Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cole Porter was injured in a car accident and is now permanently confined to a wheelchair. In the current year Cole expended $20,000 to

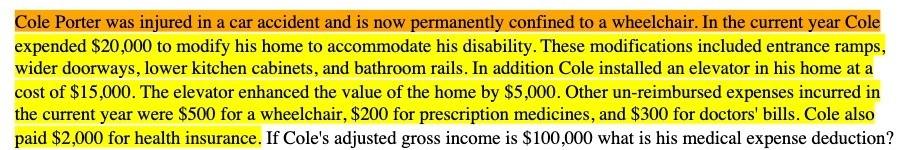

Cole Porter was injured in a car accident and is now permanently confined to a wheelchair. In the current year Cole expended $20,000 to modify his home to accommodate his disability. These modifications included entrance ramps, wider doorways, lower kitchen cabinets, and bathroom rails. In addition Cole installed an elevator in his home at a cost of $15,000. The elevator enhanced the value of the home by $5,000. Other un-reimbursed expenses incurred in the current year were $500 for a wheelchair, $200 for prescription medicines, and $300 for doctors' bills. Cole also paid $2,000 for health insurance. If Cole's adjusted gross income is $100,000 what is his medical expense deduction?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Medical expense deductions are subject to certain limitations and criteria set by the IRS To determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started