Collins Company, which, on April 1, had 6,000 units of WIP in Department B the second and last stage of its production cycle. The costs attached to these 6,000 units were P 12,000 of costs transferred in from Department A, P2,500 of material costs added in Department B, and P2,000 of conversion costs added in Department B. Materials are added at the Beginning of the process in Department B. Conversion was 50% complete on April 1, During April, 14,000 units were transferred in from Department A at a cost of P27,000 and material costs of P3,500 and conversion costs of P3,000 were added in Department B. On April 30, Department B had 5,000 units of WIP, 60% complete as to conversion costs. The costs attached to these 5,000 units were P 10,500 of costs transferred in from Department A, P1,800 of material costs added in Department B, and P800 of conversion costs added in Department B.

Using the weighted average & FIFO method, make a production report (you may use the reference image for the production report)

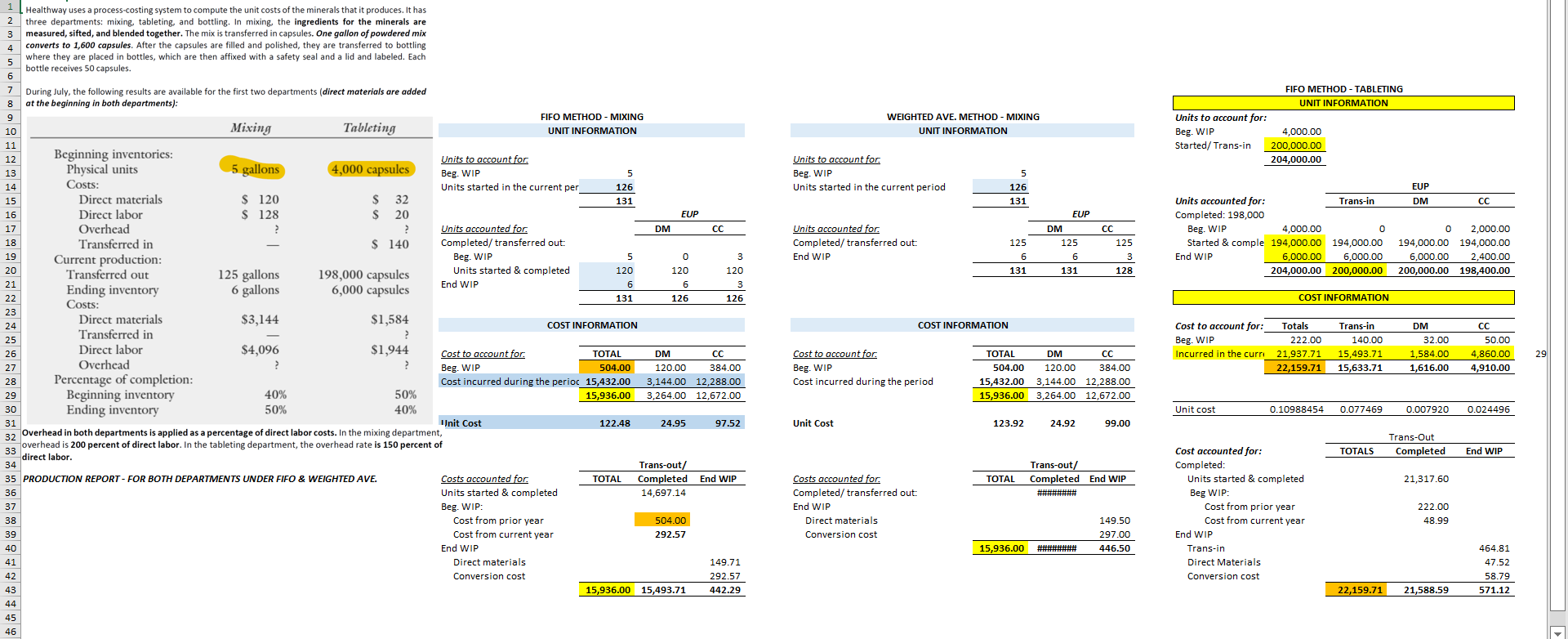

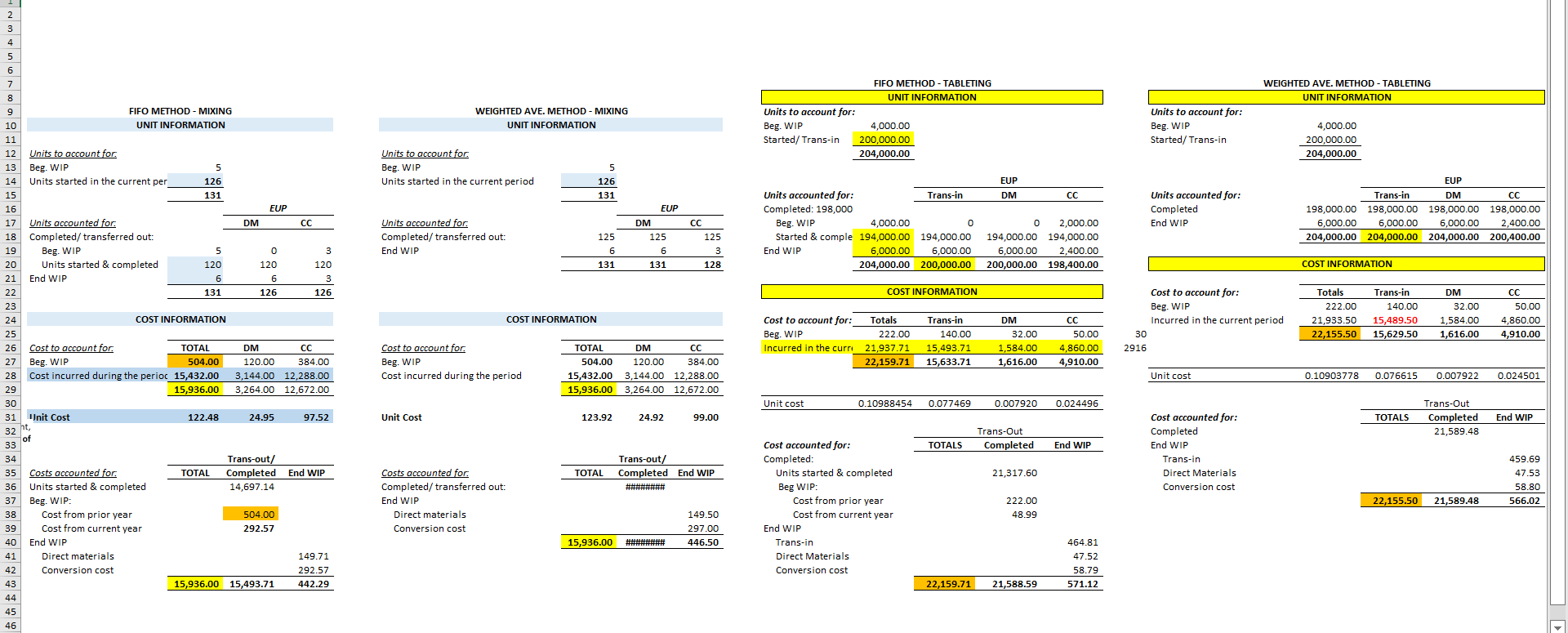

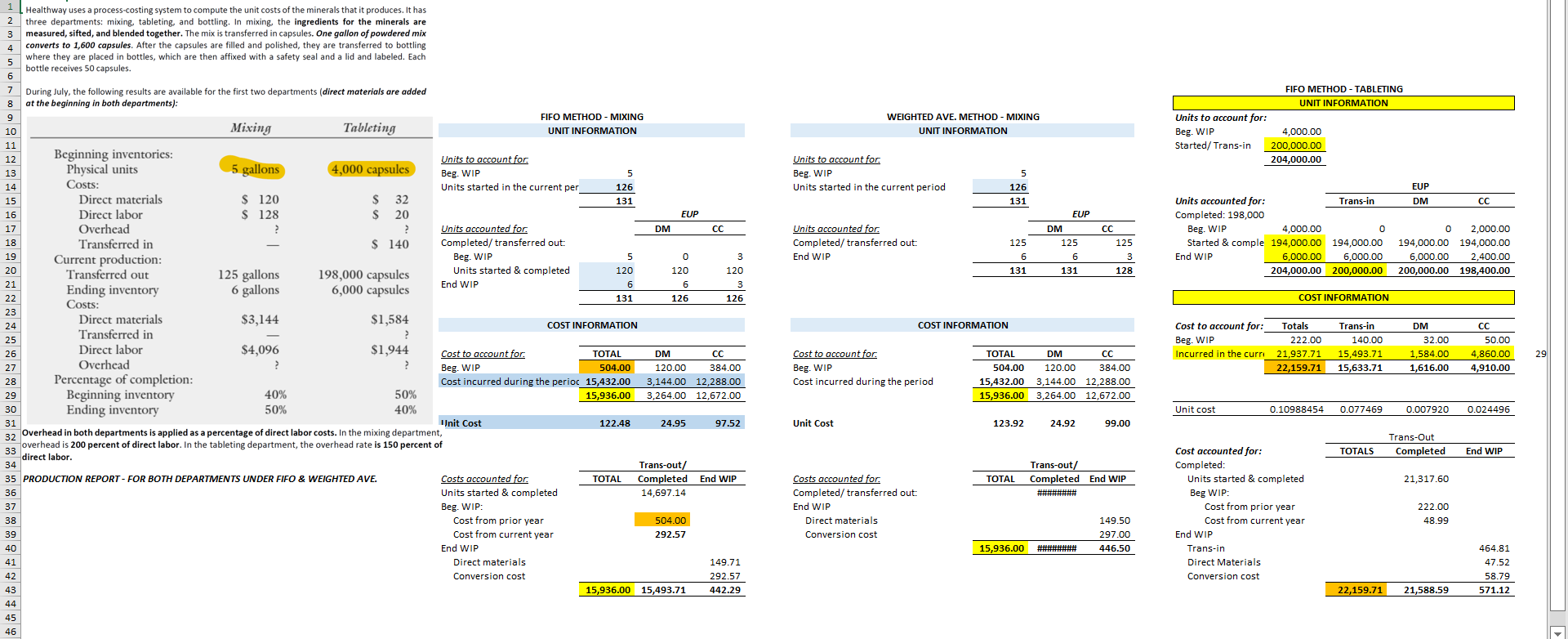

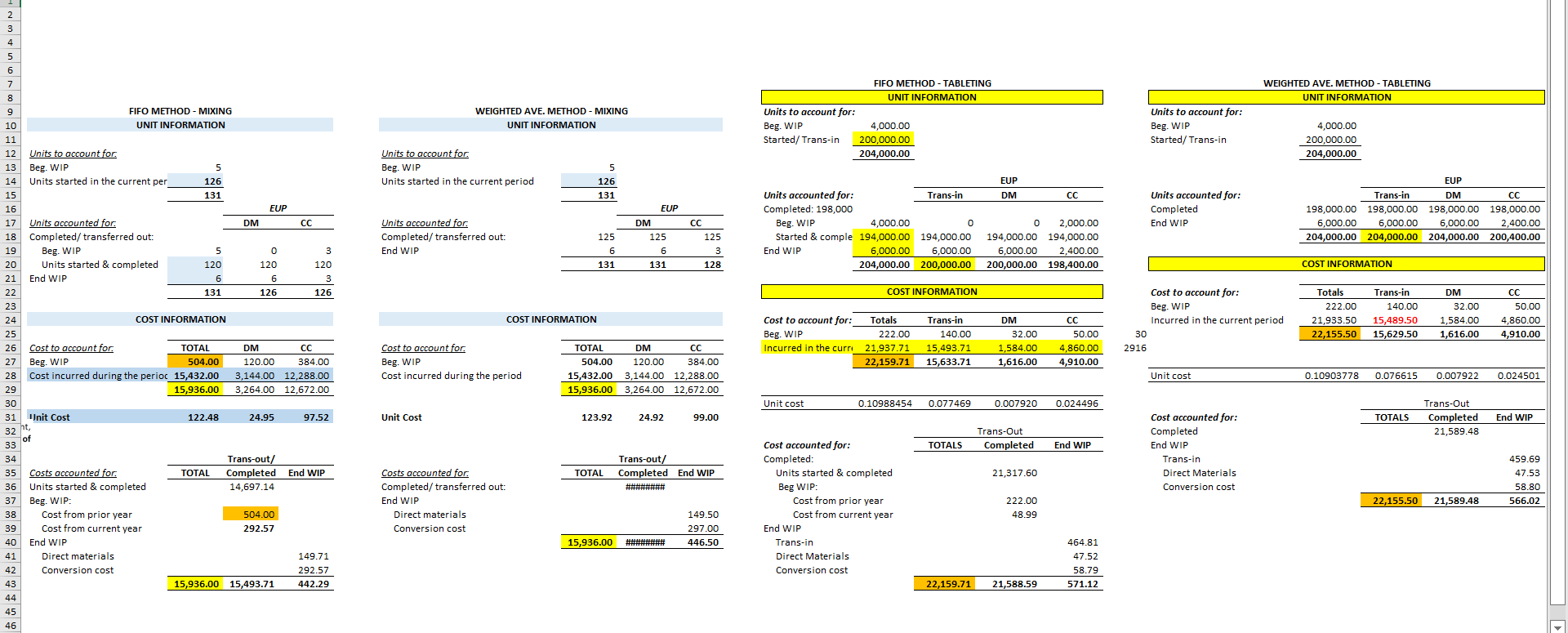

WEIGHTED AVE. METHOD - MIXING UNIT INFORMATION FIFO METHOD - TABLETING UNIT INFORMATION Units to account for: Beg. WIP 4,000.00 Started/Trans-in 200,000.00 204,000.00 Units to account for Beg. WIP Units started in the current period 5 126 131 EUP DM Units accounted for Completed/ transferred out: End WIP EUP DM 125 6 131 Units accounted for: Trans-in Completed: 198,000 Beg. WIP 4,000.00 0 Started 1 comple 194,000.00 194,000.00 End WIP 6,000.00 6,000.00 204,000.00 200,000.00 0 194,000.00 125 6 131 CC 125 3 128 2,000.00 194,000.00 2,400.00 198,400.00 6,000.00 200,000.00 COST INFORMATION Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has 2 three departments: mixing, tableting, and bottling. In mixing, the ingredients for the minerals are 3 measured, sifted, and blended together. The mix is transferred in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. 