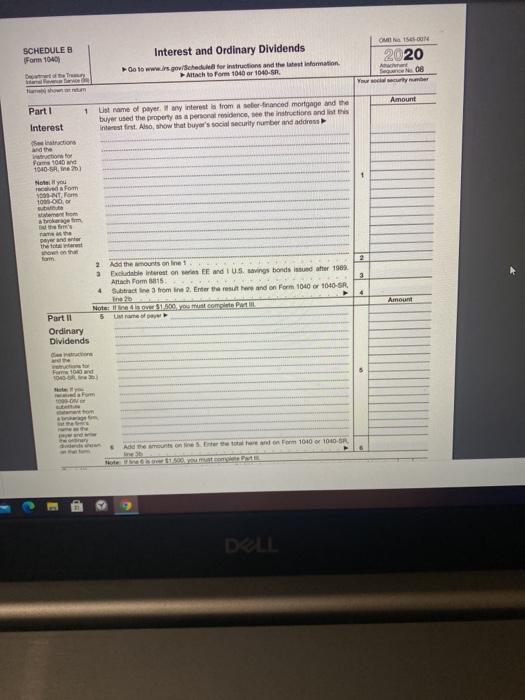

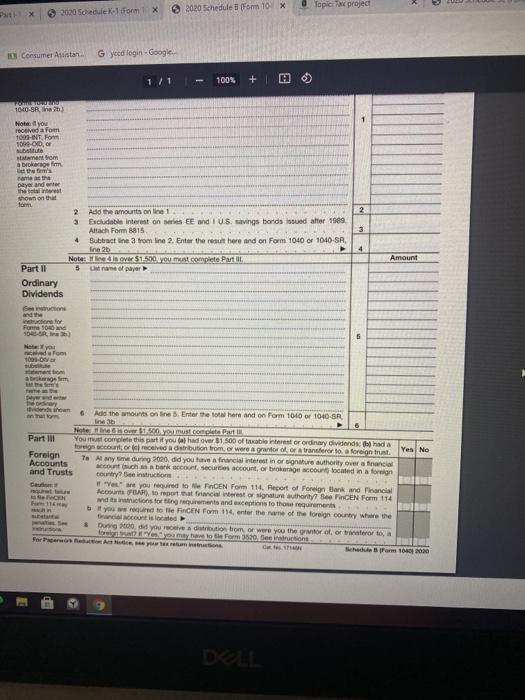

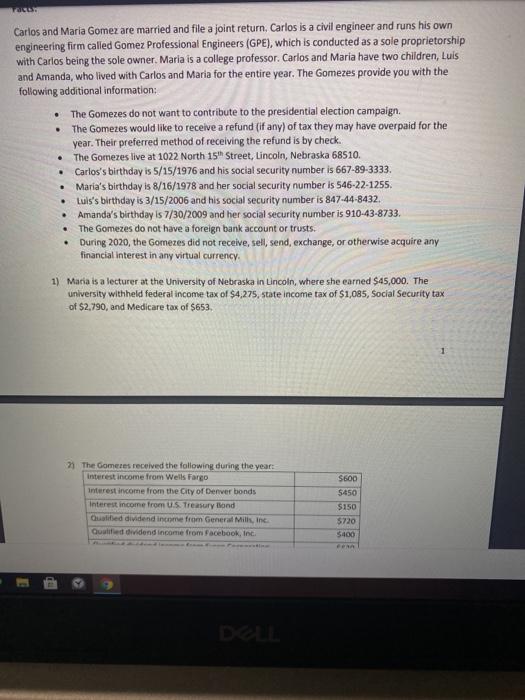

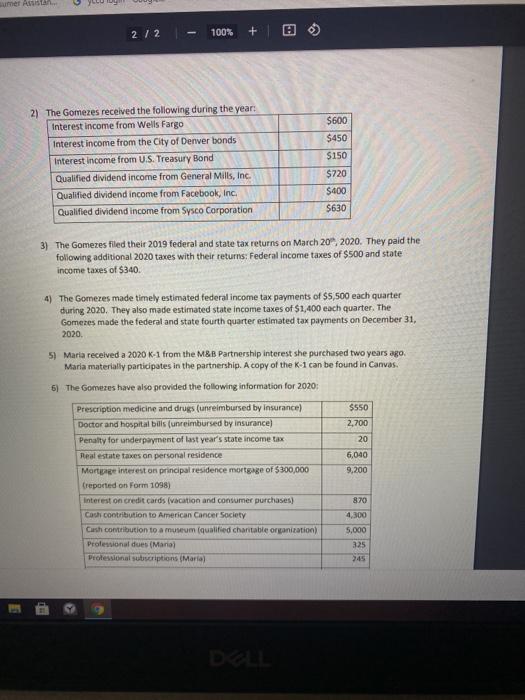

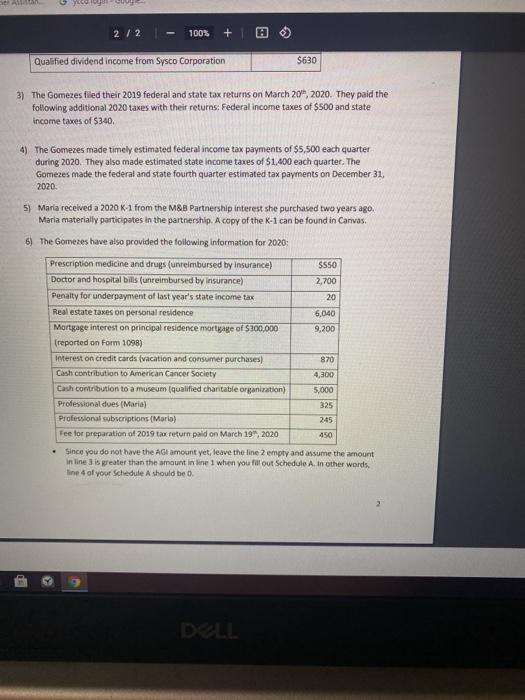

COM1505-BUN SCHEDULEB Form 10401 2020 Interest and Ordinary Dividends o to www.in.gov/Schedule for instructions and the latest information Attach to Form 1046 or 104-SR. Det er 08 www.br Amount 1 Part 1 Interest List name of payer wy interest is from a tenned mortgage and the buyer used the property as a persona dance, the instructions and is this Interest first. Also, show that buyer's social security number and address Sections and the conto F1040 1040-1 Now you form VENT, 10000 stagem the the yer and enter th on the 10 Amount 2 Add the mounts online Excludable Interest on EE and US savingstonds under 1909 Anachrom 15 4 Subtone 3 tromine 2. Enter the resterend on Form 1040 or 1046-GR Ina Note 31.500 com PM Part 11 UM Ordinary Dividends 100 Addison Form 1010 1010 - DD > 2020 Schedule Form 10X o Topic Fax project X > 2020 Schedule Room X Consumer Assistan Gyeed login - Google 1/1 100% + FOTO 1040-SR ina 2 Hotell you Feved for 1001- INT. Fom 109000, OF entom aber firm 2 3 payer and enter the totalt shown on that fo 2 Add the amounts on line 1 3 Excludable interest on EE and U.S. savings bonds issued after 1989 Altach Form 8815 4 Subtract line 3 trom line 2. Enter the result here and on Form 1040 of 1040-SR line 25 Note: line 4s over $1500, you must complete Part 1 Part 11 5 Una per Ordinary Dividends 4 Amount and the contor For 100 GR 1001- argum Add the wounts on Enter the here and on Form 1040 or 1040-SR line 3 New 51 500 You must complete Part Part III You must complete this part of you (al had over $1.500 of taxable interest or ordinary dividend had a fourt or received a distribution from or were a gran for alor transfer to a foreign trust Yes No Foreign Accounts To Any Sme during 2000, did you e a francial interest in or signature authority over financial otwch a bank account count, or brokerage courted in a foreign and Trusts country instruction Cau You are you required to Me EN Form 114. Report of Foreign lank and Financial CFA, to report na francia Werest or signature authority in Form 114 VEN dictions for ingements and exceptions to the requirements tyd toe PCEN Form 154, enter theme of the foreign country where the account is located & Dung 200 did you hear trom or were you the foref, or transferorto, you may have to form finns For Pro uso Car Schecks om 16402020 E Carlos and Maria Gomez are married and file a joint return. Carlos is a civil engineer and runs his own engineering firm called Gomez Professional Engineers (GPE), which is conducted as a sole proprietorship with Carlos being the sole owner. Maria is a college professor. Carlos and Maria have two children, Luis and Amanda, who lived with Carlos and Maria for the entire year. The Gomezes provide you with the following additional information: