Answered step by step

Verified Expert Solution

Question

1 Approved Answer

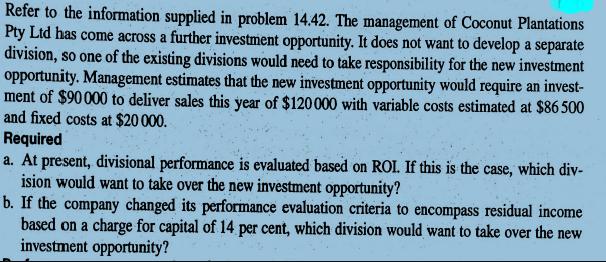

Refer to the information supplied in problem 14.42. The management of Coconut Plantations Pty Ltd has come across a further investment opportunity. It does

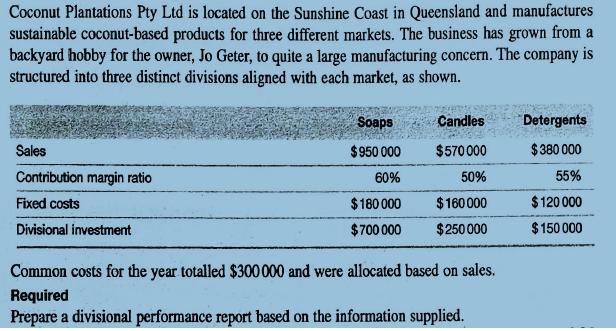

Refer to the information supplied in problem 14.42. The management of Coconut Plantations Pty Ltd has come across a further investment opportunity. It does not want to develop a separate division, so one of the existing divisions would need to take responsibility for the new investment opportunity. Management estimates that the new investment opportunity would require an invest- ment of $90000 to deliver sales this year of $120000 with variable costs estimated at $86 500 and fixed costs at $20 000. Required a. At present, divisional performance is evaluated based on ROL. If this is the case, which div- ision would want to take over the new investment opportunity? b. If the company changed its performance evaluation criteria to encompass residual income based on a charge for capital of 14 per cent, which division would want to take over the new investment opportunity? Coconut Plantations Pty Ltd is located on the Sunshine Coast in Queensland and manufactures sustainable coconut-based products for three different markets. The business has grown from a backyard hobby for the owner, Jo Geter, to quite a large manufacturing concern. The company is structured into three distinct divisions aligned with each market, as shown. Soaps Candles Detergents Sales $950 000 $570000 $380 000 Contribution margin ratio 60% 50% 55% Fixed costs $180 000 $160 000 $120 000 Divisional investment $700 000 $250 000 $150 000 Common costs for the year totalled $300 000 and were allocated based on sales. Required Prepare a divisional performance report based on the information supplied.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of present ROI Particulars soaps candles detergents Total sales 950000 570000 380000 190...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started