6 7 During July, the following results are available for the first two departments (direct materials are added 8 at the beginning in both departments): 9 FIFO METHOD - MIXING 10 Mixing Tableting UNIT INFORMATION 11 12 Beginning inventories: Units to account for 13 Physical units 5 gallons 4,000 capsules Beg. WIP 5 14 Costs: Units started in the current per 126 15 Direct materials $ 120 S 32 131 16 Direct labor $ 128 S 20 EUP 17 Overhead ? ? Units accounted for. DM CC 18 Transferred in $ 140 Completed/transferred out: 19 Current production: Beg. WIP 5 0 3 20 Transferred out 125 gallons 198,000 capsules Units started & completed 120 120 120 Ending inventory End WIP 6 6 gallons 6,000 capsules 6 3 Costs: 131 126 126 Direct materials $3,144 $1,584 COST INFORMATION 25 Transferred in 26 Direct labor $4,096 $1,944 Cost to account for. TOTAL DM 27 Overhead ? ? Beg. WIP 504.00 120.00 384.00 28 Percentage of completion: Cost incurred during the perioc 15,432.00 3,144.00 12,288.00 29 Beginning inventory 40% 50% 15,936.00 3,264.00 12,672.00 30 Ending inventory 50% 31 Unit Cost 122.48 24.95 97.52 32 Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200 percent of direct labor. In the tableting department, the overhead rate is 150 percent of 33 direct labor. 34 Trans-out/ 35 PRODUCTION REPORT - FOR BOTH DEPARTMENTS UNDER FIFO & WEIGHTED AVE. Costs accounted for. TOTAL Completed End WIP 36 Units started & completed 14,697.14 37 Beg. WIP: 38 Cost from prior year 504.00 39 Cost from current year 292.57 40 End WIP 41 Direct materials 149.71 42 Conversion cost 292.57 43 15,936.00 15,493.71 442.29 44 45 46 COST INFORMATION Cost to account for: Totals Beg. WIP 222.00 Incurred in the currt 21,937.71 22,159.71 Trans-in 140.00 15,493.71 15,633.71 DM 32.00 1,584.00 1,616.00 CC 50.00 4,860.00 4,910.00 Cost to account for Beg. WIP Cost incurred during the period TOTAL DM 504.00 