Question

Coca-Cola issued their quarterly earnings release (2020 Q4) this past week which includes the following unaudited 2020 financial statements: (1) an income statement and a

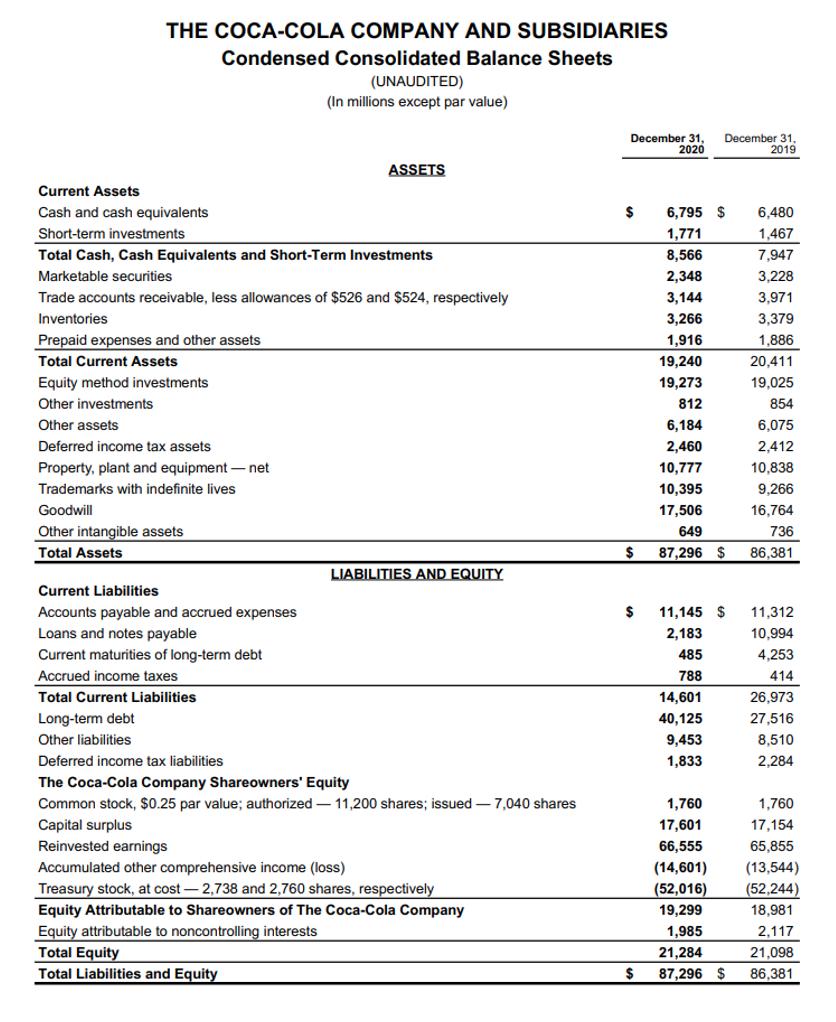

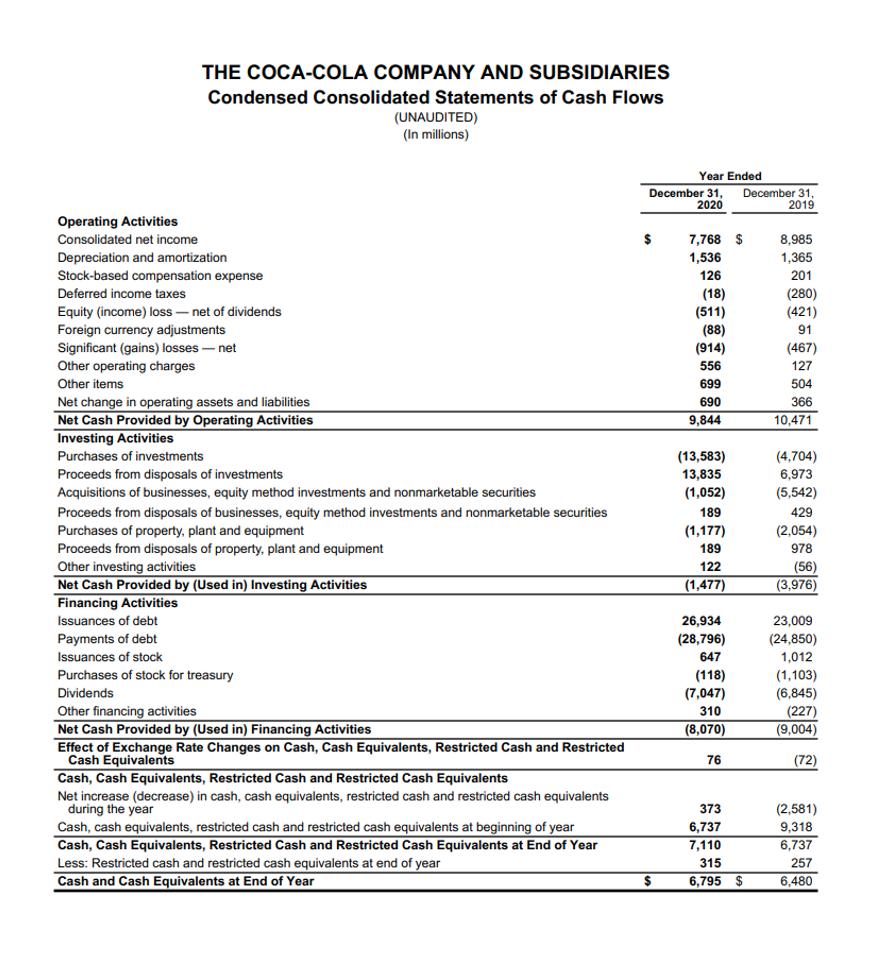

Coca-Cola issued their quarterly earnings release (2020 Q4) this past week which includes the following unaudited 2020 financial statements: (1) an income statement and a cash flows statement for the year ended December 31, 2020 and (2) a balance sheet as of December 31, 2020. A copy of each of these financial statements is included at the end of this.

- Coca-Cola presents their income statement in a multi-step format. Discuss your understanding of the multi-step income statement. Here are a few questions to consider: What does “multi-step” mean? As a publicly traded company, is Coca-Cola required to use this format? What are the advantages of using a multi-step format over a single-step format? What information is conveyed, or at least made apparent, by the subtotals and groupings in a multi-step income statement? In your opinion, which subtotals in Coca-Cola’s multi-step income statement are particularly informative? What can an investor learn from them?

- Coca-Cola presents two EPS calculations in its income statement (Basic and Diluted). What is the meaning of each of these two figures? Why do we need both? If you were an investor in Coca-Cola, would you want the difference between the two numbers to be small or large? Why?

- Coca-Cola reports Consolidated Net Income of $7,768 million in 2020. Their income statement makes no mention of discontinued operations. Assume instead the following hypothetical scenario:

On January 15, 2021 Coca-Cola disposed of a domestic bottling business that qualifies as a material segment of the company. As of December 31, 2020, the segment was considered held for sale. The segment experienced a net operating loss of $130 million in 2020. As of December 31, 2020, the book value of the bottling segment was $430 million. Management of Coca-Cola estimates the segment’s fair value on that date to be $360 million. Management also estimates $10 million in costs associated with selling the segment. Assume Coca-Cola pays income taxes of 20%.

Construct the bottom portion of Coca-Cola’s income statement to reflect discontinued operations. Begin your income statement with Income from Continuing Operations of $7,768 million.

Income from Continuing Operations | $ 7,768 |

