Question

Comfy Home is a retail business selling a broad range of homeware, kitchen, and electrical appliances to consumers and small businesses. In addition to the

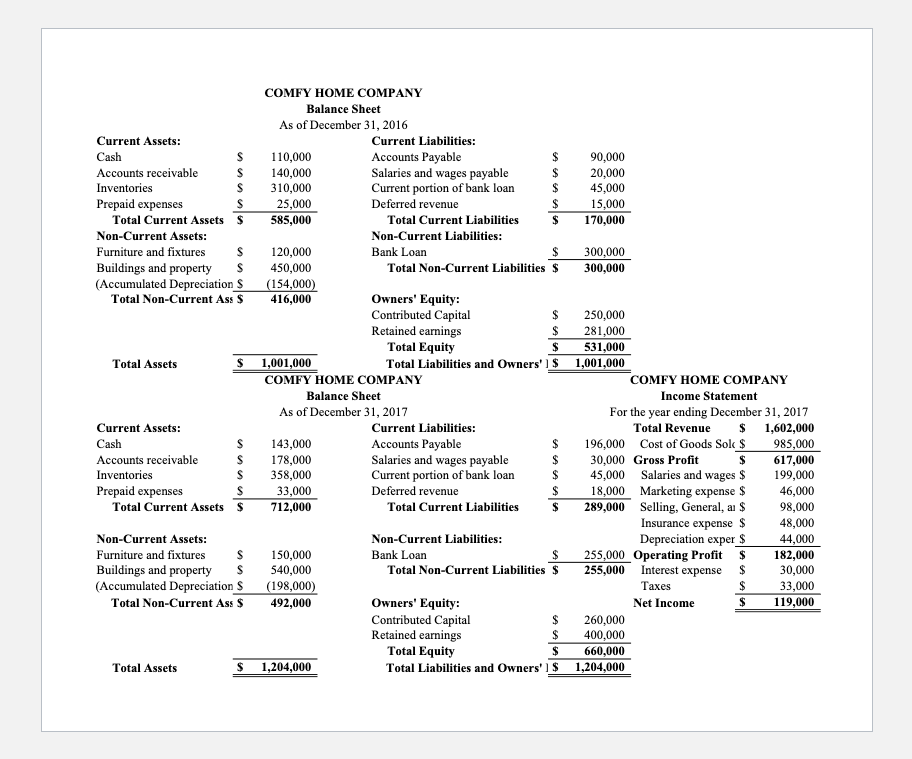

Comfy Home is a retail business selling a broad range of homeware, kitchen, and electrical appliances to consumers and small businesses. In addition to the home and kitchen appliances, Comfy Home makes and sells home decorating items including artisanal candles and holiday arrangements. The company has two stores located in the small city of Warmtown, USA. Its downtown store offers decorating services to the banks and small businesses in the vicinity. Tenisa Singh handles the candle making and decorating side of the business while Randolf Singh manages the stores. The business is wholly owned by Tenisa and Randolf Singh and was started by the couple in 2014. Comfy Home uses US GAAP for accounting purposes.

At the end of 2017, Comfy Home is performing a ratio analysis. Using the financial statements provided, please calculate the following ratio for Comfy Home:

Days inventory

Note: round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started