120.00 384.00 15,432.00 3,144.00 12,288.00 15,936.00 3,264.00 12,672.00 40% Unit cost 0.10988454 0.077469 0.007920 0.024496 Unit Cost 123.92 24.92 99.00 Trans-Out Completed TOTALS End WIP Trans-out/ Completed End WIP Cost accounted for: Completed: Units started completed TOTAL 21,317.60 Beg WIP: Costs accounted for Completed/ transferred out: End WIP Direct materials Conversion cost 222.00 48.99 149.50 297.00 446.50 Cost from prior year Cost from current year End WIP Trans-in Direct Materials Conversion cost 15,936.00 464.81 47.52 58.79 571.12 22,159.71 21,588.59 WEIGHTED AVE. METHOD - TABLETING UNIT INFORMATION WEIGHTED AVE. METHOD - MIXING UNIT INFORMATION FIFO METHOD - TABLETING UNIT INFORMATION Units to account for: Beg. WIP 4,000.00 Started/Trans-in 200,000.00 204,000.00 Units to account for: Beg. WIP Started/Trans-in 4,000.00 200,000.00 204,000.00 Units to account for. Beg, WIP Units started in the current period EUP 126 131 DM CC EUP Units accounted for: Completed End WIP EUP Trans-in DM 198,000.00 198,000.00 198,000.00 6,000.00 6,000.00 6,000.00 204,000.00 204,000.00 204,000.00 CC 198,000.00 2,400.00 200,400.00 Units accounted for Completed/transferred out: End WIP Units accounted for: Trans-in Completed: 198,000 Beg. WIP 4,000.00 o Started & comple 194,000.00 194,000.00 End WIP 6,000.00 6,000.00 204,000.00 200,000.00 CC 125 DM 125 6 131 125 6 O 2,000.00 194,000.00 194,000.00 6,000.00 2,400.00 200,000.00 198,400.00 131 128 COST INFORMATION COST INFORMATION Totals 222.00 21,933.50 22,155.50 Trans-in 140.00 15,489.50 15,629.50 DM 32.00 1,584.00 1,616.00 CC 50.00 4,860.00 4,910.00 COST INFORMATION Cost to account for: 5 6 7 8 9 FIFO METHOD - MIXING 10 UNIT INFORMATION 11 12 Units to account for. 13 Beg. WIP 5 14 Units started in the current per 126 15 131 16 EUP 17 Units accounted for DM CC 18 Completed/transferred out: 19 Beg. WIP 5 0 3 20 Units started & completed 120 120 120 21 End WIP 6 6 3 22 131 126 126 23 24 COST INFORMATION 