The Gomezes do not want to contribute to the presidential election campaign. The Gomezes would like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by check. The Gomezes live at 1022 North 15h Street, Lincoln, Nebraska 68510. Carlos's birthday is 5/15/1976 and his social security number is 667-89-3333. Maria's birthday is 8/16/1978 and her social security number is 546-22-1255. Luis's birthday is 3/15/2006 and his social security number is 847-44-8432. Amanda's birthday is 7/30/2009 and her social security number is 910-43-8733. The Gomezes do not have a foreign bank account or trusts. . During 2020, the Gomezes did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency 1) Maria is a lecturer at the University of Nebraska in Lincoln, where she earned $45,000. The university withheld federal income tax of $4,275, state income tax of $1,085, Social Security tax of $2,790, and Medicare tax of $653 . . . 1 The Gometes received the following during the year: Interest income from Wells Fargo Interest income from the City of Denver bonds Interest income from US Treasury and Qualified dividend income from General Mills, inc. Qualified dividend income from Facebook, Inc. S600 5450 $150 $720 $400 sumer Assist 2 / 2 100% + $600 $450 2) The Gomezes received the following during the year Interest income from Wells Fargo Interest income from the City of Denver bonds Interest income from U.S. Treasury Bond Qualified dividend income from General Mills, Inc. Qualified dividend income from Facebook, Inc. Qualified dividend income from Sysco Corporation $150 $720 $400 $630 3) The Gomezes filed their 2019 federal and state tax returns on March 20, 2020. They paid the following additional 2020 taxes with their returns: Federal income taxes of $500 and state income taxes of $340 4) The Gomeres made timely estimated federal income tax payments of $5,500 each quarter during 2020. They also made estimated state income taxes of $1,400 each quarter. The Gomezes made the federal and state fourth quarter estimated tax payments on December 31, 2020 5) Maria received a 2020 K-1 from the M&B Partnership interest she purchased two years ago Maria materially participates in the partnership. A copy of the K-1 can be found in Canvas. 6) The Gomezes have also provided the following information for 2020: $550 2,700 20 6,040 9,200 Prescription medicine and drugs (unreimbursed by Insurance) Doctor and hospital bills (unreimbursed by insurance) Penalty for underpayment of last year's state income tax Real estate taxes on personal residence Mortgage interest on principal residence mortgage of $300,000 (reported on Form 1098) Interest on credit cards (vacation and consumer purchases) Cash contribution to American Cancer Society Cash contribution to a museum (qualified charitable organization) Profesional dues (Maria) Professional subscriptions (Maria) 870 4,300 5,000 325 245 A w 2 / 2 100% + Qualified dividend income from Sysco Corporation $630 3) The