Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coca-cola Co. 10-k report for last three years: Walmart Inc. 10-k report. After looking at the 10-ks provided, calculate the financial ratios for the balance

Coca-cola Co. 10-k report for last three years:

Walmart Inc. 10-k report.

After looking at the 10-ks provided, calculate the financial ratios for the balance sheet, for the last three years for both companies?

How did the companies compare? What do these ratios mean specifically for these companies? Elaborate and be specific.

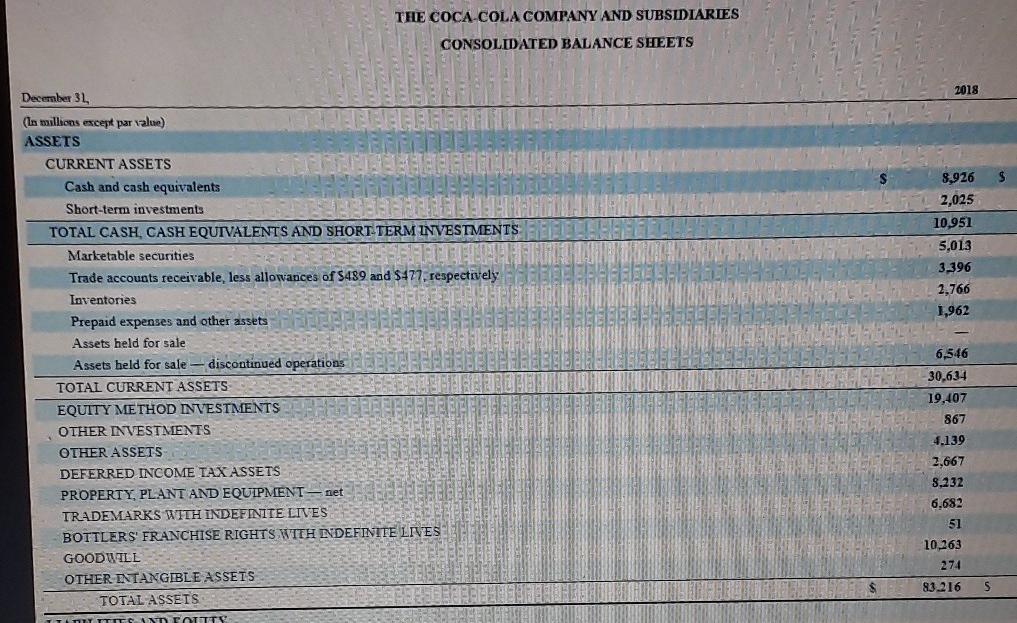

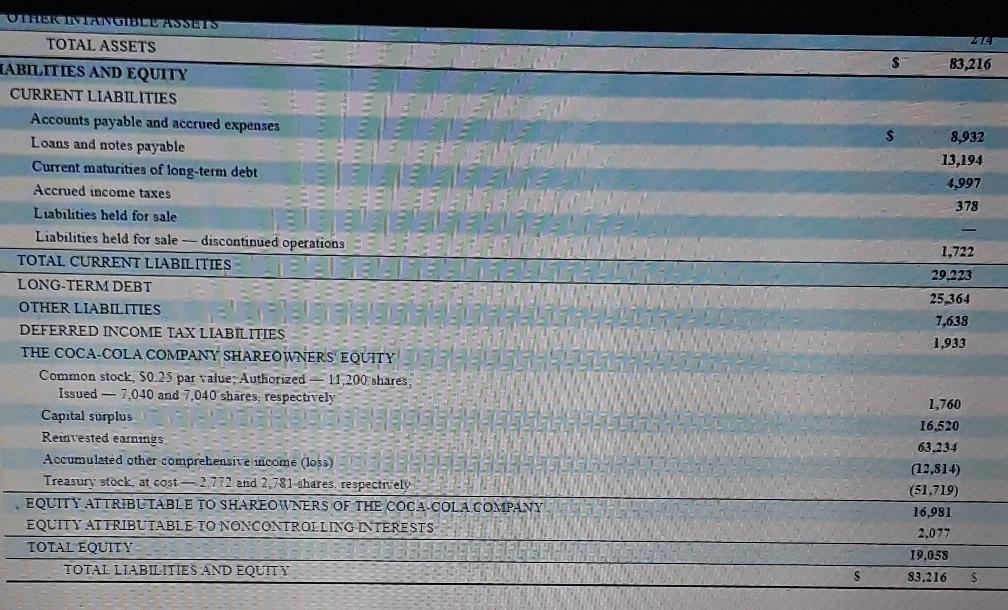

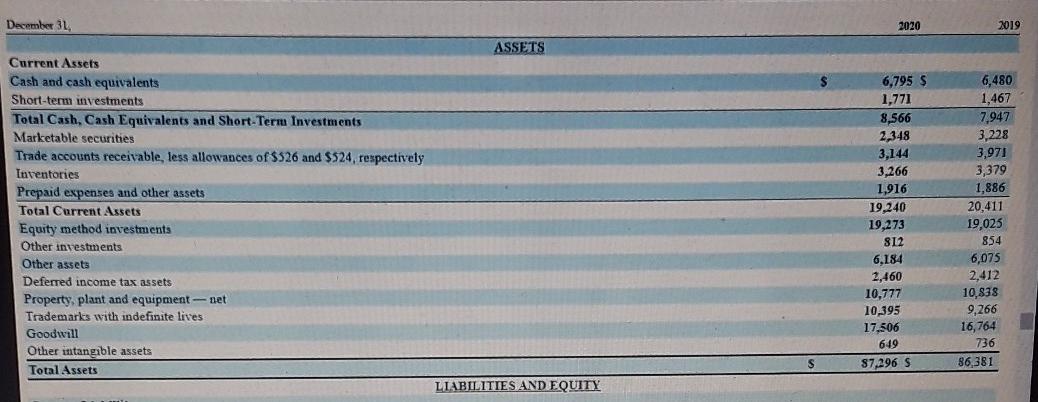

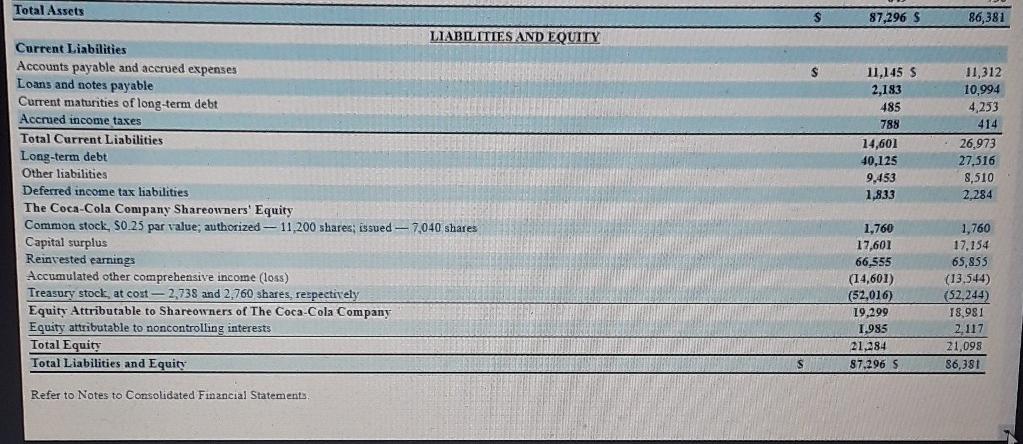

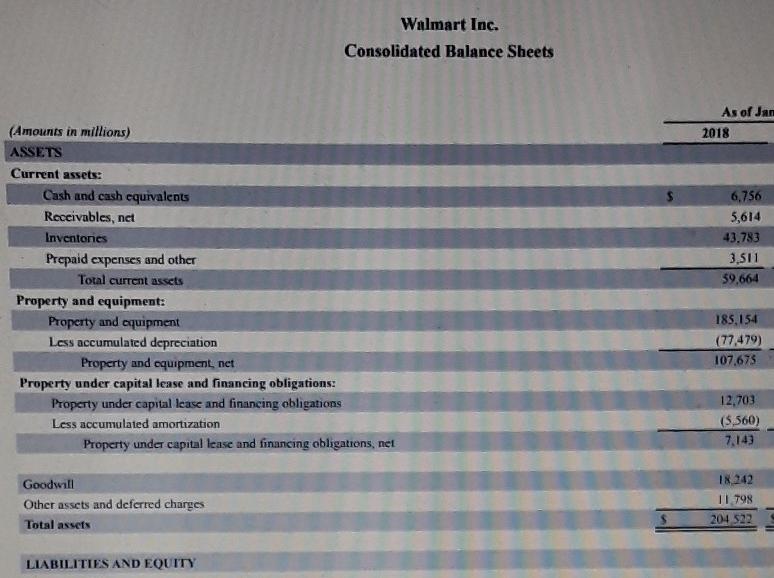

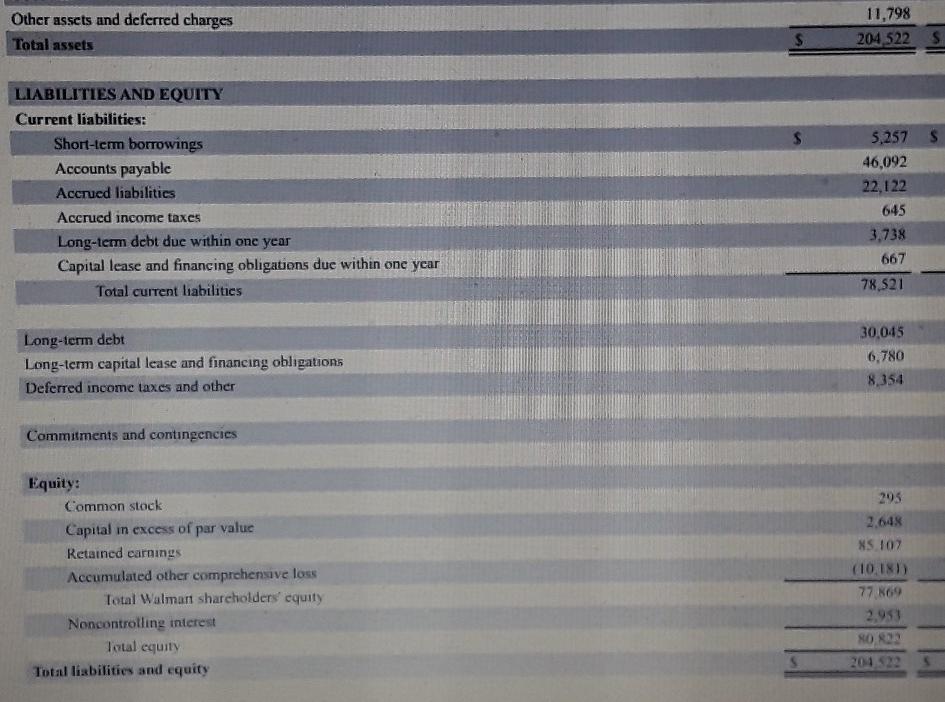

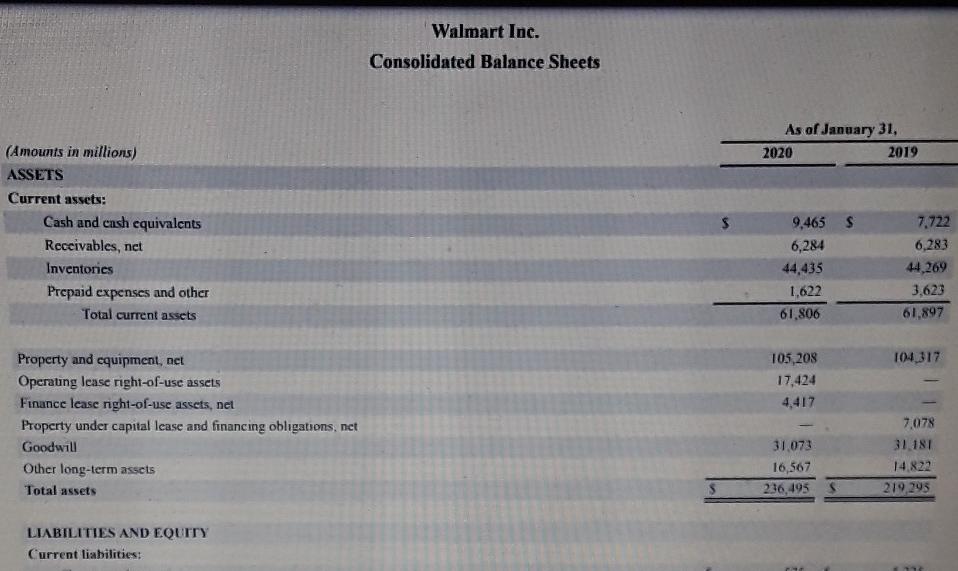

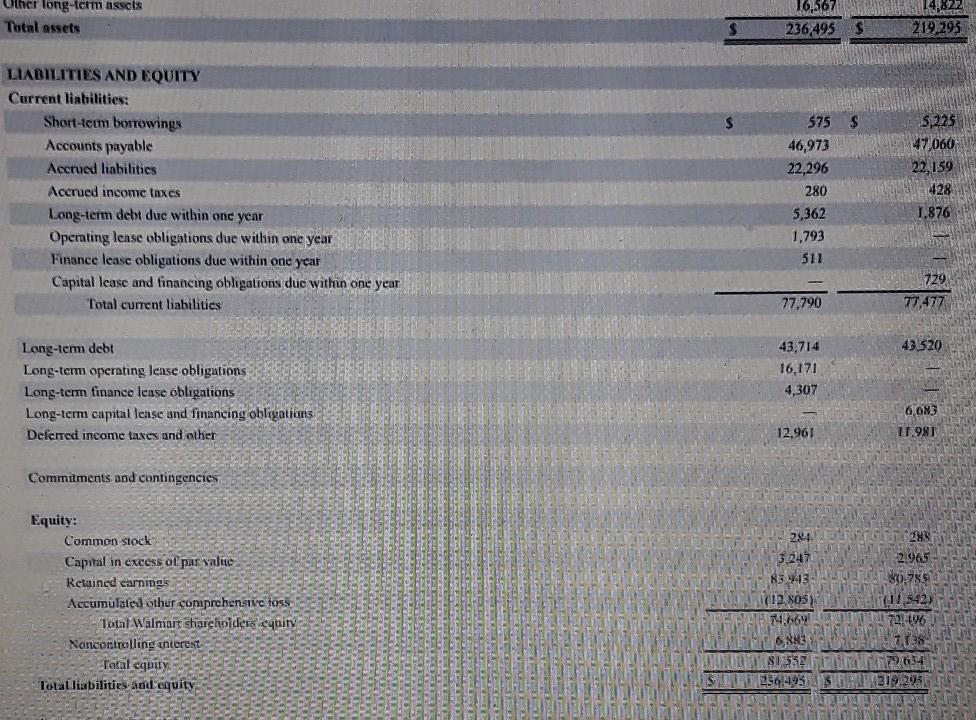

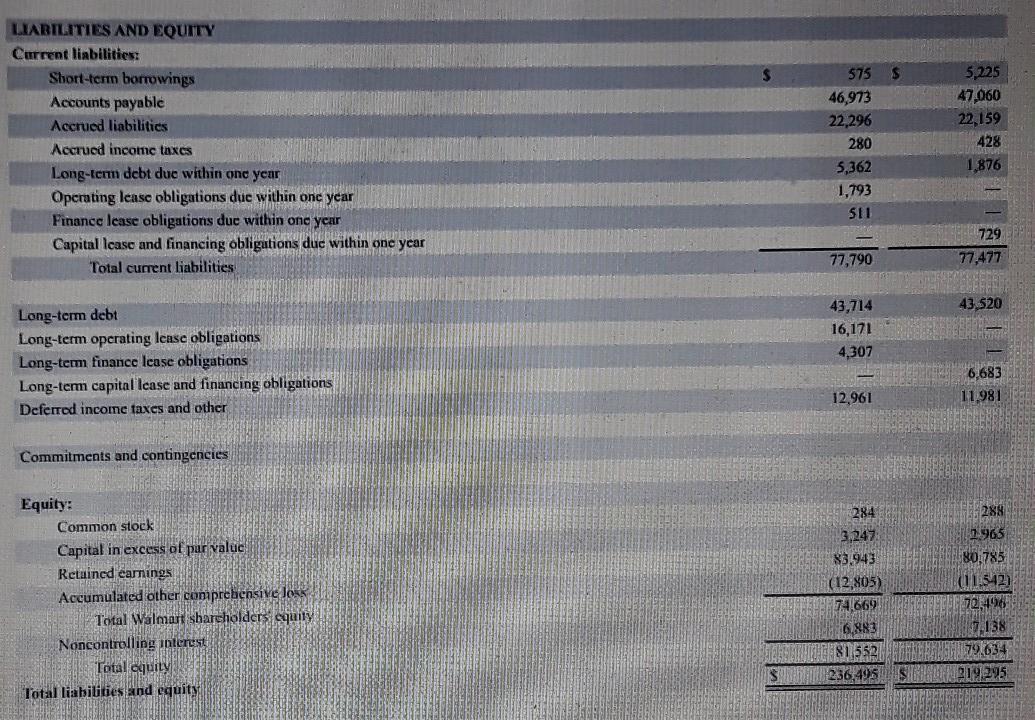

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS 2018 8,926 2,025 10.951 5,013 3,396 1,766 1,962 December 31 (Las baillons except par value) ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of S489 and $477. respectively Inventories Prepaid expenses and other assets Assets held for sale Assets held for sale - discontinued operations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS BER OTHER INVESTMENTS