25 26 Cost to account for: TOTAL DM 27 Beg. WIP 504.00 120.00 384.00 28 Cost incurred during the perioc 15,432.00 3,144.00 12,288.00 29 15,936.00 3,264.00 12,672.00 30 31 Unit Cost 122.48 24.95 97.52 32 33 34 Trans-out/ 35 Costs accounted for. TOTAL Completed End WIP 36 Units started & completed 14,697.14 37 Beg. WIP: 38 Cost from prior year 504.00 39 Cost from current year 292.57 40 End WIP 41 Direct materials 149.71 42 Conversion cost 292.57 43 15,936.00 15,493.71 442.29 44 45 46 Cost to account for: Beg. WIP Incurred in the current period 30 2916 Beg. WIP Totals 222.00 21,937.71 22,159.71 Trans-in 140.00 15,493.71 15,633.71 DM 32.00 1,584.00 1,616.00 Incurred in the curri CC 50.00 4,860.00 4,910.00 Cost to account for Beg. WIP Cost incurred during the period TOTAL 504.00 15,432.00 15,936.00 DM CC 120.00 384.00 3,144.00 12,288.00 3,264.00 12,672.00 Unit cost 0.10903778 0.076615 0.007922 0.024501 Unit cost 0.10988454 0.077469 0.007920 0.024496 Unit Cost 123.92 24.92 99.00 TOTALS Trans-Out Completed 21.589.48 End WIP Trans-Out Completed TOTALS End WIP Cost accounted for: Completed End WIP Trans-in Direct Materials Conversion cost TOTAL Trans-out/ Completed End WIP ### 21,317.60 Costs accounted for Completed/ transferred out: End WIP Direct materials Conversion cost 459.69 47.53 58.80 566.02 22,155.50 21,589.48 Cost accounted for: Completed: Units started & completed Beg WIP: Cost from prior year Cost from current year End WIP Trans-in Direct Materials Conversion cost 222.00 48.99 149.50 297.00 446.50 15,936.00 464.81 47.52 58.79 571.12 22,159.71 21,588.59 WEIGHTED AVE. METHOD - MIXING UNIT INFORMATION FIFO METHOD - TABLETING UNIT INFORMATION Units to account for: Beg. WIP 4,000.00 Started/Trans-in 200,000.00 204,000.00 Units to account for Beg. WIP Units started in the current period 5 126 131 EUP DM Units accounted for Completed/ transferred out: End WIP EUP DM 125 6 131 Units accounted for: Trans-in Completed: 198,000 Beg. WIP 4,000.00 0 