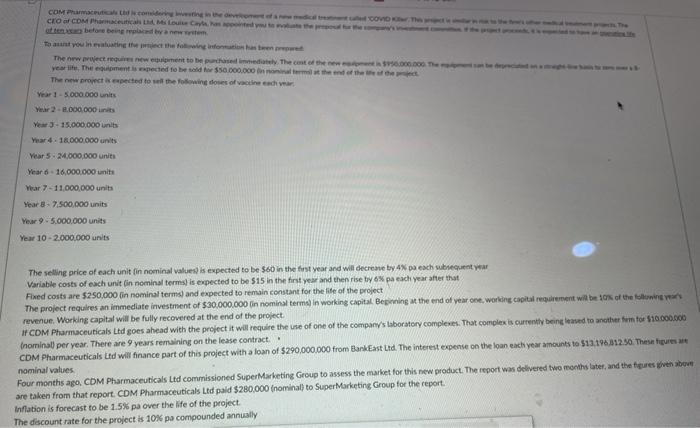

COM Pharmaceutical comigo CEO of COM Pharmaceutical Care atten before being van that you in ting tect the footste The new projectes new ent to be purchase. The cost of the 5.000.000 The year. Thement is expected to be told to $50.000.000 The new project inpected to the windows of acid Year 15.000.000 units Year 2.000.000 units Year 3-15.000.000 units Year 4. 18.000.000 units Year 5. 2,000,000 units Year 16,000,000 unite Year 7-11,000,000 units Year 87,500,000 units Year 95.000.000 units Year 10 - 2.000.000 units The selling price of each unit in nominal values is expected to be $60 in the trust year and will decreme by 4% pa each subsequent year Variable costs of each unit in nominal terms) is expected to be $15 in the first year and then rise to pa each year after that Fixed costs are $250,000 in nominal terms) and expected to remain constant for the life of the project The project requires an immediate investment of $30,000,000 in nominal terms in working capital Berning at the end of year one, working capital requirement will be 10% of the following revenue. Working capital will be fully recovered at the end of the project I COM Pharmaceuticals Ltd goes ahead with the project it will require the use of one of the company's laboratory complexes. That complex is currently being leased to another tem to $10.000.000 Inominal per year. There are 9 years remaining on the lease contract CDM Pharmaceuticals Ltd will finance part of this project with a loan of $290,000,000 from BankEast Ltd. The interest expense on the loan each year amounts to $11.196.212.30. These nominal values Four months ago. CDM Pharmaceuticals Ltd commissioned Super Marketing Group to assess the market for this new product. The report was delivered two months later, and the present are taken from that report. CDM Pharmaceuticals Ltd paid $280,000 (nominal) to Super Marketing Group for the report. Inflation is forecast to be 1.5% pa over the life of the project The discount rate for the project is 10% pa compounded annually Question 1 Cate of the cash flow for this project Excel being sure to belach com and row deal. Mae sure you the death NOT in the cash flows. Once completed out and paste the table into the space below or upload a screenshot of your BIA COM Pharmaceutical comigo CEO of COM Pharmaceutical Care atten before being van that you in ting tect the footste The new projectes new ent to be purchase. The cost of the 5.000.000 The year. Thement is expected to be told to $50.000.000 The new project inpected to the windows of acid Year 15.000.000 units Year 2.000.000 units Year 3-15.000.000 units Year 4. 18.000.000 units Year 5. 2,000,000 units Year 16,000,000 unite Year 7-11,000,000 units Year 87,500,000 units Year 95.000.000 units Year 10 - 2.000.000 units The selling price of each unit in nominal values is expected to be $60 in the trust year and will decreme by 4% pa each subsequent year Variable costs of each unit in nominal terms) is expected to be $15 in the first year and then rise to pa each year after that Fixed costs are $250,000 in nominal terms) and expected to remain constant for the life of the project The project requires an immediate investment of $30,000,000 in nominal terms in working capital Berning at the end of year one, working capital requirement will be 10% of the following revenue. Working capital will be fully recovered at the end of the project I COM Pharmaceuticals Ltd goes ahead with the project it will require the use of one of the company's laboratory complexes. That complex is currently being leased to another tem to $10.000.000 Inominal per year. There are 9 years remaining on the lease contract CDM Pharmaceuticals Ltd will finance part of this project with a loan of $290,000,000 from BankEast Ltd. The interest expense on the loan each year amounts to $11.196.212.30. These nominal values Four months ago. CDM Pharmaceuticals Ltd commissioned Super Marketing Group to assess the market for this new product. The report was delivered two months later, and the present are taken from that report. CDM Pharmaceuticals Ltd paid $280,000 (nominal) to Super Marketing Group for the report. Inflation is forecast to be 1.5% pa over the life of the project The discount rate for the project is 10% pa compounded annually Question 1 Cate of the cash flow for this project Excel being sure to belach com and row deal. Mae sure you the death NOT in the cash flows. Once completed out and paste the table into the space below or upload a screenshot of your BIA