Answered step by step

Verified Expert Solution

Question

1 Approved Answer

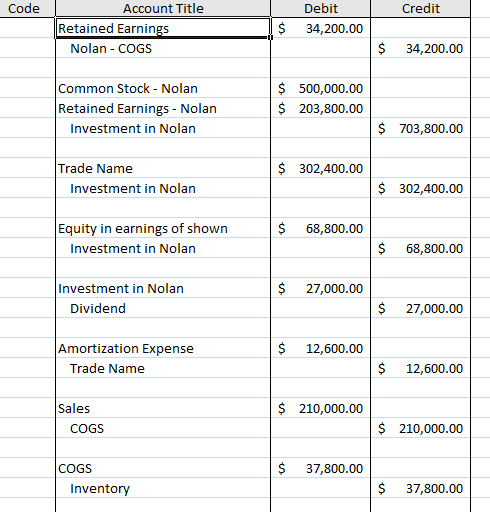

Code Account Title Debit Retained Earnings $ Credit Nolan - COGS 34,200.00 $ 34,200.00 Common Stock - Nolan $ 500,000.00 Retained Earnings - Nolan

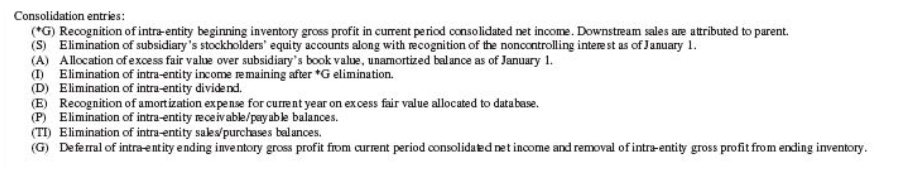

Code Account Title Debit Retained Earnings $ Credit Nolan - COGS 34,200.00 $ 34,200.00 Common Stock - Nolan $ 500,000.00 Retained Earnings - Nolan $ 203,800.00 Investment in Nolan $ 703,800.00 Trade Name $ 302,400.00 Investment in Nolan $ 302,400.00 Equity in earnings of shown $ 68,800.00 Investment in Nolan $ 68,800.00 Investment in Nolan $ 27,000.00 Dividend $ 27,000.00 Amortization Expense $ 12,600.00 Trade Name $ 12,600.00 Sales $ 210,000.00 COGS $ 210,000.00 COGS $ 37,800.00 Inventory $ 37,800.00 Consolidation entries: (*G) Recognition of intra-entity beginning inventory gross profit in current period consolidated net income. Downstream sales are attributed to parent. (S) Elimination of subsidiary's stockholders' equity accounts along with recognition of the noncontrolling interest as of January 1. (A) Allocation of excess fair value over subsidiary's book value, unamortized balance as of January 1. (I) Elimination of intra-entity income remaining after *G elimination. (D) Elimination of intra-entity dividend. (E) Recognition of amortization expense for current year on excess fair value allocated to database. (P) Elimination of intra-entity receivable/payable balances. (TI) Elimination of intra-entity sales/purchases balances. (G) Deferral of intra-entity ending inventory gross profit from current period consolidated net income and removal of intra-entity gross profit from ending inventory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started