Started 1 comple 194,000.00 194,000.00 End WIP 6,000.00 6,000.00 204,000.00 200,000.00 0 194,000.00 125 6 131 CC 125 3 128 2,000.00 194,000.00 2,400.00 198,400.00 6,000.00 200,000.00 COST INFORMATION Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has 2 three departments: mixing, tableting, and bottling. In mixing, the ingredients for the minerals are 3 measured, sifted, and blended together. The mix is transferred in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. 6 7 During July, the following results are available for the first two departments (direct materials are added 8 at the beginning in both departments): 9 FIFO METHOD - MIXING 10 Mixing Tableting UNIT INFORMATION 11 12 Beginning inventories: Units to account for 13 Physical units 5 gallons 4,000 capsules Beg. WIP 5 14 Costs: Units started in the current per 126 15 Direct materials $ 120 S 32 131 16 Direct labor $ 128 S 20 EUP 17 Overhead ? ? Units accounted for. DM CC 18 Transferred in $ 140 Completed/transferred out: 19 Current production: Beg. WIP 5 0 3 20 Transferred out 125 gallons 198,000 capsules Units started & completed 120 120 120 Ending inventory End WIP 6 6 gallons 6,000 capsules 6 3 Costs: 131 126 126 Direct materials $3,144 $1,584 COST INFORMATION 25 Transferred in 26 Direct labor $4,096 $1,944 Cost to account for. TOTAL DM 27 Overhead ? ? Beg. WIP 504.00 120.00 384.00 28 Percentage of completion: Cost incurred during the perioc 15,432.00 3,144.00 12,288.00 29 Beginning inventory 40% 50% 15,936.00 3,264.00 12,672.00 30 Ending inventory 50% 31 Unit Cost 122.48 24.95 97.52 32 Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200 percent of direct labor. In the tableting department, the overhead rate is 150 percent of 33 direct labor. 