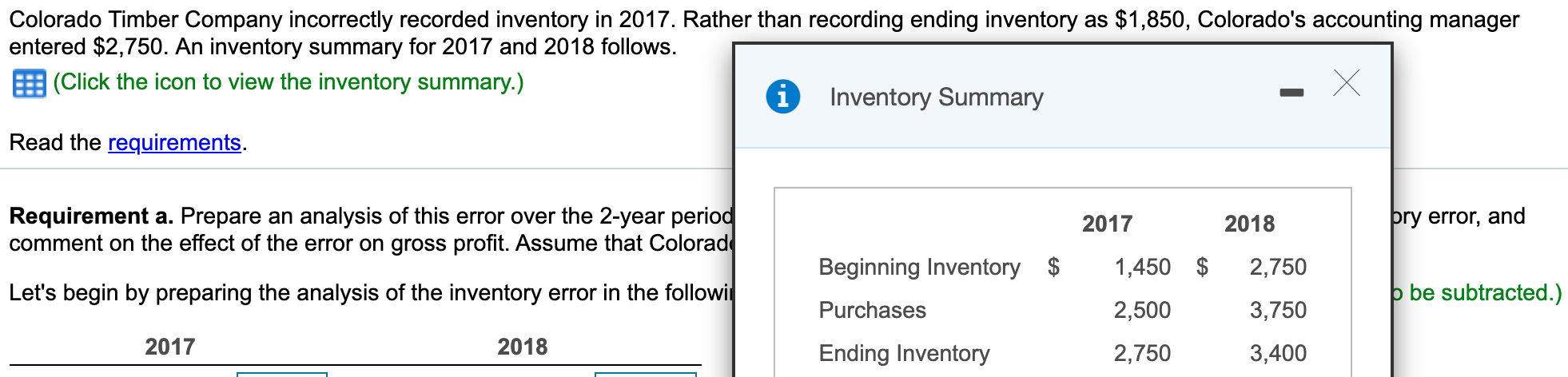

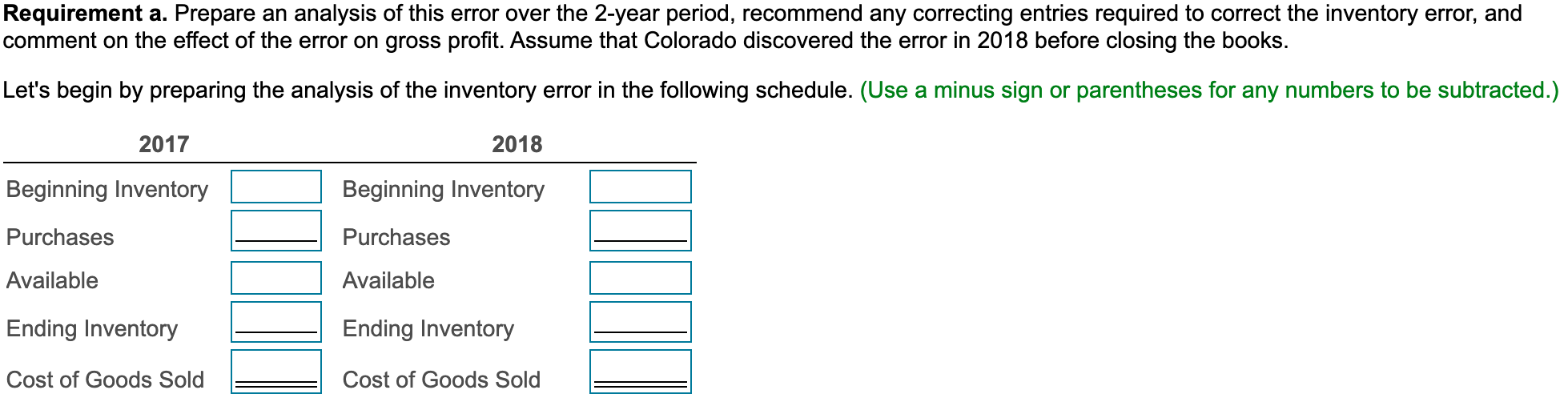

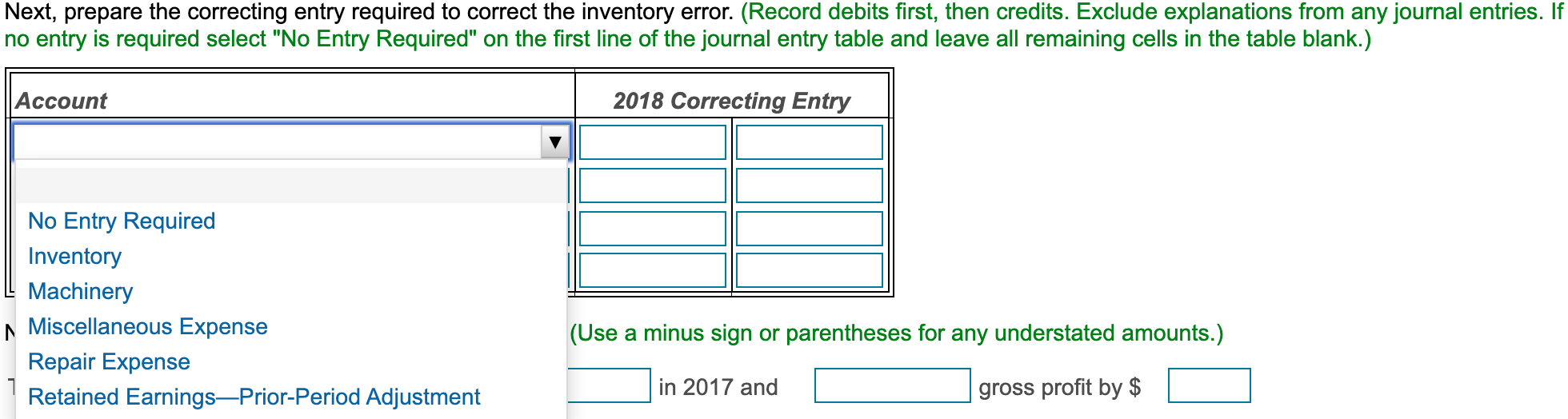

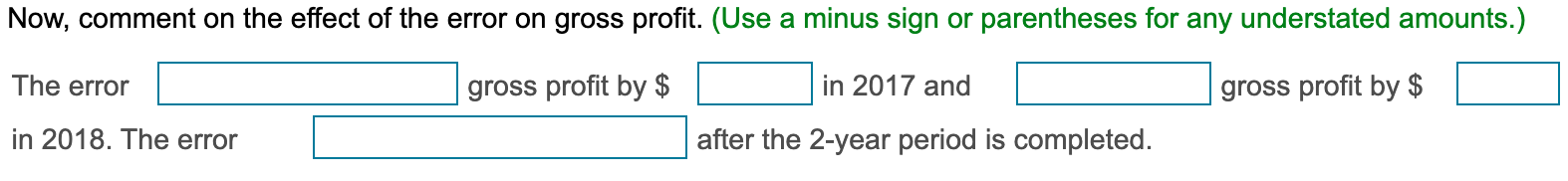

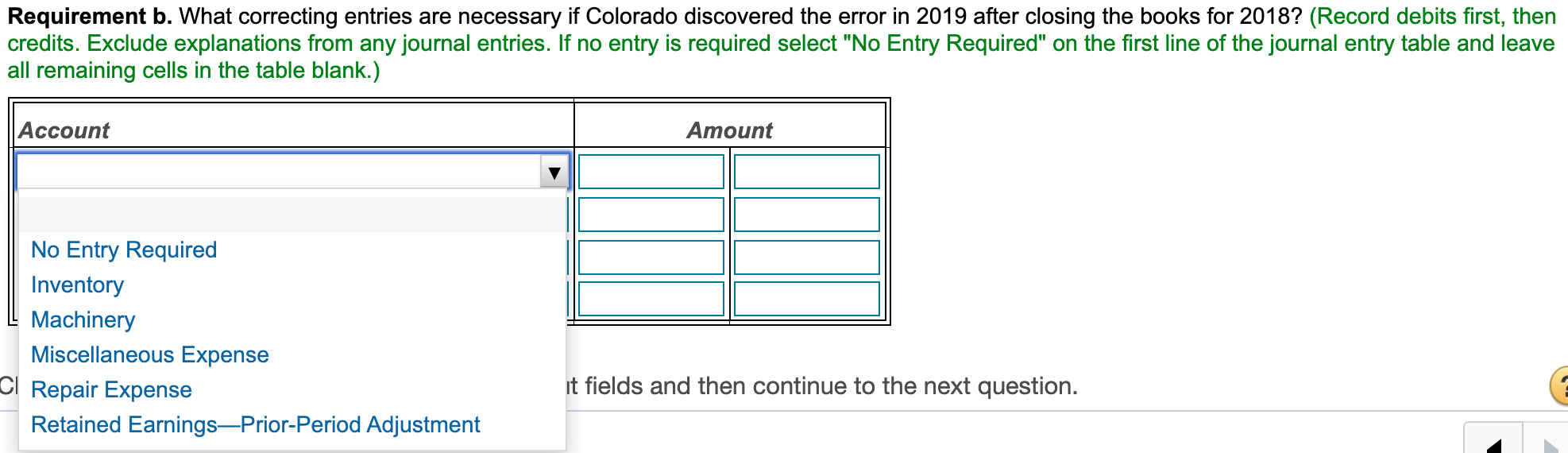

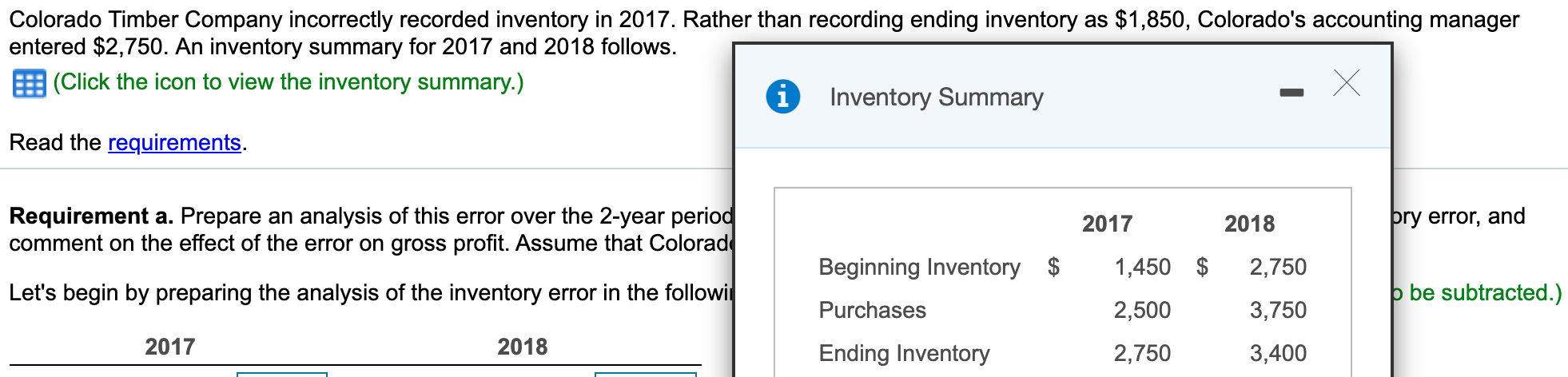

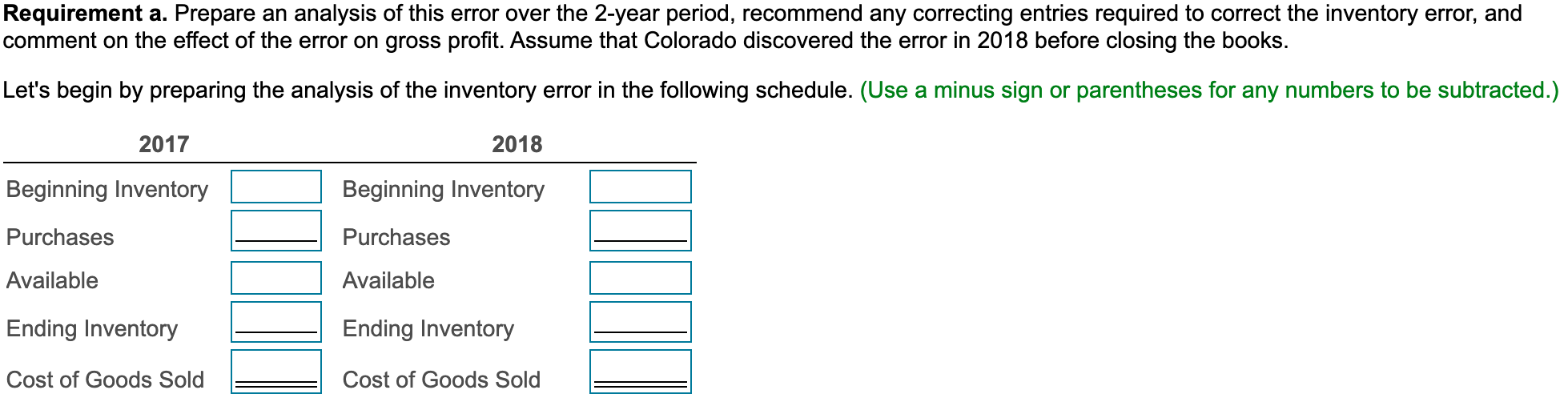

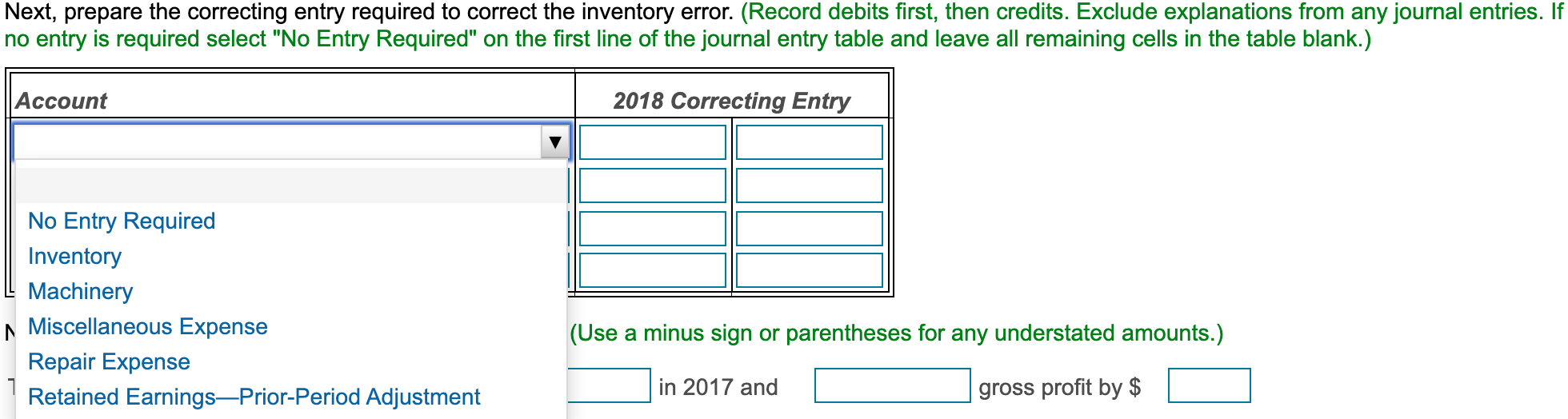

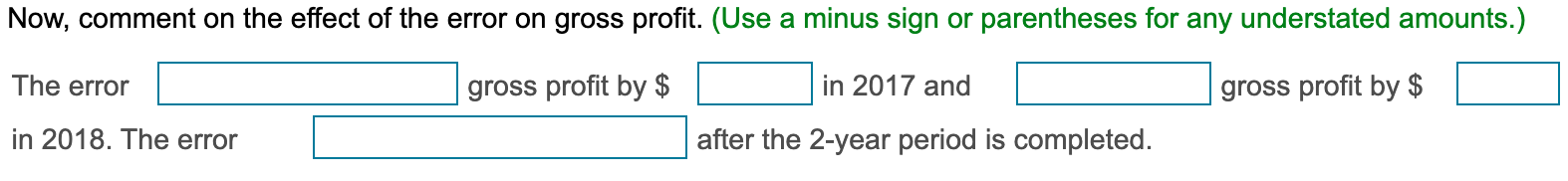

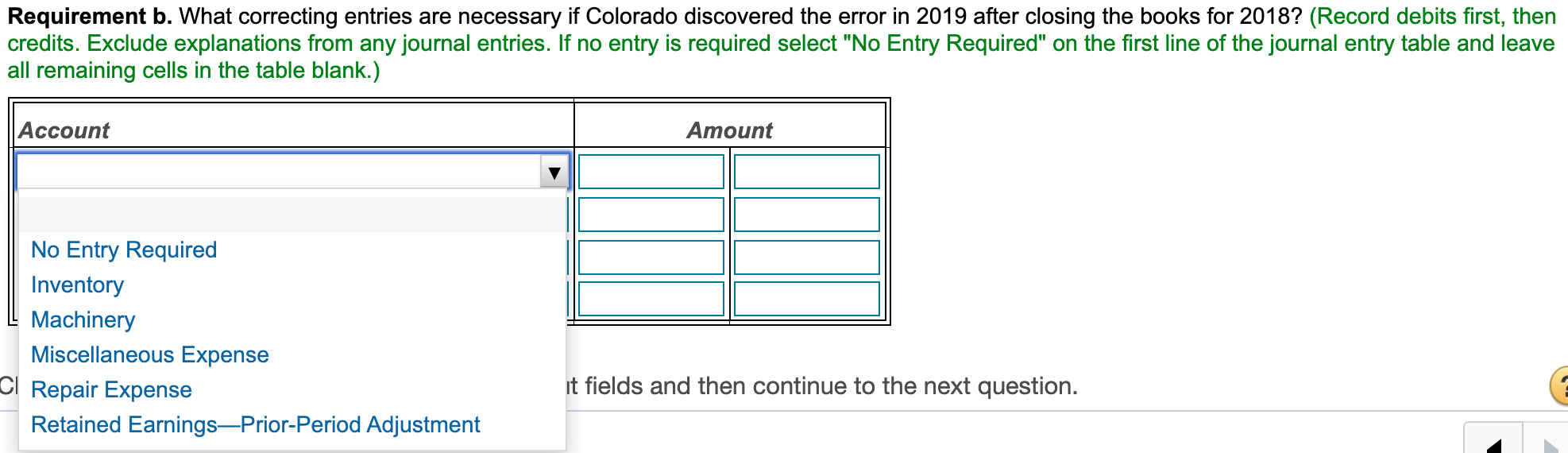

Colorado Timber Company incorrectly recorded inventory in 2017. Rather than recording ending inventory as $1,850, Colorado's accounting manager entered $2,750. An inventory summary for 2017 and 2018 follows. (Click the icon to view the inventory summary.) i X Inventory Summary - Read the requirements. Requirement a. Prepare an analysis of this error over the 2-year period comment on the effect of the error on gross profit. Assume that Colorad 2017 2018 pry error, and 1,450 $ 2,750 Let's begin by preparing the analysis of the inventory error in the followi Beginning Inventory $ Purchases be subtracted.) 2,500 3,750 2017 2018 Ending Inventory 2,750 3,400 Requirement a. Prepare an analysis of this error over the 2-year period, recommend any correcting entries required to correct the inventory error, and comment on the effect of the error on gross profit. Assume that Colorado discovered the error in 2018 before closing the books. Let's begin by preparing the analysis of the inventory error in the following schedule. (Use a minus sign or parentheses for any numbers to be subtracted.) 2017 2018 Beginning Inventory Beginning Inventory Purchases Purchases Available Available Ending Inventory Ending Inventory Cost of Goods Sold Cost of Goods Sold Next, prepare the correcting entry required to correct the inventory error. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Account 2018 Correcting Entry No Entry Required Inventory Machinery Miscellaneous Expense Repair Expense Retained EarningsPrior-Period Adjustment (Use a minus sign or parentheses for any understated amounts.) in 2017 and gross profit by $ Now, comment on the effect of the error on gross profit. (Use a minus sign or parentheses for any understated amounts.) The error gross profit by $ in 2017 and gross profit by $ in 2018. The error after the 2-year period is completed. Requirement b. What correcting entries are necessary if Colorado discovered the error in 2019 after closing the books for 2018? (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Account Amount No Entry Required Inventory Machinery Miscellaneous Expense Cl Repair Expense Retained EarningsPrior-Period Adjustment it fields and then continue to the next