Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Colt McCoy Co. started had the following transactions related to inventory in December Beginning inventory December 5 Purchase December 7 Sold December 20 Purchase

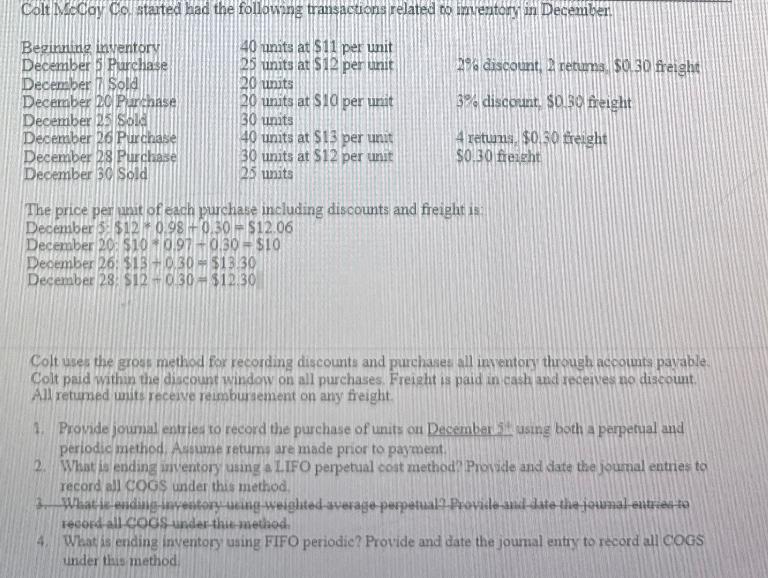

Colt McCoy Co. started had the following transactions related to inventory in December Beginning inventory December 5 Purchase December 7 Sold December 20 Purchase December 25 Sold December 26 Purchase December 28 Purchase December 30 Sold 40 units at $11 per unit 25 units at $12 per unit 20 units 20 units at $10 per unit 30 units 40 units at $13 per unit 2% discount, 2 returns $0.30 freight 3% discount. $0.30 freight 30 units at $12 per unit 25 units 4 returns, $0.30 freight $0.30 freight The price per unit of each purchase including discounts and freight is: December 5 $12 +0.98 +0.30-$12.06 December 20: $10+0.97-0.30-$10 December 26: $130.30-$13.30 December 28: $12-0.30-$12.30 Colt uses the gross method for recording discounts and purchases all inventory through accounts payable. Colt paid within the discount window on all purchases. Freight is paid in cash and receives no discount. All retumed units receive reimbursement on any freight. 4. Provide journal entries to record the purchase of units on December 5 using both a perpetual and periodic method. Assume returns are made prior to payment. 2. What is ending inventory using a LIFO perpetual cost method? Provide and date the journal entries to record all COGS under this method. Whatic-ending-inventory sting-weiglied average perpetual2.Provide-and-date the joumal-entred-to record all COGS under the method. What is ending inventory using FIFO periodic? Provide and date the journal entry to record all COGS under this method

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each part of the problem 1 Journal Entries to Record the Purchase on December 5 Perpetual Method Debit Inventory 30220 40 units 1206 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663db3c8aa6b0_963445.pdf

180 KBs PDF File

663db3c8aa6b0_963445.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started