Gomezes filled their 2019 federal and state tax returns on March 20", 2020. They paid the following additional 2020 taxes with their returns: Federal income taxes of $500 and state income taxes of $340, 4) The Gomezes made timely estimated federal income tax payments of $5,500 each quarter during 2020. They also made estimated state income taxes of $1,400 each quarter. The Gomezes made the federal and state fourth quarter estimated tax payments on December 31, 2020 5) Maria received a 2020 K-1 from the M&B Partnership interest she purchased two years ago. Maria materially participates in the partnership. A copy of the K-1 can be found in Canvas. 6) The Gomezes have also provided the following information for 2020 Prescription medicine and drugs (unreimbursed by insurance) $550 Doctor and hospital bills (unreimbursed by insurance) 2,700 Penalty for underpayment of last year's state income tax 20 Real estate taxes on personal residence 6,040 Mortgage interest on principal residence mortgage of $300,000 9,200 (reported on Form 1098) Interest on credit cards (vacation and consumer purchases) 870 Cash contribution to American Cancer Society 4,300 Cash contribution to a museum (qualified charitable organization) 5,000 Professional dues (Maria) 325 Professional subscriptions (Maria) 245 Fee for preparation of 2019 tax return paid on March 19, 2020 450 Since you do not have the Alamount yet, leave the line 2 empty and assume the amount in line 3 is greater than the amount in line 1 when you fill out Schedule A. In other words, line 4 of your schedule A should be 0. DOLLS COM1505-BUN SCHEDULEB Form 10401 2020 Interest and Ordinary Dividends o to www.in.gov/Schedule for instructions and the latest information Attach to Form 1046 or 104-SR. Det er 08 www.br Amount 1 Part 1 Interest List name of payer wy interest is from a tenned mortgage and the buyer used the property as a persona dance, the instructions and is this Interest first. Also, show that buyer's social security number and address Sections and the conto F1040 1040-1 Now you form VENT, 10000 stagem the the yer and enter th on the 10 Amount 2 Add the mounts online Excludable Interest on EE and US savingstonds under 1909 Anachrom 15 4 Subtone 3 tromine 2. Enter the resterend on Form 1040 or 1046-GR Ina Note 31.500 com PM Part 11 UM Ordinary Dividends 100 Addison Form 1010 1010 - DD > 2020 Schedule Form 10X o Topic Fax project X > 2020 Schedule Room X Consumer Assistan Gyeed login - Google 1/1 100% + FOTO 1040-SR ina 2 Hotell you Feved for 1001- INT. Fom 109000, OF entom aber firm 2 3 payer and enter the totalt shown on that fo 2 Add the amounts on line 1 3 Excludable interest on EE and U.S. savings bonds issued after 1989 Altach Form 8815 4 Subtract line 3 trom line 2. Enter the result here and on Form 1040 of 1040-SR line 25 Note: line 4s over $1500, you must complete Part 1 Part 11 5 Una per Ordinary Dividends 4 Amount and the contor For 100 GR 1001- argum Add the