Answered step by step

Verified Expert Solution

Question

1 Approved Answer

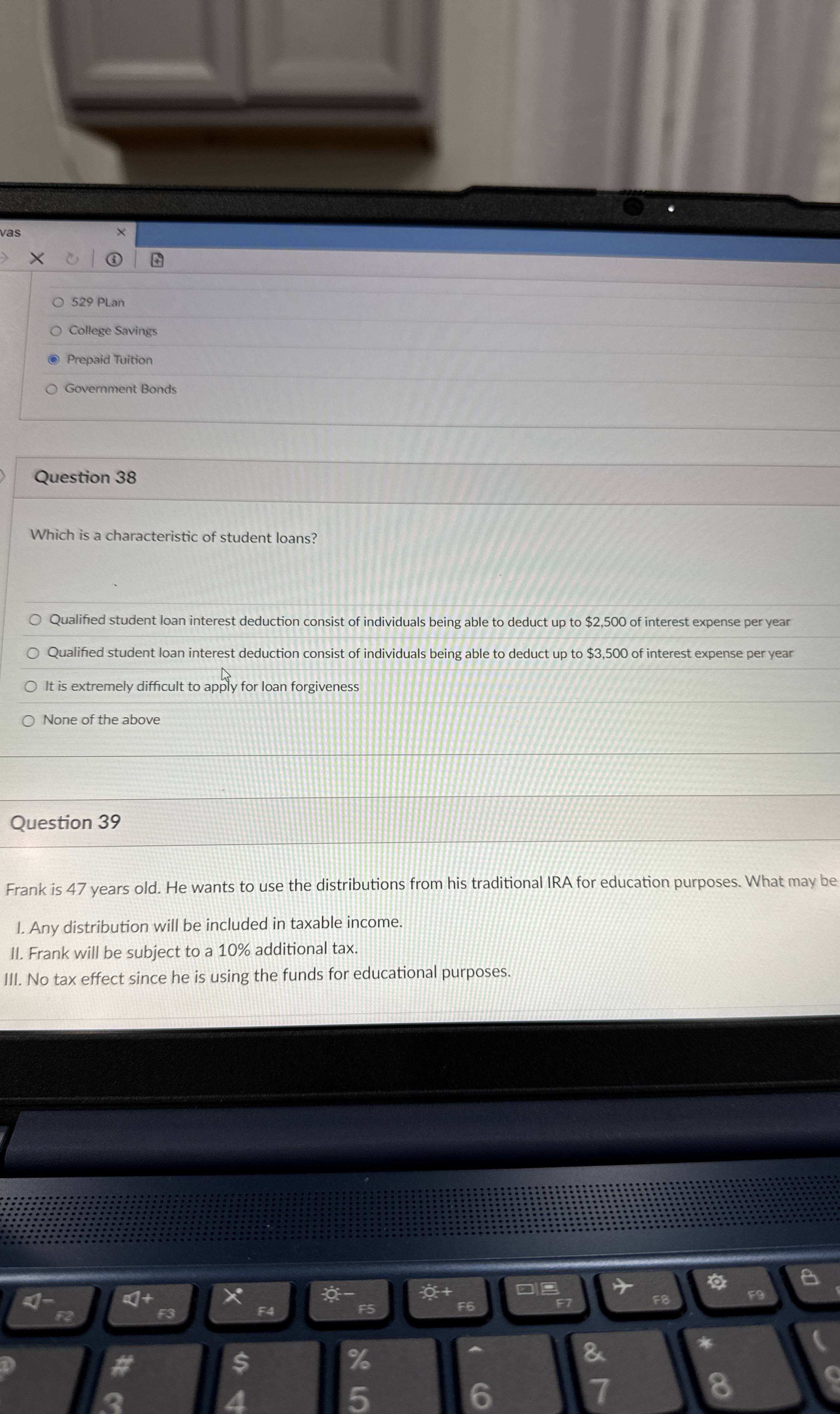

College Savings Prepaid Tuition Government Bonds Question 3 8 Which is a characteristic of student loans? Qualified student loan interest deduction consist of individuals being

College Savings

Prepaid Tuition

Government Bonds

Question

Which is a characteristic of student loans?

Qualified student loan interest deduction consist of individuals being able to deduct up to $ of interest expense per year

Qualified student loan interest deduction consist of individuals being able to deduct up to $ of interest expense per year

It is extremely difficult to apply for loan forgiveness

None of the above

Question

Frank is years old. He wants to use the distributions from his traditional IRA for education purposes. What may be

Any distribution will be included in taxable income.

II Frank will be subject to a additional tax.

III. No tax effect since he is using the funds for educational purposes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started