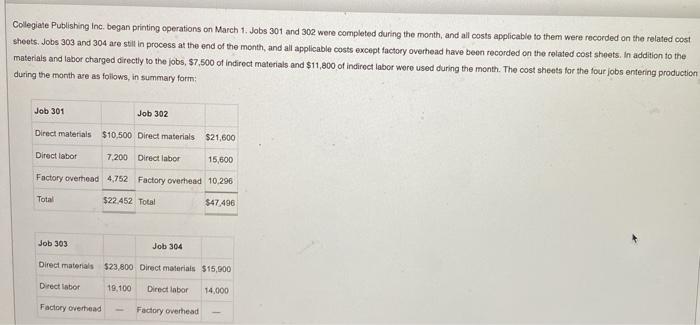

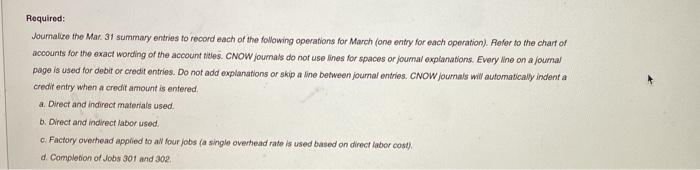

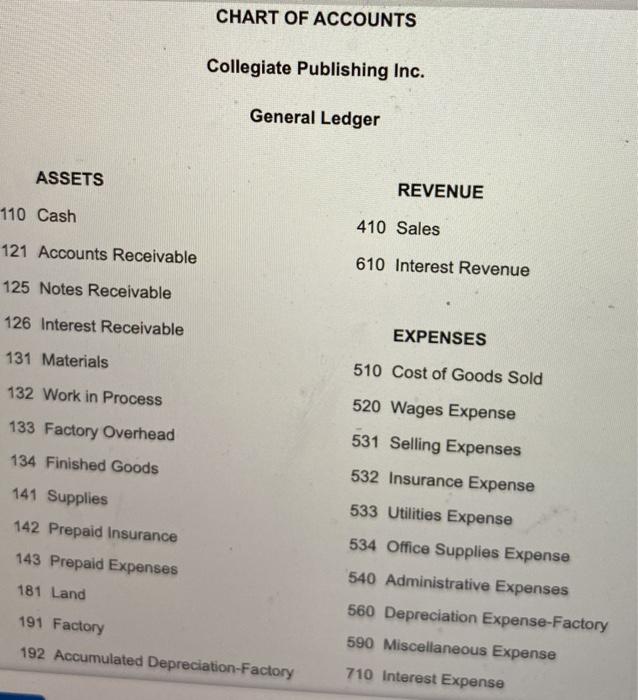

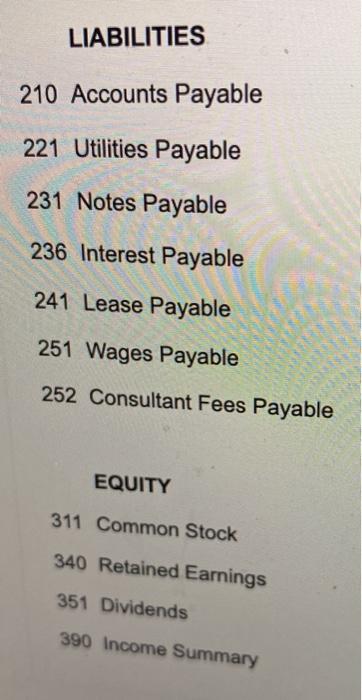

Collegiate Publishing Inc began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost shoots. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,500 of indirect materials and $11,800 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $10.500 Direct materials $21,600 Direct labor 7,200 Direct labor 15,600 Factory overhead 4,752 Factory overhead 10.296 Total $22.452 Total $47496 Job 303 Job 304 Direct materials $23.800 Direct materials $15.900 Direct labor 19,100 Direct labor 14,000 Factory overhead Factory overhead Required: Joumalize the Mar. 31 summary entries to record each of the following operations for March (one entry for each operation). Refer to the chart of accounts for the exact wording of the account files. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW Journals will automatically indert a credit entry when a credit amount is entered, a. Direct and indirect materials used b. Direct and indirect labor used. c. Factory overhead applied to all four jobs (a single overhead rate is used based on direct labor cost), d. Completion of Jobs 301 and 302 CHART OF ACCOUNTS Collegiate Publishing Inc. General Ledger ASSETS REVENUE 110 Cash 410 Sales 121 Accounts Receivable 610 Interest Revenue 125 Notes Receivable 126 Interest Receivable EXPENSES 131 Materials 510 Cost of Goods Sold 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance 143 Prepaid Expenses 181 Land 520 Wages Expense 531 Selling Expenses 532 Insurance Expense 533 Utilities Expense 534 Office Supplies Expense 540 Administrative Expenses 560 Depreciation Expense-Factory 590 Miscellaneous Expense 710 Interest Expense 191 Factory 192 Accumulated Depreciation-Factory LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 241 Lease Payable 251 Wages Payable 252 Consultant Fees Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends 390 Income Summary Journalize the Mar. 31 summary entries to record each of the following operations for March (one entry for each operation). Refer to the chart of accounts for the exact wording of the account ones. CNOW journals do not use lines for spaces or journal explanations. Every ine on a journal page is used for debitor credit entries. Do not add explanations or skip a line between journal entres. CNOW journals will automatically indenta creat entry when a credit amount is entered. Direct and indirect materials used b. Direct and indirect labor used 6. Factory overhead applied to al tour jobs (a single overhead rate is used based on direct labor cos). d. Completion of bw 301 and 302 I PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. IF DIT CREDIT ASSETS LABILITIES EQUITY 1 PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST REF DEBT CREDIT ASSETS UABILITIES EQUITY I 1 4 5