wounts on Enter the here and on Form 1040 or 1040-SR line 3 New 51 500 You must complete Part Part III You must complete this part of you (al had over $1.500 of taxable interest or ordinary dividend had a fourt or received a distribution from or were a gran for alor transfer to a foreign trust Yes No Foreign Accounts To Any Sme during 2000, did you e a francial interest in or signature authority over financial otwch a bank account count, or brokerage courted in a foreign and Trusts country instruction Cau You are you required to Me EN Form 114. Report of Foreign lank and Financial CFA, to report na francia Werest or signature authority in Form 114 VEN dictions for ingements and exceptions to the requirements tyd toe PCEN Form 154, enter theme of the foreign country where the account is located & Dung 200 did you hear trom or were you the foref, or transferorto, you may have to form finns For Pro uso Car Schecks om 16402020 E Carlos and Maria Gomez are married and file a joint return. Carlos is a civil engineer and runs his own engineering firm called Gomez Professional Engineers (GPE), which is conducted as a sole proprietorship with Carlos being the sole owner. Maria is a college professor. Carlos and Maria have two children, Luis and Amanda, who lived with Carlos and Maria for the entire year. The Gomezes provide you with the following additional information: The Gomezes do not want to contribute to the presidential election campaign. The Gomezes would like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by check. The Gomezes live at 1022 North 15h Street, Lincoln, Nebraska 68510. Carlos's birthday is 5/15/1976 and his social security number is 667-89-3333. Maria's birthday is 8/16/1978 and her social security number is 546-22-1255. Luis's birthday is 3/15/2006 and his social security number is 847-44-8432. Amanda's birthday is 7/30/2009 and her social security number is 910-43-8733. The Gomezes do not have a foreign bank account or trusts. . During 2020, the Gomezes did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency 1) Maria is a lecturer at the University of Nebraska in Lincoln, where she earned $45,000. The university withheld federal income tax of $4,275, state income tax of $1,085, Social Security tax of $2,790, and Medicare tax of $653 . . . 1 The Gometes received the following during the year: Interest income from Wells Fargo Interest income from the City of Denver bonds Interest income from US Treasury and Qualified dividend income from General Mills, inc. Qualified dividend income from Facebook, Inc. S600 5450 $150 $720 $400 sumer Assist 2 / 2 100% + $600 $450 2) The Gomezes received the following during the year Interest income from Wells Fargo Interest income from the City of Denver bonds Interest income from U.S. Treasury Bond Qualified dividend income from General Mills, Inc. Qualified dividend income from Facebook, Inc. Qualified dividend income from Sysco Corporation $150 $720 $400 $630 