- Define the term Comprehensive Income. In your response, use the language we used in class. Coca-Cola did not include a statement of comprehensive income in their earnings release (it will be part of the 10-K which will come out later this month). What can you learn about the amount of total comprehensive income from the financial statements provided here? Is it possible to estimate the total amount of comprehensive income? Show me.

- Does Coca-Cola use the direct or indirect method of presenting the statement of cash flows? How do you know this? How would the statement look different if the opposite method was used? Describe why Coca-Cola lists Depreciation and amortization as a positive number in the Operating Activities section of the cash flows statement.

THE COCA-COLA COMPANY AND SUBSIDIARIES Condensed Consolidated Balance Sheets (UNAUDITED) (In millions except par value) December 31, 2020 December 31. 2019 ASSETS Current Assets Cash and cash equivalents 6,795 $ 6,480 Short-term investments 1,771 1,467 Total Cash, Cash Equivalents and Short-Term Investments 8,566 7,947 Marketable securities 2,348 3,228 Trade accounts receivable, less allowances of $526 and $524, respectively 3,144 3,971 Inventories 3,266 3,379 Prepaid expenses and other assets 1,916 1,886 Total Current Assets 19,240 20,411 Equity method investments 19,273 19,025 Other investments 812 854 Other assets 6,184 6,075 Deferred income tax assets 2,460 2,412 Property, plant and equipment - net 10,777 10,838 Trademarks with indefinite lives 10,395 9,266 Goodwill 17,506 16,764 Other intangible assets 649 736 Total Assets 87,296 $ 86,381 LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued expenses $ 11,145 $ 11,312 Loans and notes payable 2,183 10,994 Current maturities of long-term debt 485 4,253 Accrued income taxes 788 414 Total Current Liabilities 14,601 26,973 Long-term debt 40,125 27,516 Other liabilities 9,453 8,510 Deferred income tax liabilities 1,833 2,284 The Coca-Cola Company Shareowners' Equity Common stock, $0.25 par value; authorized 11,200 shares; issued - 7,040 shares 1,760 1,760 17,601 Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost - 2,738 and 2,760 shares, respectively 17,154 66,555 65,855 (14,601) (13,544) (52,244) 18,981 (52,016) Equity Attributable to Shareowners of The Coca-Cola Company 19,299 Equity attributable to noncontrolling interests 1,985 2,117 Total Equity 21,284 21,098 Total Liabilities and Equity $ 87,296 $ 86,381

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 MultiStep Income Statement The multistep income statement is an approach to presenting financial performance that is more comprehensive than the singlestep income statement This format groups ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started