Answered step by step

Verified Expert Solution

Question

1 Approved Answer

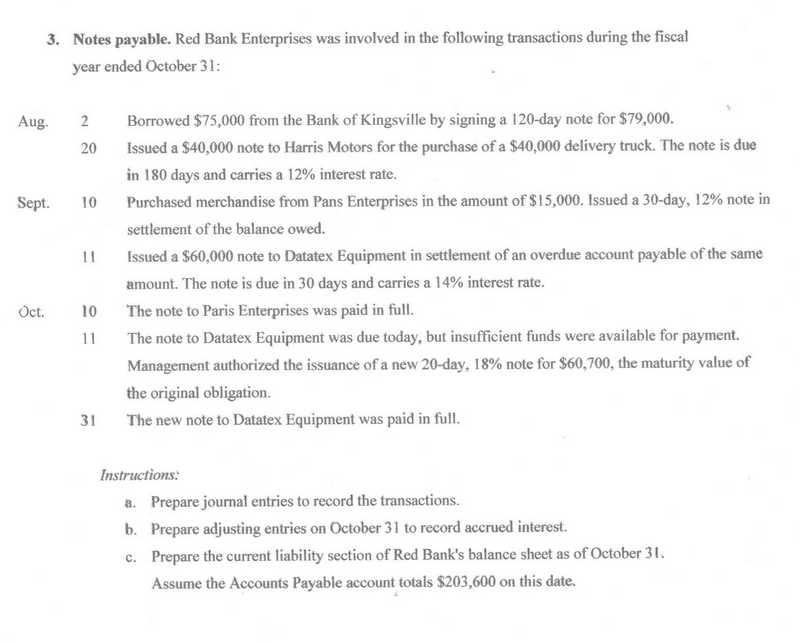

3. Notes payable. Red Bank Enterprises was involved in the following transactions during the fiscal year ended October 31: Aug. Oct. 2 20 Sept.

3. Notes payable. Red Bank Enterprises was involved in the following transactions during the fiscal year ended October 31: Aug. Oct. 2 20 Sept. 10 11 10 11 31 Borrowed $75,000 from the Bank of Kingsville by signing a 120-day note for $79,000. Issued a $40,000 note to Harris Motors for the purchase of a $40,000 delivery truck. The note is due in 180 days and carries a 12% interest rate. Purchased merchandise from Pans Enterprises in the amount of $15,000. Issued a 30-day, 12% note in settlement of the balance owed. Issued a $60,000 note to Datatex Equipment in settlement of an overdue account payable of the same amount. The note is due in 30 days and carries a 14% interest rate. The note to Paris Enterprises was paid in full. The note to Datatex Equipment was due today, but insufficient funds were available for payment. Management authorized the issuance of a new 20-day, 18% note for $60,700, the maturity value of the original obligation. The new note to Datatex Equipment was paid in full. Instructions: a. Prepare journal entries to record the transactions. b. Prepare adjusting entries on October 31 to record accrued interest. c. Prepare the current liability section of Red Bank's balance sheet as of October 31. Assume the Accounts Payable account totals $203,600 on this date.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started