Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coconut Corp. Prepares its financial statements under IFRS During the Year 2 0 2 0 : The company begins operations on January 1 , 2

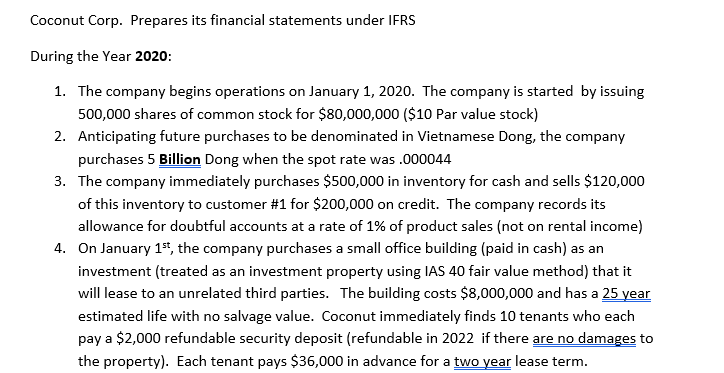

Coconut Corp. Prepares its financial statements under IFRS

During the Year :

The company begins operations on January The company is started by issuing

shares of common stock for $ $ Par value stock

Anticipating future purchases to be denominated in Vietnamese Dong, the company

purchases Billion Dong when the spot rate was

The company immediately purchases $ in inventory for cash and sells $

of this inventory to customer # for $ on credit. The company records its

allowance for doubtful accounts at a rate of of product sales not on rental income

On January the company purchases a small office building paid in cash as an

investment treated as an investment property using IAS fair value method that it

will lease to an unrelated third parties. The building costs $ and has a ear

estimated life with no salvage value. Coconut immediately finds tenants who each

pay a $ refundable security deposit refundable in if there are no damages to

the property Each tenant pays $ in advance for a two year lease term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started