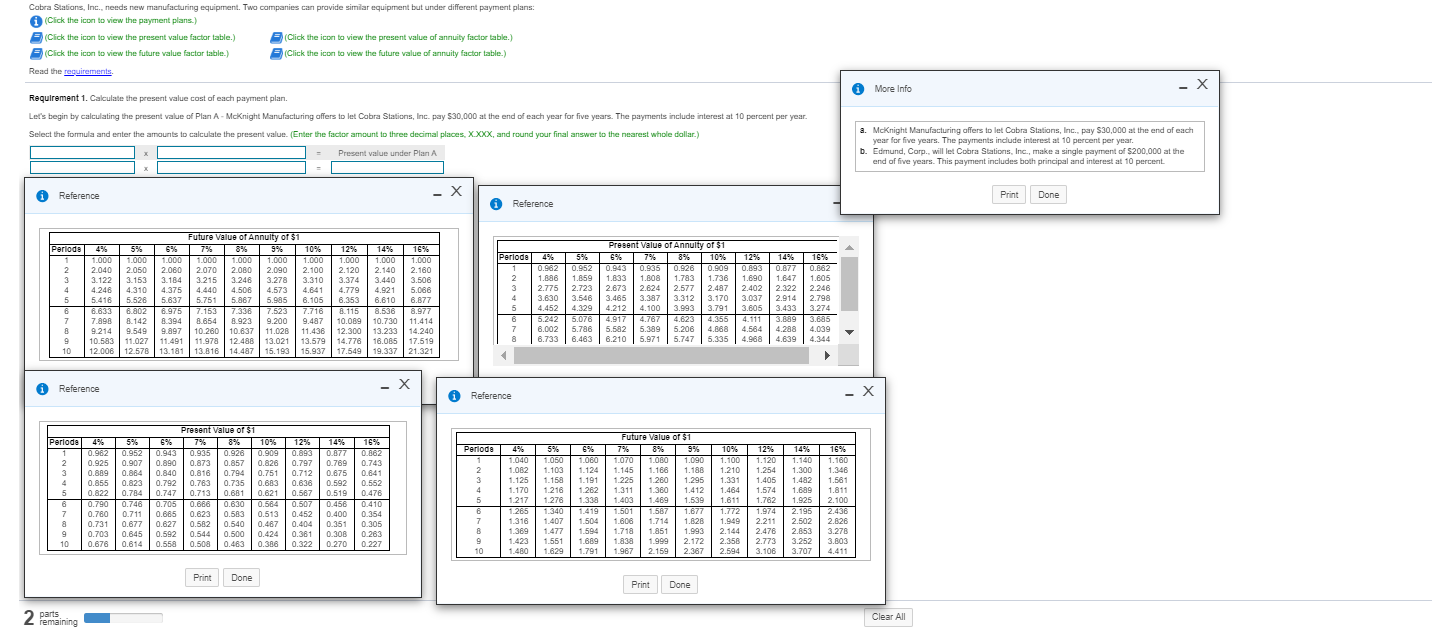

Cobra Stations, Inc., needs new manufacturing equipment. The companies can provide similar equipment but under different payment plans Click the icon to view the payment plans) (Click the icon to view the present value factor table.) Click the icon to view the present value of annuity factor table.) (Click the icon to view the future value factor table) Click the icon to view the future value of nuity factor table.) Read the rements More Info - X Requirement 1. Calculate the present value cost of each payment plan Let's begin by calculating the present value of Plan A. McKnight Manufacturing offers to let Cobra Stations, Inc. pay $30,000 at the end of each year for five years. The payments include interest at 10 percent per year. Select the formula and enter the amounts to calculate the present value. (Enter the factor amount to three decimal places, XXX, and round your final answer to the nearest whole dolar) - Present value under Plan A a. McKnight Manufacturing offers to let Cobra Stations, Inc., pay $30,000 at the end of each year for five years. The payments include interest at 10 percent per year. b. Edmund, Corp., will let Cobra Stations, Inc., make a single payment of $200.000 at the end of five years. This payment includes both principal and interest at 10 percent Reference Print Done 0 Reference Future Value of Annuity of $1 Periodo 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% TODO 17000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2040 2050 2060 1 2070 2080 2.090 2.100 2.120 2.140 2.160 3.122 3.153 3.184 | 3.215 3.248 3.278 3.310 3.374 3.440 3.506 4.246 4.310 4.375 4.440 4.5084.573 4.641 4.779 14.9215,066 5.416 5.526 5.6371 5.751 5 .867 5.995 | 6.105 6.353 6,610 6.877 663802697513736 7523 7.7168.115 8.5368.977 7.898 8.142 1394 8.654 8.9239.2009.487 10.069 10.730 11.414 9.2149 .549 9.897 10.280 10.637 11,028 11.436 12.300 13.233 14,240 10.583 11.027 11.49111.978 12.488 13.021 13.579 14,778 16,085 17.519 10 1 2006 12 578 13.181 13.816 14.487 15.193 15.937 17.549 19.337 21,321 Present Value of Annuity of $1 Periodo 4% 5% 6% 7% 8% 10% 12% 0.9. 2 0.9520.9430.935 0.926 0.9090.893 1.886 1.859 1.833 1.308 1.783 1.736 1.690 2.775 2.723 2.673 2.624 2.577 2487 2.402 3.630 3.546 3.485 3.312 3.170 3,037 14.452 4.329 4.212 4.100 3.993 3.791 3.605 5.2425 .076 491 4.767 4.62 4.355 4.111 6.002 5.786 5.582 5.349 5.206 4,668 4,564 8 6.7336.483 6.210 5.971 5.7475.335 4.988 14% 15% 0.877 0.862 1,647 1.605 2.322 2.246 2.914 2.798 3,433 3.274 3.6.893.685 4.288 4,039 4.639 14,344 Reference X Reference 12% 14% 15% Future Value of 51 7% 8% 9% Periodo 4% 5% 6% 10% 12% 14% 16% 0.797 0.743 0.789 0.675 0.592 Present Value of $1 Periodel 4% 5% 6% 7 % 10% 1902 019520794301935 0.928 0.925 0.907 0.890 0.873 0.857 0.828 0.889 0.864 0.840 0.855 0.823 0.792 0.763 0.735 0.683 0.822 0.784 0.747 0.713 090 0740 0705868 0.780 0.7110.885 0.623 0.583 0.513 0.731 101877 0162701582 0.540 0467 0.703 01845 01592 01544 0.500 101424 1878 181401558 0 452 0.400 0404 0.351 0.3810308 0270 0.305 0.263 2.850 Done Print Done Clear All 2 parts remaining