34 Trans-out/ 35 PRODUCTION REPORT - FOR BOTH DEPARTMENTS UNDER FIFO & WEIGHTED AVE. Costs accounted for. TOTAL Completed End WIP 36 Units started & completed 14,697.14 37 Beg. WIP: 38 Cost from prior year 504.00 39 Cost from current year 292.57 40 End WIP 41 Direct materials 149.71 42 Conversion cost 292.57 43 15,936.00 15,493.71 442.29 44 45 46 COST INFORMATION Cost to account for: Totals Beg. WIP 222.00 Incurred in the currt 21,937.71 22,159.71 Trans-in 140.00 15,493.71 15,633.71 DM 32.00 1,584.00 1,616.00 CC 50.00 4,860.00 4,910.00 Cost to account for Beg. WIP Cost incurred during the period TOTAL DM 504.00 120.00 384.00 15,432.00 3,144.00 12,288.00 15,936.00 3,264.00 12,672.00 40% Unit cost 0.10988454 0.077469 0.007920 0.024496 Unit Cost 123.92 24.92 99.00 Trans-Out Completed TOTALS End WIP Trans-out/ Completed End WIP Cost accounted for: Completed: Units started completed TOTAL 21,317.60 Beg WIP: Costs accounted for Completed/ transferred out: End WIP Direct materials Conversion cost 222.00 48.99 149.50 297.00 446.50 Cost from prior year Cost from current year End WIP Trans-in Direct Materials Conversion cost 15,936.00 464.81 47.52 58.79 571.12 22,159.71 21,588.59 WEIGHTED AVE. METHOD - TABLETING UNIT INFORMATION WEIGHTED AVE. METHOD - MIXING UNIT INFORMATION FIFO METHOD - TABLETING UNIT INFORMATION Units to account for: Beg. WIP 4,000.00 Started/Trans-in 200,000.00 204,000.00 Units to account for: Beg. WIP Started/Trans-in 4,000.00 200,000.00 204,000.00 Units to account for. Beg, WIP Units started in the current period EUP 126 131 DM CC EUP Units accounted for: Completed End WIP EUP Trans-in DM 198,000.00 198,000.00 198,000.00 6,000.00 6,000.00 6,000.00 204,000.00 204,000.00 204,000.00 CC 198,000.00 2,400.00 200,400.00 Units accounted for Completed/transferred out: End WIP Units accounted for: Trans-in Completed: 198,000 Beg. WIP 4,000.00 o Started & comple 194,000.00 194,000.00 End WIP 6,000.00 6,000.00 204,000.00 200,000.00 CC 125 DM 125 6 131 125 6 O 2,000.00 194,000.00 194,000.00 6,000.00 2,400.00 200,000.00 198,400.00 131 128 COST INFORMATION COST INFORMATION Totals 222.00 21,933.50 22,155.50 Trans-in 140.00 15,489.50 15,629.50 DM 32.00 1,584.00 