OTHER ASSETS DEFERRED INCOME TAX ASSETS PROPERTY, PLANT AND EQUIPMENT - net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS INITITSYT TOUTTY 6,546 30,634 19,407 867 4.139 2.667 8.232 6.682 51 10,263 274 83.216 S 27 83,216 8,932 13,194 4.997 378 181818 =" URBRINGINGIBLU HISSETS TOTAL ASSETS IABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale Liabilities held for sale - discontinued operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAX LIABILITIES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value: Authorized 11,200 shares; Issued - 7,040 and 7,040 shares, respectively Capital surplus Reinvested eamngs Accumulated other comprehensive income (loss) Treasury stock at cost 2.772 and 2.781 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1,722 29.223 25.364 1,638 1,933 1,760 16,520 63,234 (12,814) (51.719) 16.981 2.077 19.055 83.216 S S December 31 2020 2019 ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $526 and $524, respectively Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment - net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets 6,795 S 1,771 8,566 2,348 3,144 3,266 1,916 19,240 19,273 812 6.184 2,460 10,777 10,395 17.506 649 87.296 S 6,480 1,467 7,947 3,228 3,971 3,379 1,886 20.411 19,025 854 6,075 2,412 10,838 9,266 16,764 736 86.381 S LIABILITIES AND EQUITY S 87,296 