Answered step by step

Verified Expert Solution

Question

1 Approved Answer

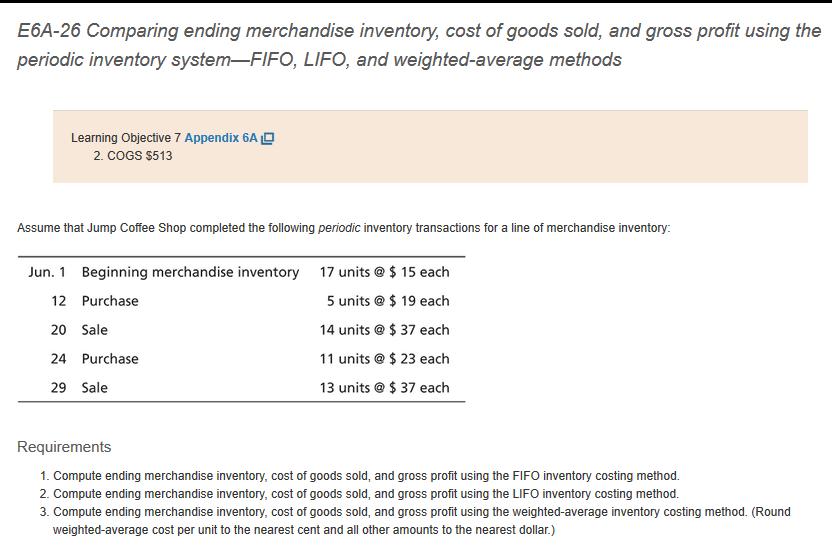

E6A-26 Comparing ending merchandise inventory, cost of goods sold, and gross profit using the periodic inventory system-FIFO, LIFO, and weighted-average methods Learning Objective 7

E6A-26 Comparing ending merchandise inventory, cost of goods sold, and gross profit using the periodic inventory system-FIFO, LIFO, and weighted-average methods Learning Objective 7 Appendix 6A O 2. COGS $513 Assume that Jump Coffee Shop completed the following periodic inventory transactions for a line of merchandise inventory: Jun. 1 Beginning merchandise inventory 17 units @ $ 15 each 12 Purchase 5 units @ $ 19 each 20 Sale 14 units @ $ 37 each 24 Purchase 11 units @ $ 23 each 29 Sale 13 units @ $ 37 each Requirements 1. Compute ending merchandise inventory, cost of goods sold, and gross profit using the FIFO inventory costing method. 2. Compute ending merchandise inventory, cost of goods sold, and gross profit using the LIFO inventory costing method. 3. Compute ending merchandise inventory, cost of goods sold, and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.)

Step by Step Solution

★★★★★

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 FIFO Cost of goods sold 603 138 465 Ending invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started