Question

(a) Calculate the amount of unrealized profit included in inventory on 31 December 2019. (b) Calculate the rate of factory profit being applied in 2019.

(a) Calculate the amount of unrealized profit included in inventory on 31 December 2019.

(b) Calculate the rate of factory profit being applied in 2019.

(c) Prepare the income statement for the year ended 31 December 2019. Additional information The factory manager has suggested that a rate of factory profit of 50% should be applied every year.

(d) Advise Barry whether or not he should apply a rate of factory profit of 50%. Justify your answer.

(e) Explain where carriage on raw materials is recorded in the financial statements of a manufacturing business.

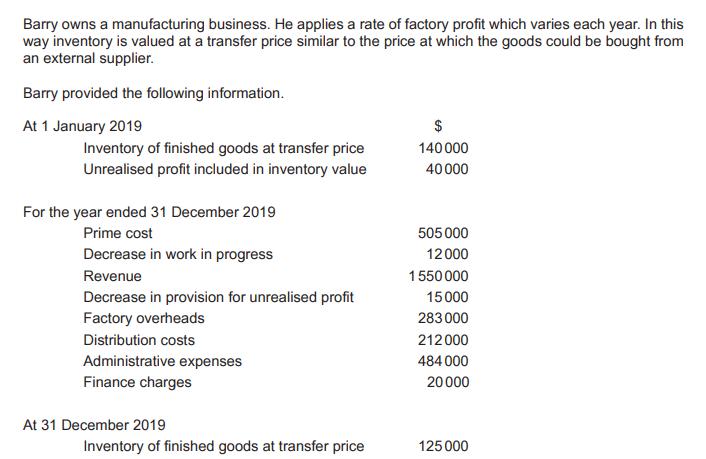

Barry owns a manufacturing business. He applies a rate of factory profit which varies each year. In this way inventory is valued at a transfer price similar to the price at which the goods could be bought from an external supplier. Barry provided the following information. At 1 January 2019 Inventory of finished goods at transfer price Unrealised profit included in inventory value For the year ended 31 December 2019 Prime cost Decrease in work in progress Revenue Decrease in provision for unrealised profit Factory overheads Distribution costs Administrative expenses Finance charges At 31 December 2019 Inventory of finished goods at transfer price 140 000 40000 505 000 12000 1550 000 15000 283000 212000 484 000 20000 125 000

Step by Step Solution

3.46 Rating (178 Votes )

There are 3 Steps involved in it

Step: 1

Answer aCalculate the amount of unrealized profit included in inventory on 31 December 2019 40...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started