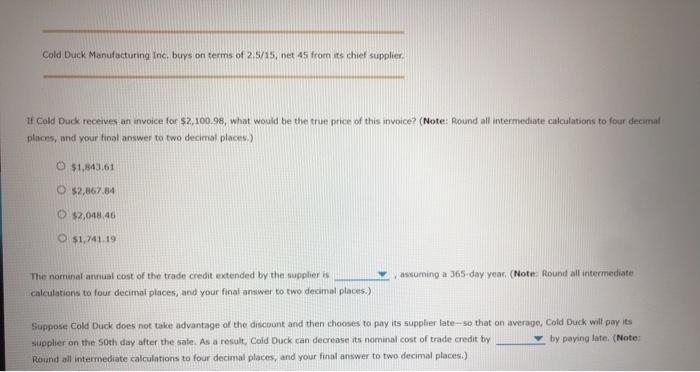

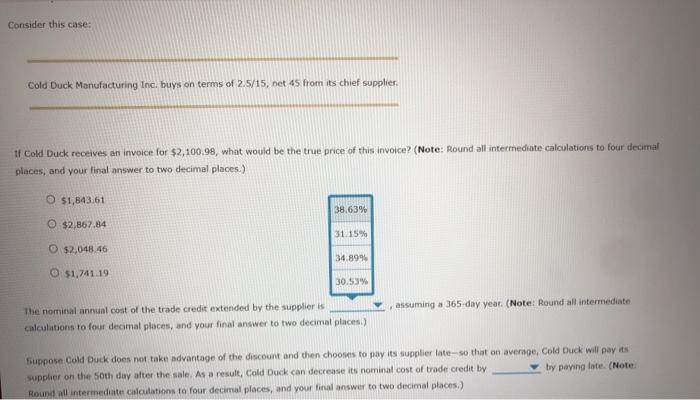

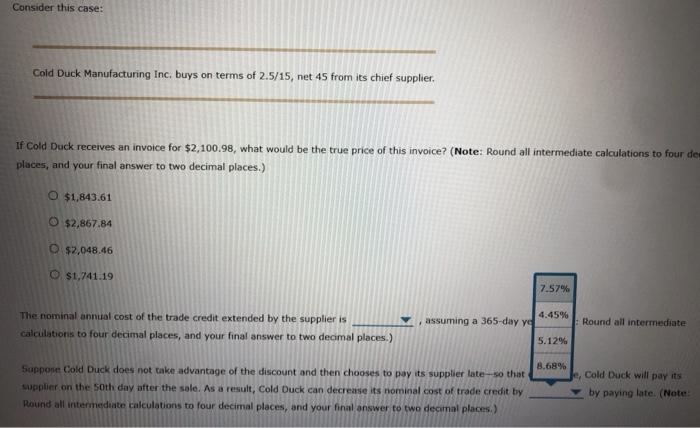

Cold Duck Manufacturing Inc. buys on terms of 2.5/15, net 45 from its chief supplier If Cold Duck receives an invoice for $2,100.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) O $1,843.61 O $2.867.84 O $2,048.46 O $1,741.19 assuming a 365 day year (Note: Round all intermediate The nominal annual cost of the trade credit extended by the suppliers calculations to four decimal places, and your final answer to two decimal places.) Suppose Cold Duck does not take advantage of the discount and then chooses to pay its supplier late--so that on average, Cold Duck will pay its supplier on the 50th day after the sale. As a result, Cold Duck can decrease its nominal cost of trade credit by by paying late. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) Consider this case: Cold Duck Manufacturing Inc. buys on terms of 2.5/15, net 45 from its chief supplier If Cold Duck receives an invoice for $2,100.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) O $1,843.61 38.63% O $2.867.84 31.15% O $2,048.46 34.899 O $1,741.19 30.53% assuming a 365-day year. (Note: Round all intermediate The nominal annual cost of the trade credit extended by the suppliers calculations to four decimal places, and your final answer to two decimal places) Suppose Cold Duck does not take advantage of the discount and then choose to pay its supplier late-so that on average, Cold Duck will pay its suppher on the oth day after the sale. As a result, Cold Duck can decrease its nominal cost of trade credit by by paying late. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) Consider this case: Cold Duck Manufacturing Inc, buys on terms of 2.5/15, net 45 from its chief supplier. If Cold Duck receives an invoice for $2,100.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four de places, and your final answer to two decimal places.) $1,843.61 O $2,867.84 O $2,048.46 0 $1,741.19 7.57% The nominal annual cost of the trade credit extended by the supplier is calculations to four decimal places, and your final answer to two decimal places.) 4.45% assuming a 365-day yo Round all intermediate 5.12% Suppose Cold Duck does not take advantage of the discount and then chooses to pay its supplier late-so that supplier on the 50th day after the sale. As a result, Cold Duck can decrease its nominal cost of trade credit by Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) 8.68% Je, Cold Duck will pay its by paying late. (