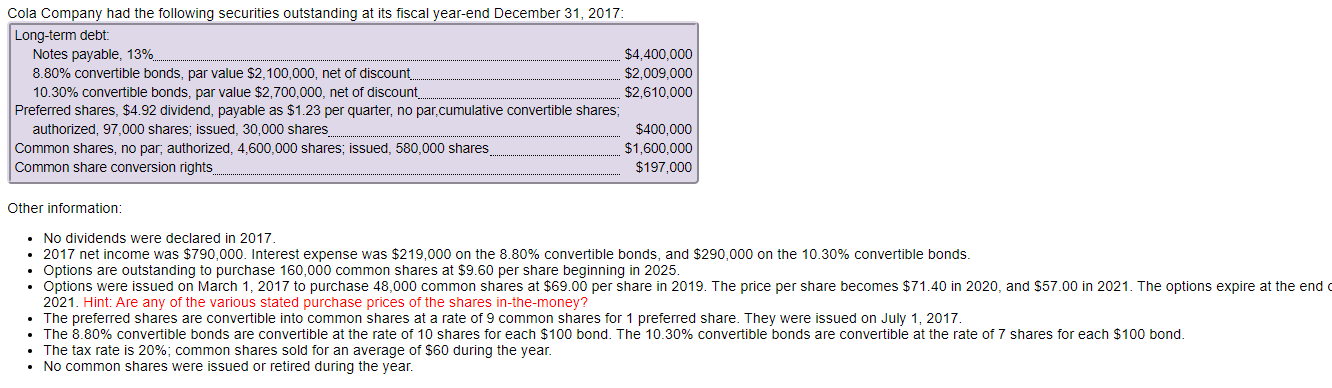

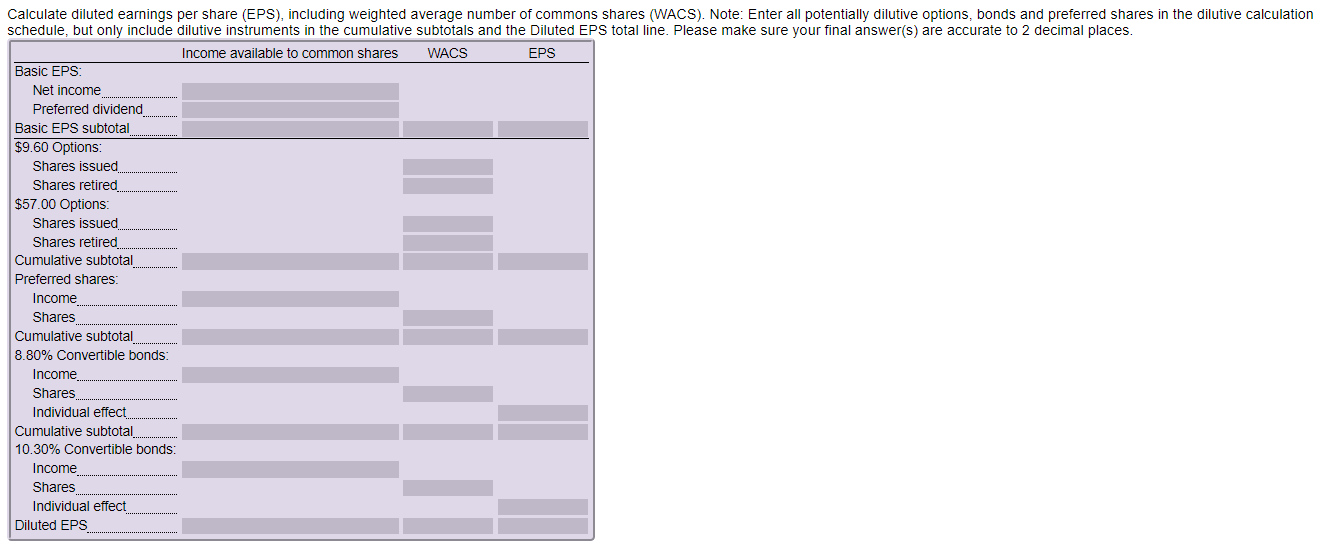

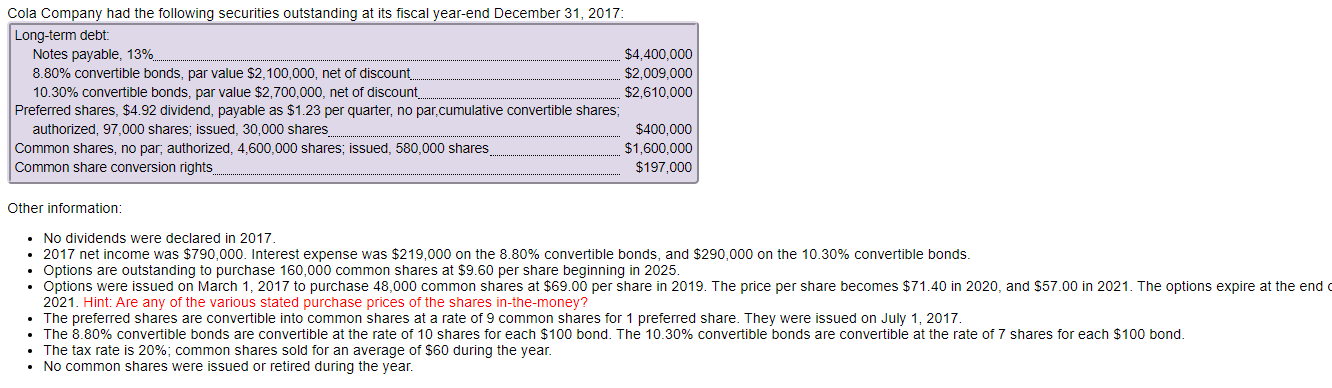

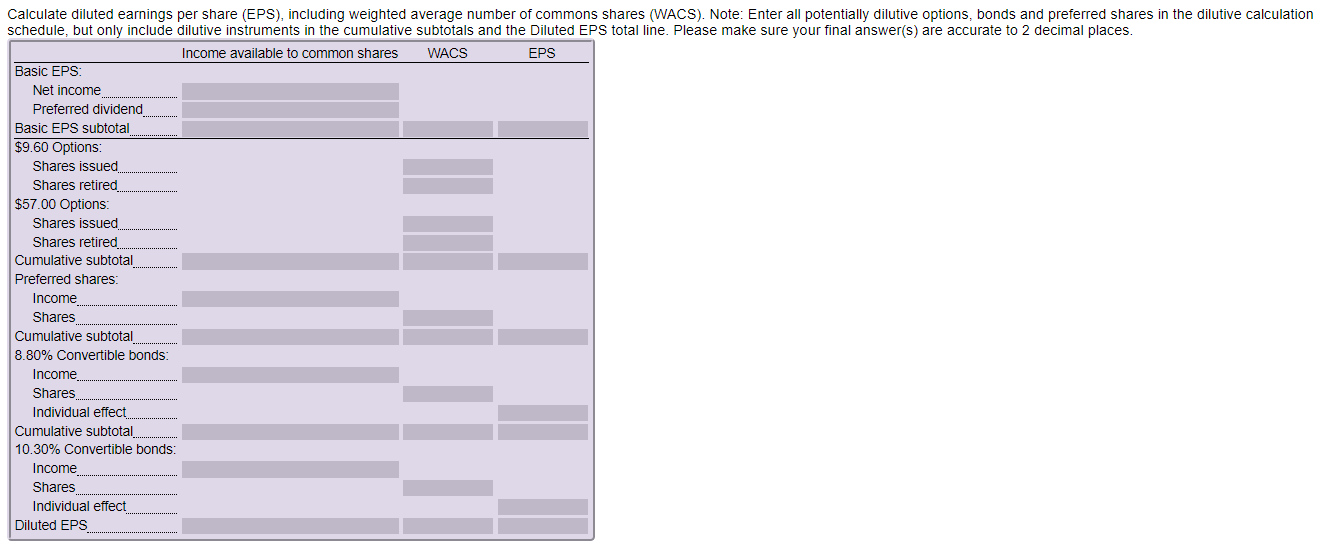

Cola Company had the following securities outstanding at its fiscal year-end December 31, 2017: Long-term debt: Notes payable, 13% $4,400,000 8.80% convertible bonds, par value $2,100,000, net of discount. $2,009,000 10.30% convertible bonds, par value $2,700,000, net of discount. $2,610,000 Preferred shares, $4.92 dividend, payable as $1.23 per quarter, no par cumulative convertible shares; authorized, 97,000 shares, issued, 30,000 shares $400,000 Common shares, no par, authorized, 4,600,000 shares; issued, 580,000 shares $1,600,000 Common share conversion rights $197,000 Other information: No dividends were declared in 2017. 2017 net income was $790,000. Interest expense was $219,000 on the 8.80% convertible bonds, and $290,000 on the 10.30% convertible bonds. Options are outstanding to purchase 160,000 common shares at $9.60 per share beginning in 2025. Options were issued on March 1, 2017 to purchase 48,000 common shares at $69.00 per share in 2019. The price per share becomes $71.40 in 2020, and $57.00 in 2021. The options expire at the end 2021. Hint: Are any of the various stated purchase prices of the shares in-the-money? The preferred shares are convertible into common shares at a rate of 9 common shares for 1 preferred share. They were issued on July 1, 2017. The 8.80% convertible bonds are convertible at the rate of 10 shares for each $100 bond. The 10.30% convertible bonds are convertible at the rate of 7 shares for each $100 bond. The tax rate is 20%, common shares sold for an average of $60 during the year. No common shares were issued or retired during the year. Calculate diluted earnings per share (EPS), including weighted average number of commons shares (WACS). Note: Enter all potentially dilutive options, bonds and preferred shares in the dilutive calculation schedule, but only include dilutive instruments in the cumulative subtotals and the Diluted EPS total line. Please make sure your final answer(s) are accurate to 2 decimal places. Income available to common shares WACS EPS Basic EPS: Net income Preferred dividend Basic EPS subtotal $9.60 Options: Shares issued Shares retired $57.00 Options: Shares issued Shares retired Cumulative subtotal Preferred shares: Income Shares Cumulative subtotal 8.80% Convertible bonds: Income Shares Individual effect Cumulative subtotal. 10.30% Convertible bonds: Income Shares Individual effect Diluted EPS