Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COD TUE FOLLOWING BUSINESS SCENARIO; PrinTech lne, has served the American market for 3D Printers for almost a docnde. intelligence on the viability of this

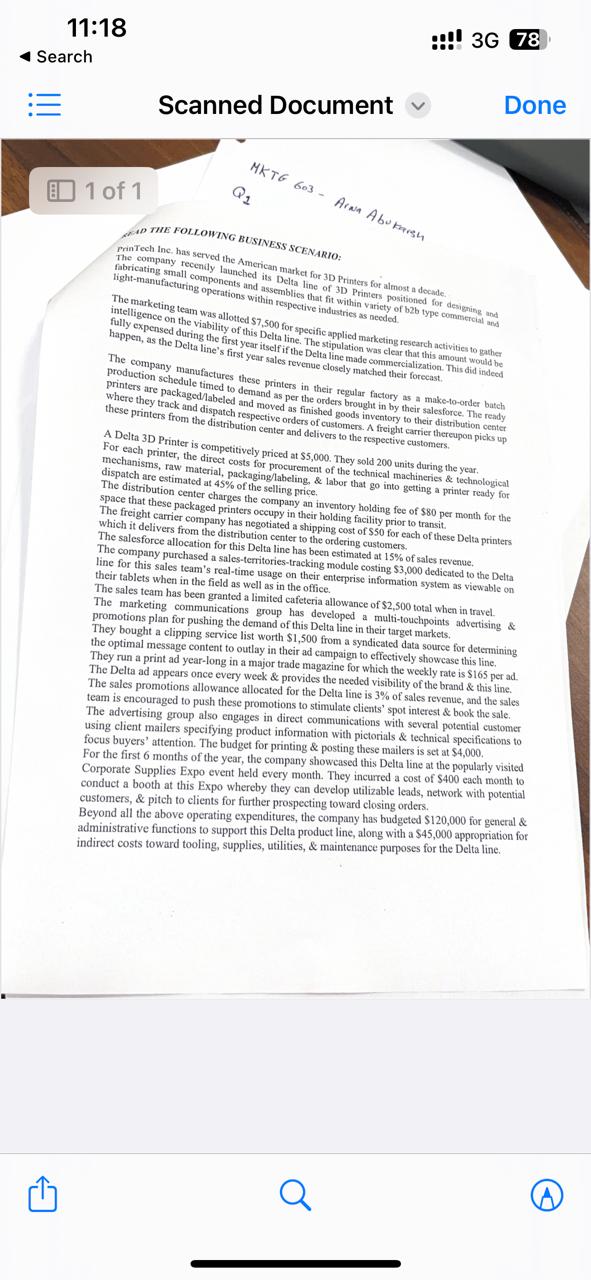

COD TUE FOLLOWING BUSINESS SCENARIO; PrinTech lne, has served the American market for 3D Printers for almost a docnde. intelligence on the viability of this Deltf fir the Delta line made commercialization. This did indeed production schedule timed to dese printers in their regular factory as a make-to-order bateh printers are packaged/labeled and moved as finished goought in by their salesforce. The ready where they track and dispatch respective orders of customens. A freight carrier thereupon picks up these printers from the distribution center and delivers to the respective custritomers. A Delta 3D Printer is competitively priced at $5,000. They sold 200 units during the year. For each printer, the direct costs for procurement of the technical machineries \& technological mechanisms, raw material, packaging/labeling, \& labor that go into getting a printer ready for dispatch are estimated at 45% of the selling price. space that these center charges the company an inventory holding fee of $80 per month for the The freight carrier company has negupy in their holding facility prior to transit. which it delivers from the distribution cent a shipping cost of $50 for each of these Delta printers The salesforce allocation for this Delta line to the ordering customers. The company purchased a sales-territories- has been estimated at 15% of sales revenue, line for this sales team's real-time usage-tracking module costing $3,000 dedicated to the Delta their tablets when in the field as well as in their enterprise information system as viewable on The sales team has been granted a limited the office. The marketing communications group cafeteria allowance of $2,500 total when in travel. promotions plan for pushing the demand has developed a multi-touchpoints advertising \& They bought a clipping service list worth $1,500 fra line in their target markets. the optimal message content to outlay in $1,500 from a syndicated data source for determining They run a print ad year-long in a may in their ad campaign to effectively showcase this line. The Delta ad appears once in a major trade magazine for which the weekly rate is $165 per ad. The sales promotions allowance week \& provides the needed visibility of the brand \& this line. team is encouraged to push these allocated for the Delta line is 3% of sales revenue, and the sales The advertising group also engages dirotions to stimulate clients' spot interest \& book the sale. using client mailers specifying pres in direct communications with several potential customer focus buyers' attention. The broduct information with pictorials \& technical specifications to For the first 6 months of the budget for printing \& posting these mailers is set at $4,000. Corporate Supplies Exp the year, the company showeased this Delta line at the popularly visited conduct a booth at customers, \& ath the Expo whereby they can develilizable leads, network with potential Beyond a pitch to clients for further prospecting toward closing orders. administratio above operating expenditures, the company has budgeted $120,000 for general \& indinistrative functions to support this Delta product line, along with a $45,000 appropriation for indirect costs toward tooling, supplies, utilities, \& maintenance purposes for the Delta line