S 86,381 S Total Assets LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, SO.25 par value; authorized - 11,200 shares: issued - 7,040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (los) Treasury stock, at cost - 2,738 and 2,760 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity 11,145 5 2,183 485 788 14,601 40,125 9,453 1,833 11,312 10,994 4,253 414 26,973 27,516 8,510 2.284 1,760 17,601 66,555 (14,601) (52,016) 19,299 1.985 21,284 87.296 S 1,760 17.154 65,855 (13.544) (52,244) 18,981 2.117 21,098 86,381 S Refer to Notes to Consolidated Financial Statements Walmart Inc. Consolidated Balance Sheets As of Jan 2018 6.756 5,614 43.783 3,511 59,664 (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventones Prepaid expenses and other Total current assets Property and equipment: Property and equipment Less accumulated depreciation Property and equipment, net Property under capital lease and financing obligations: Property under capital lease and financing obligations Less accumulated amortization Property under capital lease and financing obligations, nel 185,154 (77.479) 107,673 12,703 (5,560) 7.143 Goodwill Other assets and deferred charges Total assets 18242 11.798 204 522 LIABILITIES AND EQUITY Other assets and deferred charges Total assets 11,798 204 522 $ s LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities 5.257 46,092 22,122 645 3,738 667 78,521 Long-term debt Long-term capital lease and financing obligations Deferred income taxes and other 30.045 6.780 8,354 Commitments and contingencies Equity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' cquity Noncontrolling interest Total equity Total liabilities and equity 295 2.648 NS 102 (10.183) 77 869 2,953 NOR 204522 Walmart Inc. Consolidated Balance Sheets As of January 31, 2020 2019 (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets 9,465 $ 6,284 44,435 1,622 61.806 7.722 6,283 44,269 3.623 61,897 104.317 105,208 17,424 4,417 Property and equipment, act Operaung lcase right-of-use assets Finance lease night-of-use assets, nel Property under capital lease and financing obligations, net Goodwill Other long-term assets Total assets 31 073 16,567 236,495 7,078 31181 14,822 219.295 LIABILITIES AND EQUITY Current liabilities: Other long-term assols Total assets 16,567 236,495 $ 14,822 219.295 $ $ LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lense obligations due within one year Finance lease obligations due within one year Capital lease and financing obligations due within one year Total current liabilities 575 46,973 22,296 280 5.362 1.793 5,225 47060 22 159 428 1,876 511 729 77,477 77,790 43.520 Long-term debt Long-term operating lease obligations Long-term finance lease obligations Long-term capital lense and Timancing obligations Deferred income taxes and other 43,714 16,171 4,307 6,083 11.981 12.961 Commitments and contingencies 284 3247 5443 2965 0755 Equity: Common stock Capital in excess oL par value Retained earnings Accumulated other comprehensive toss Total Walmart shareholders canity Nancontrolling interest Total cquity Totallisbilities and cquity 12. EL 74.569 WE 1 842) 72116 6.883 TA 81552 S256 495 $ LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance Icase obligations due within one year Capital lease and financing obligations due within one year Total current liabilities 575 46,973 22,296 280 5.362 1,793 511 5,225 47,060 22.159 428 1,876 729 77,477 77,790 43,714 43.520 16,171 4,307 Long-term debt Long-term operating lease obligations Long-term finance lease obligations Long-term capital lease and financing obligations Deferred income taxes and other 6,683 11.981 12.961 Commitments and contingencies 288 Equity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive Joss Total Walmart shareholders equiry Noncontrolling interest Total equity Total liabilities and equity 284 3.247 83.943 (12,805) 74669 6,883 81552 236,495 1965 80.785 (11.542) 72,498 7.138 79.634 SMAN 2191295 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started