1,616.00 CC 50.00 4,860.00 4,910.00 COST INFORMATION Cost to account for: 5 6 7 8 9 FIFO METHOD - MIXING 10 UNIT INFORMATION 11 12 Units to account for. 13 Beg. WIP 5 14 Units started in the current per 126 15 131 16 EUP 17 Units accounted for DM CC 18 Completed/transferred out: 19 Beg. WIP 5 0 3 20 Units started & completed 120 120 120 21 End WIP 6 6 3 22 131 126 126 23 24 COST INFORMATION 25 26 Cost to account for: TOTAL DM 27 Beg. WIP 504.00 120.00 384.00 28 Cost incurred during the perioc 15,432.00 3,144.00 12,288.00 29 15,936.00 3,264.00 12,672.00 30 31 Unit Cost 122.48 24.95 97.52 32 33 34 Trans-out/ 35 Costs accounted for. TOTAL Completed End WIP 36 Units started & completed 14,697.14 37 Beg. WIP: 38 Cost from prior year 504.00 39 Cost from current year 292.57 40 End WIP 41 Direct materials 149.71 42 Conversion cost 292.57 43 15,936.00 15,493.71 442.29 44 45 46 Cost to account for: Beg. WIP Incurred in the current period 30 2916 Beg. WIP Totals 222.00 21,937.71 22,159.71 Trans-in 140.00 15,493.71 15,633.71 DM 32.00 1,584.00 1,616.00 Incurred in the curri CC 50.00 4,860.00 4,910.00 Cost to account for Beg. WIP Cost incurred during the period TOTAL 504.00 15,432.00 15,936.00 DM CC 120.00 384.00 3,144.00 12,288.00 3,264.00 12,672.00 Unit cost 0.10903778 0.076615 0.007922 0.024501 Unit cost 0.10988454 0.077469 0.007920 0.024496 Unit Cost 123.92 24.92 99.00 TOTALS Trans-Out Completed 21.589.48 End WIP Trans-Out Completed TOTALS End WIP Cost accounted for: Completed End WIP Trans-in Direct Materials Conversion cost TOTAL Trans-out/ Completed End WIP ### 21,317.60 Costs accounted for Completed/ transferred out: End WIP Direct materials Conversion cost 459.69 47.53 58.80 566.02 22,155.50 21,589.48 Cost accounted for: Completed: Units started & completed Beg WIP: Cost from prior year Cost from current year End WIP Trans-in Direct Materials Conversion cost 222.00 48.99 149.50 297.00 446.50 15,936.00 464.81 47.52 58.79 571.12 22,159.71 21,588.59