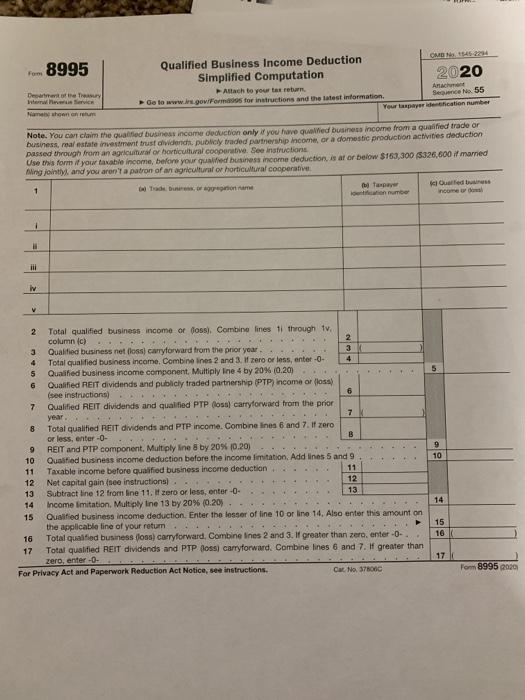

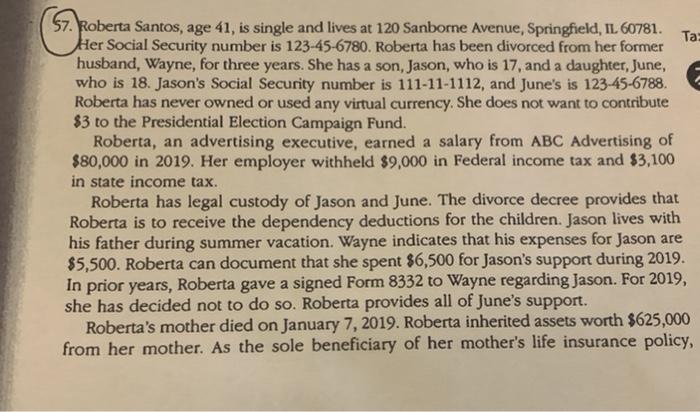

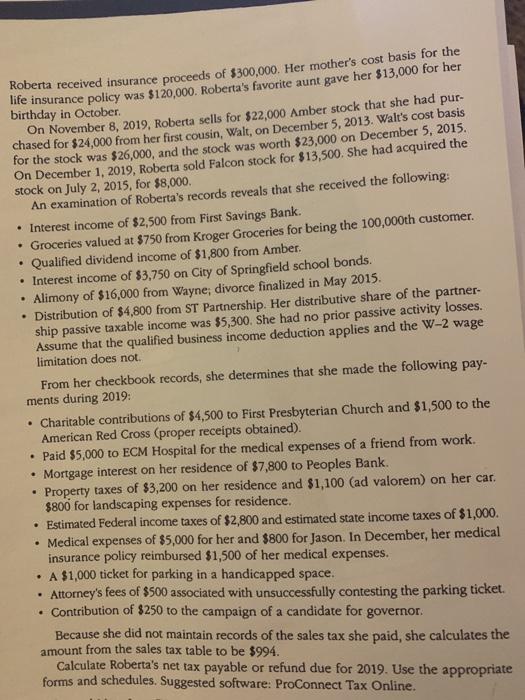

com 8995 Qualified Business Income Deduction OM 14522 Simplified Computation 2020 Attach to your tax rebarn Anach e to www.lrs.gowiFormasis for instructions and the latest information Secc No. 55 Your taxpayer identification number Det of the Intervi Name when you Note. You can claim the qualified business income deduction only if you have quoted business income from a qualified trade or business, mal estate investment trust hidend publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions Use this form if your taxable income, before your qualified business income deduction is af or below $163,300 (5326,600 if mamed Ming johtly and you aren't a patron of an agricultural or horticultural cooperative 1 Tradu, Outlet in numbe nome do III iv V 9 2 Total qualified business income or loss). Combine lines 11 through tv column (C) 2 3 Qualified business net loss carryforward from the prior year 3 4 Total qualified business income. Combine lines 2 and 3. f zero or less, enter -- 4 5 Qualified business income component Multiply line 4 by 20% (0.20) 6 Qualified REIT dividends and publicly traded partnership (PTP) income or flosa) (see instructions) 6 7 Qualified REIT dividends and qualified PTP os carryforward from the prior year 7 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter 0 B REIT and PIP component, Multiply ine 8 by 20% 10.20) 10 Qualified business income deduction before the income limitation Add lines 5 and 9 11 Taxable income before qualified business income deduction 11 12 Net capital gain see instructions). 12 13 Subtract line 12 from line 11. zero or less enter-O- 13 14 Income Imitation Multiply ine 13 by 20% (0.20) 15 Qualified business Income deduction Enter the losser of line 10 or line 14. Also enter this amount on the applicable line of your retum. 16 Total qualified business dons) carryforward. Combine Ines 2 and 3. If greater than zero, enter-O- 17 Total qualified REIT dividends and PTP (oss) carryforward. Combine lines 6 and 7. If greater than zero, enter -- For Privacy Act and Paperwork Reduction Act Notice, see instructions Cat No. 37 10 14 15 16 17 Form 8995 2020 57. Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 60781. Ta: Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for three years. She has a son, Jason, who is 17, and a daughter, June, who is 18. Jason's Social Security number is 111-11-1112, and June's is 123-45-6788. Roberta has never owned or used any virtual currency. She does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta, an advertising executive, earned a salary from ABC Advertising of $80,000 in 2019. Her employer withheld $9,000 in Federal income tax and $3,100 in state income tax. Roberta has legal custody of Jason and June. The divorce decree provides that Roberta is to receive the dependency deductions for the children. Jason lives with his father during summer vacation. Wayne indicates that his expenses for Jason are $5,500. Roberta can document that she spent $6,500 for Jason's support during 2019. In prior years, Roberta gave a signed Form 8332 to Wayne regarding Jason. For 2019, she has decided not to do so. Roberta provides all of June's support. Roberta's mother died on January 7, 2019. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received insurance proceeds of $300,000. Her mother's cost basis for the life insurance policy was $120,000. Roberta's favorite aunt gave her $13,000 for her birthday in October On November 8, 2019, Roberta sells for $22,000 Amber stock that she had pur- chased for $24,000 from her first cousin, Walt , on December 5, 2013. Walt's cost basis for the stock was $26,000, and the stock was worth $23,000 on December 5, 2015. On December 1, 2019, Roberta sold Falcon stock for $13,500. She had acquired the stock on July 2, 2015, for $8,000. An examination of Roberta's records reveals that she received the following: Interest income of $2,500 from First Savings Bank. Groceries valued at $750 from Kroger Groceries for being the 100,000th customer. Qualified dividend income of $1,800 from Amber. Interest income of $3,750 on City of Springfield school bonds. Alimony of $16,000 from Wayne; divorce finalized in May 2015 Distribution of $4,800 from ST Partnership. Her distributive share of the partner- ship passive taxable income was $5,300. She had no prior passive activity losses. Assume that the qualified business income deduction applies and the W-2 wage limitation does not. From her checkbook records, she determines that she made the following pay- ments during 2019: . Charitable contributions of $4,500 to First Presbyterian Church and $1,500 to the American Red Cross (proper receipts obtained). Paid $5,000 to ECM Hospital for the medical expenses of a friend from work. Mortgage interest on her residence of $7,800 to Peoples Bank. Property taxes of $3,200 on her residence and $1,100 (ad valorem) on her car. $800 for landscaping expenses for residence Estimated Federal income taxes of $2,800 and estimated state income taxes of $1,000 Medical expenses of $5,000 for her and $800 for Jason. In December, her medical insurance policy reimbursed $1,500 of her medical expenses. A $1,000 ticket for parking in a handicapped space. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket. Contribution of $250 to the campaign of a candidate for governor. Because she did not maintain records of the sales tax she paid, she calculates the amount from the sales tax table to be $994. Calculate Roberta's net tax payable or refund due for 2019. Use the appropriate forms and schedules. Suggested software: ProConnect Tax Online. com 8995 Qualified Business Income Deduction OM 14522 Simplified Computation 2020 Attach to your tax rebarn Anach e to www.lrs.gowiFormasis for instructions and the latest information Secc No. 55 Your taxpayer identification number Det of the Intervi Name when you Note. You can claim the qualified business income deduction only if you have quoted business income from a qualified trade or business, mal estate investment trust hidend publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions Use this form if your taxable income, before your qualified business income deduction is af or below $163,300 (5326,600 if mamed Ming johtly and you aren't a patron of an agricultural or horticultural cooperative 1 Tradu, Outlet in numbe nome do III iv V 9 2 Total qualified business income or loss). Combine lines 11 through tv column (C) 2 3 Qualified business net loss carryforward from the prior year 3 4 Total qualified business income. Combine lines 2 and 3. f zero or less, enter -- 4 5 Qualified business income component Multiply line 4 by 20% (0.20) 6 Qualified REIT dividends and publicly traded partnership (PTP) income or flosa) (see instructions) 6 7 Qualified REIT dividends and qualified PTP os carryforward from the prior year 7 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter 0 B REIT and PIP component, Multiply ine 8 by 20% 10.20) 10 Qualified business income deduction before the income limitation Add lines 5 and 9 11 Taxable income before qualified business income deduction 11 12 Net capital gain see instructions). 12 13 Subtract line 12 from line 11. zero or less enter-O- 13 14 Income Imitation Multiply ine 13 by 20% (0.20) 15 Qualified business Income deduction Enter the losser of line 10 or line 14. Also enter this amount on the applicable line of your retum. 