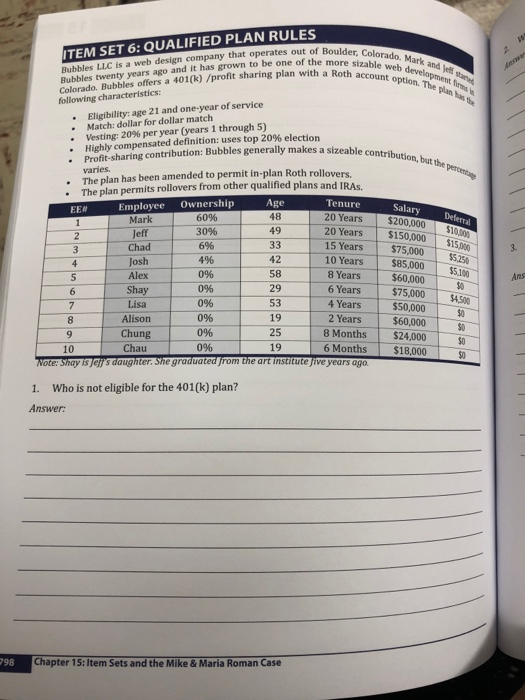

Colorado. Mark and shable web development account option. The plante ITEM SET 6: QUALIFIED PLAN RULES Rubbles LLC is a web design company that operates out of Boulder Bubbles twenty years ago and it has grown to be one of the more Colorado. Bubbles offers a 401(k) /profit sharing plan with a Roth following characteristics: Eligibility: age 21 and one-year of service Match: dollar for dollar match Vesting: 20% per year (years 1 through 5) Highly compensated definition: uses top 20% election bution, but the percent Salary $200,000 Deferral $10,000 $15.00 contribution: Bubbles generally makes a sizeable contributi varies. The plan has been amended to permit in-plan Roth rollovers The plan permits rollovers from other qualified plans and IRAs FE Employee Ownership Age Tenure 1 Mark 60% 20 Years Jeff 2 30% 49 20 Years Chad 6% 15 Years Josh 4% 10 Years Alex 0% 8 Years Shay 0% 6 Years Lisa 0% 53 4 Years Alison 0% 19 2 Years Chung 8 Months 10 Chau 0% 19 6 Months Note: Shay is jer daughter. She graduated from the art institute five years ago. 55.250 $5.10 $150,000 $75,000 $85,000 $60,000 $75,000 $50,000 $60,000 $24,000 $18,000 096 25 1. Who is not eligible for the 401(k) plan? Answer: 798 Chapter 15: Item Sets and the Mike & Maria Roman Case Who is highly compensated? Eral 000 000 250 What is the most that Bubbles could contribute to the profit-sharing plan for the ontribute to the profit sharing plan for the current year assuming the salary deferrals stay constant? Answer: . Item Set 6r Qualified Plan Rules 199 highly compensated employees? What is the actual deferral percentage for the highly compensated em Answer: 5. What is the actual deferral percentage for the non-highly compensated employees Answer: 15 P test? Why or why not and what can the company do If the plan dos as the plan pass the ADP pass the test? Assume the company decided to make a profit-sharing contribution that was integrated with Social Security, with an integration level equal to the Social Security wage base. If the base percentage was 10% with a maximum excess percentage, how much would be contributed to the plan on behalf of Mark (disregard the salary deferral)? Answer: Item Set 6e Qualified Plan Rules 8. How many years of service does Alison currently have for purposes of ve Answer: Colorado. Mark and shable web development account option. The plante ITEM SET 6: QUALIFIED PLAN RULES Rubbles LLC is a web design company that operates out of Boulder Bubbles twenty years ago and it has grown to be one of the more Colorado. Bubbles offers a 401(k) /profit sharing plan with a Roth following characteristics: Eligibility: age 21 and one-year of service Match: dollar for dollar match Vesting: 20% per year (years 1 through 5) Highly compensated definition: uses top 20% election bution, but the percent Salary $200,000 Deferral $10,000 $15.00 contribution: Bubbles generally makes a sizeable contributi varies. The plan has been amended to permit in-plan Roth rollovers The plan permits rollovers from other qualified plans and IRAs FE Employee Ownership Age Tenure 1 Mark 60% 20 Years Jeff 2 30% 49 20 Years Chad 6% 15 Years Josh 4% 10 Years Alex 0% 8 Years Shay 0% 6 Years Lisa 0% 53 4 Years Alison 0% 19 2 Years Chung 8 Months 10 Chau 0% 19 6 Months Note: Shay is jer daughter. She graduated from the art institute five years ago. 55.250 $5.10 $150,000 $75,000 $85,000 $60,000 $75,000 $50,000 $60,000 $24,000 $18,000 096 25 1. Who is not eligible for the 401(k) plan? Answer: 798 Chapter 15: Item Sets and the Mike & Maria Roman Case Who is highly compensated? Eral 000 000 250 What is the most that Bubbles could contribute to the profit-sharing plan for the ontribute to the profit sharing plan for the current year assuming the salary deferrals stay constant? Answer: . Item Set 6r Qualified Plan Rules 199 highly compensated employees? What is the actual deferral percentage for the highly compensated em Answer: 5. What is the actual deferral percentage for the non-highly compensated employees Answer: 15 P test? Why or why not and what can the company do If the plan dos as the plan pass the ADP pass the test? Assume the company decided to make a profit-sharing contribution that was integrated with Social Security, with an integration level equal to the Social Security wage base. If the base percentage was 10% with a maximum excess percentage, how much would be contributed to the plan on behalf of Mark (disregard the salary deferral)? Answer: Item Set 6e Qualified Plan Rules 8. How many years of service does Alison currently have for purposes of ve