COD TUE FOLLOWING BUSINESS SCENARIO; PrinTech lne, has served the American market for 3D Printers for almost a docnde. intelligence on the viability of this Deltf fir the Delta line made commercialization. This did indeed production schedule timed to dese printers in their regular factory as a make-to-order bateh printers are packaged/labeled and moved as finished goought in by their salesforce. The ready where they track and dispatch respective orders of customens. A freight carrier thereupon picks up these printers from the distribution center and delivers to the respective custritomers. A Delta 3D Printer is competitively priced at $5,000. They sold 200 units during the year. For each printer, the direct costs for procurement of the technical machineries \& technological mechanisms, raw material, packaging/labeling, \& labor that go into getting a printer ready for dispatch are estimated at 45% of the selling price. space that these center charges the company an inventory holding fee of $80 per month for the The freight carrier company has negupy in their holding facility prior to transit. which it delivers from the distribution cent a shipping cost of $50 for each of these Delta printers The salesforce allocation for this Delta line to the ordering customers. The company purchased a sales-territories- has been estimated at 15% of sales revenue, line for this sales team's real-time usage-tracking module costing $3,000 dedicated to the Delta their tablets when in the field as well as in their enterprise information system as viewable on The sales team has been granted a limited the office. The marketing communications group cafeteria allowance of $2,500 total when in travel. promotions plan for pushing the demand has developed a multi-touchpoints advertising \& They bought a clipping service list worth $1,500 fra line in their target markets. the optimal message content to outlay in $1,500 from a syndicated data source for determining They run a print ad year-long in a may in their ad campaign to effectively showcase this line. The Delta ad appears once in a major trade magazine for which the weekly rate is $165 per ad. The sales promotions allowance week \& provides the needed visibility of the brand \& this line. team is encouraged to push these allocated for the Delta line is 3% of sales revenue, and the sales The advertising group also engages dirotions to stimulate clients' spot interest \& book the sale. using client mailers specifying pres in direct communications with several potential customer focus buyers' attention. The broduct information with pictorials \& technical specifications to For the first 6 months of the budget for printing \& posting these mailers is set at $4,000. Corporate Supplies Exp the year, the company showeased this Delta line at the popularly visited conduct a booth at customers, \& ath the Expo whereby they can develilizable leads, network with potential Beyond a pitch to clients for further prospecting toward closing orders. administratio above operating expenditures, the company has budgeted $120,000 for general \& indinistrative functions to support this Delta product line, along with a $45,000 appropriation for indirect costs toward tooling, supplies, utilities, \& maintenance purposes for the Delta line Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started