16 Total qualified business dons) carryforward. Combine Ines 2 and 3. If greater than zero, enter-O- 17 Total qualified REIT dividends and PTP (oss) carryforward. Combine lines 6 and 7. If greater than zero, enter -- For Privacy Act and Paperwork Reduction Act Notice, see instructions Cat No. 37 10 14 15 16 17 Form 8995 2020 57. Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 60781. Ta: Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for three years. She has a son, Jason, who is 17, and a daughter, June, who is 18. Jason's Social Security number is 111-11-1112, and June's is 123-45-6788. Roberta has never owned or used any virtual currency. She does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta, an advertising executive, earned a salary from ABC Advertising of $80,000 in 2019. Her employer withheld $9,000 in Federal income tax and $3,100 in state income tax. Roberta has legal custody of Jason and June. The divorce decree provides that Roberta is to receive the dependency deductions for the children. Jason lives with his father during summer vacation. Wayne indicates that his expenses for Jason are $5,500. Roberta can document that she spent $6,500 for Jason's support during 2019. In prior years, Roberta gave a signed Form 8332 to Wayne regarding Jason. For 2019, she has decided not to do so. Roberta provides all of June's support. Roberta's mother died on January 7, 2019. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received insurance proceeds of $300,000. Her mother's cost basis for the life insurance policy was $120,000. Roberta's favorite aunt gave her $13,000 for her birthday in October On November 8, 2019, Roberta sells for $22,000 Amber stock that she had pur- chased for $24,000 from her first cousin, Walt , on December 5, 2013. Walt's cost basis for the stock was $26,000, and the stock was worth $23,000 on December 5, 2015. On December 1, 2019, Roberta sold Falcon stock for $13,500. She had acquired the stock on July 2, 2015, for $8,000. An examination of Roberta's records reveals that she received the following: Interest income of $2,500 from First Savings Bank. Groceries valued at $750 from Kroger Groceries for being the 100,000th customer. Qualified dividend income of $1,800 from Amber. Interest income of $3,750 on City of Springfield school bonds. Alimony of $16,000 from Wayne; divorce finalized in May 2015 Distribution of $4,800 from ST Partnership. Her distributive share of the partner- ship passive taxable income was $5,300. She had no prior passive activity losses. Assume that the qualified business income deduction applies and the W-2 wage limitation does not. From her checkbook records, she determines that she made the following pay- ments during 2019: . Charitable contributions of $4,500 to First Presbyterian Church and $1,500 to the American Red Cross (proper receipts obtained). Paid $5,000 to ECM Hospital for the medical expenses of a friend from work. Mortgage interest on her residence of $7,800 to Peoples Bank. Property taxes of $3,200 on her residence and $1,100 (ad valorem) on her car. $800 for landscaping expenses for residence Estimated Federal income taxes of $2,800 and estimated state income taxes of $1,000 Medical expenses of $5,000 for her and $800 for Jason. In December, her medical insurance policy reimbursed $1,500 of her medical expenses. A $1,000 ticket for parking in a handicapped space. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket. Contribution of $250 to the campaign of a candidate for governor. Because she did not maintain records of the sales tax she paid, she calculates the amount from the sales tax table to be $994. Calculate Roberta's net tax payable or refund due for 2019. Use the appropriate forms and schedules. Suggested software: ProConnect Tax Online