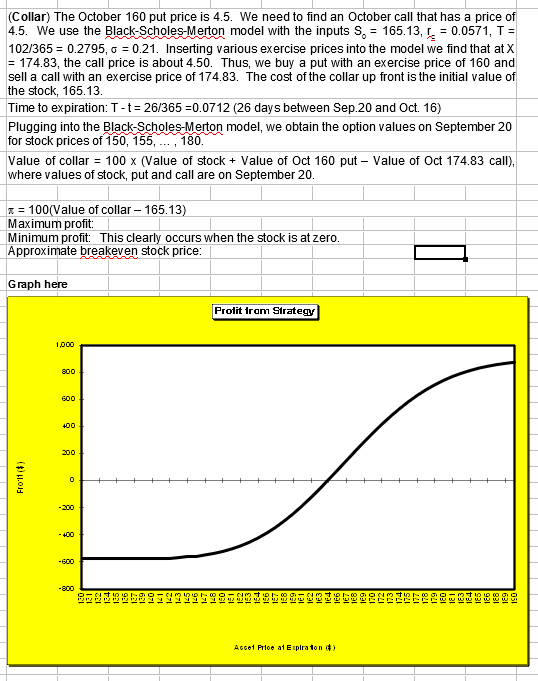

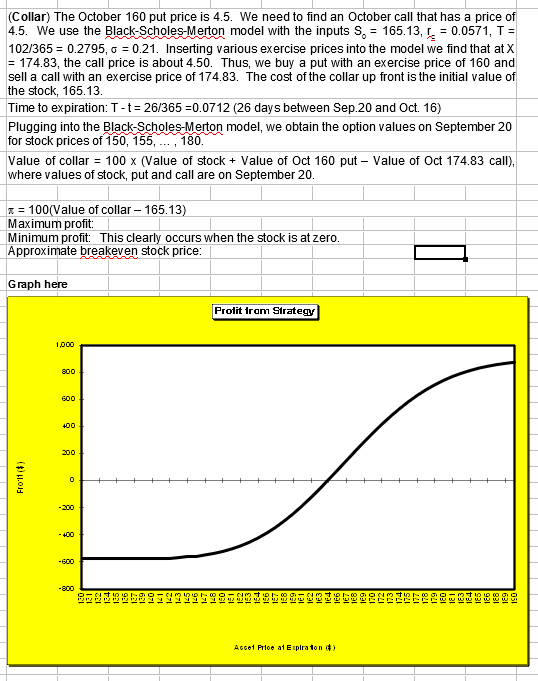

(Collar) The October 160 put price is 4.5. We need to find an October call that has a price of 4.5. We use the Black-Scholes-Merton model with the inputs S, - 165.13,1 = 0.0571, T = 102/365 = 0.2795, 0 = 0.21. Inserting various exercise prices into the model we find that at X = 174.83, the call price is about 4.50. Thus, we buy a put with an exercise price of 160 and sell a call with an exercise price of 174.83. The cost of the collar up front is the initial value of the stock, 165.13. Time to expiration: T-t = 26/365 =0.0712 (26 days between Sep.20 and Oct. 16) Plugging into the Black-Scholes-Merton model, we obtain the option values on September 20 for stock prices of 150, 155, 180. Value of collar = 100 x (Value of stock + Value of Oct 160 put Value of Oct 174.83 call), where values of stock, put and call are on September 20. * = 100(Value of collar 165.13) Maximum profit Minimum profit: This clearly occurs when the stock is at zero. Approximate breakeven stock price: Graph here Prolit Irom Strategy 1,000 800 600 400 200 Fro'11($) -200 - 400 -600 Accet Ploe at Explra ton ) (Collar) The October 160 put price is 4.5. We need to find an October call that has a price of 4.5. We use the Black-Scholes-Merton model with the inputs S, - 165.13,1 = 0.0571, T = 102/365 = 0.2795, 0 = 0.21. Inserting various exercise prices into the model we find that at X = 174.83, the call price is about 4.50. Thus, we buy a put with an exercise price of 160 and sell a call with an exercise price of 174.83. The cost of the collar up front is the initial value of the stock, 165.13. Time to expiration: T-t = 26/365 =0.0712 (26 days between Sep.20 and Oct. 16) Plugging into the Black-Scholes-Merton model, we obtain the option values on September 20 for stock prices of 150, 155, 180. Value of collar = 100 x (Value of stock + Value of Oct 160 put Value of Oct 174.83 call), where values of stock, put and call are on September 20. * = 100(Value of collar 165.13) Maximum profit Minimum profit: This clearly occurs when the stock is at zero. Approximate breakeven stock price: Graph here Prolit Irom Strategy 1,000 800 600 400 200 Fro'11($) -200 - 400 -600 Accet Ploe at Explra ton )