3) The Gomezes filed their 2019 federal and state tax returns on March 20, 2020. They paid the following additional 2020 taxes with their returns: Federal income taxes of $500 and state income taxes of $340 4) The Gomeres made timely estimated federal income tax payments of $5,500 each quarter during 2020. They also made estimated state income taxes of $1,400 each quarter. The Gomezes made the federal and state fourth quarter estimated tax payments on December 31, 2020 5) Maria received a 2020 K-1 from the M&B Partnership interest she purchased two years ago Maria materially participates in the partnership. A copy of the K-1 can be found in Canvas. 6) The Gomezes have also provided the following information for 2020: $550 2,700 20 6,040 9,200 Prescription medicine and drugs (unreimbursed by Insurance) Doctor and hospital bills (unreimbursed by insurance) Penalty for underpayment of last year's state income tax Real estate taxes on personal residence Mortgage interest on principal residence mortgage of $300,000 (reported on Form 1098) Interest on credit cards (vacation and consumer purchases) Cash contribution to American Cancer Society Cash contribution to a museum (qualified charitable organization) Profesional dues (Maria) Professional subscriptions (Maria) 870 4,300 5,000 325 245 A w 2 / 2 100% + Qualified dividend income from Sysco Corporation $630 3) The Gomezes filled their 2019 federal and state tax returns on March 20", 2020. They paid the following additional 2020 taxes with their returns: Federal income taxes of $500 and state income taxes of $340, 4) The Gomezes made timely estimated federal income tax payments of $5,500 each quarter during 2020. They also made estimated state income taxes of $1,400 each quarter. The Gomezes made the federal and state fourth quarter estimated tax payments on December 31, 2020 5) Maria received a 2020 K-1 from the M&B Partnership interest she purchased two years ago. Maria materially participates in the partnership. A copy of the K-1 can be found in Canvas. 6) The Gomezes have also provided the following information for 2020 Prescription medicine and drugs (unreimbursed by insurance) $550 Doctor and hospital bills (unreimbursed by insurance) 2,700 Penalty for underpayment of last year's state income tax 20 Real estate taxes on personal residence 6,040 Mortgage interest on principal residence mortgage of $300,000 9,200 (reported on Form 1098) Interest on credit cards (vacation and consumer purchases) 870 Cash contribution to American Cancer Society 4,300 Cash contribution to a museum (qualified charitable organization) 5,000 Professional dues (Maria) 325 Professional subscriptions (Maria) 245 Fee for preparation of 2019 tax return paid on March 19, 2020 450 Since you do not have the Alamount yet, leave the line 2 empty and assume the amount in line 3 is greater than the amount in line 1 when you fill out Schedule A. In other words, line 4 of your schedule A should be 0. DOLLS