Answered step by step

Verified Expert Solution

Question

1 Approved Answer

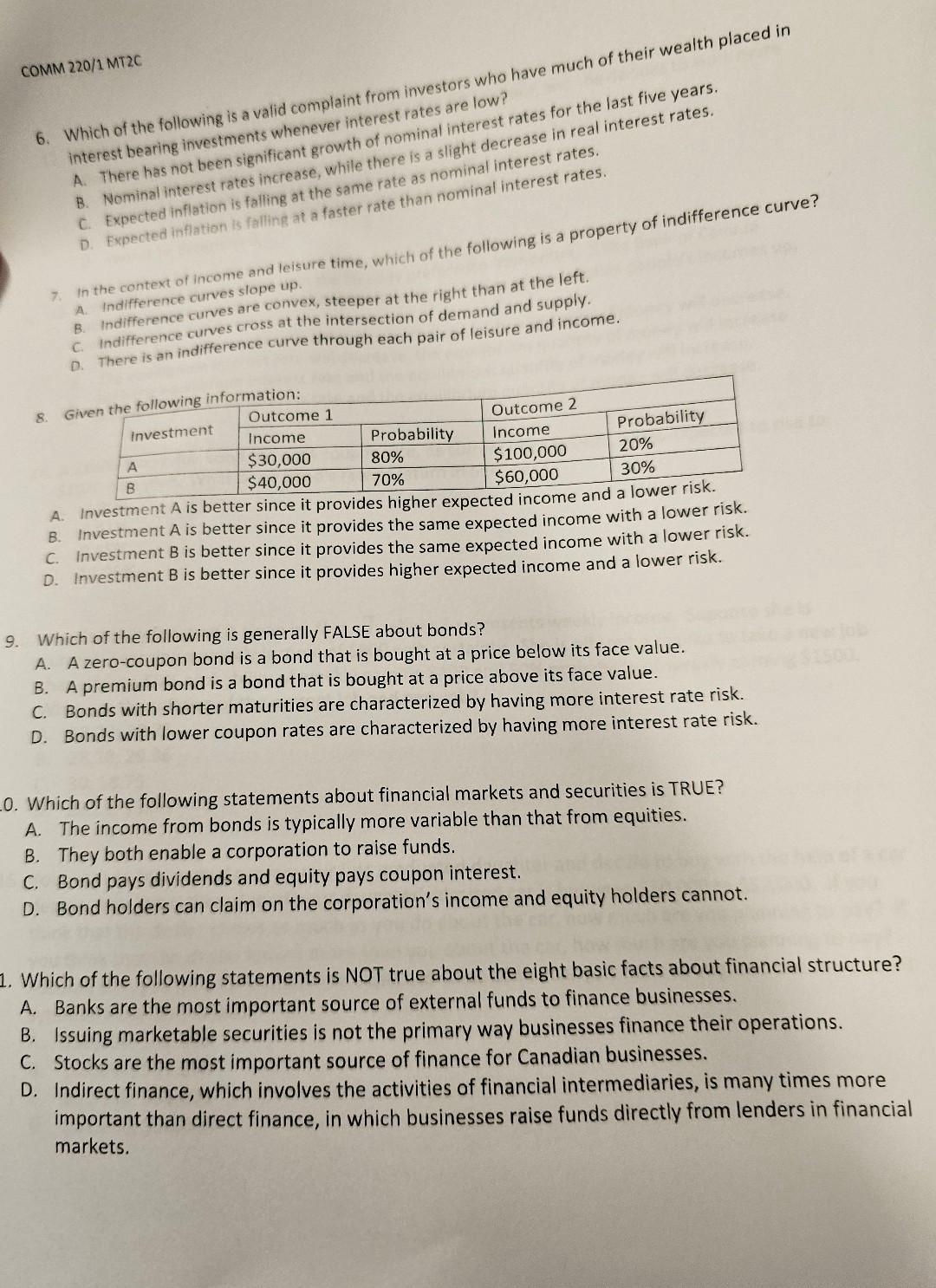

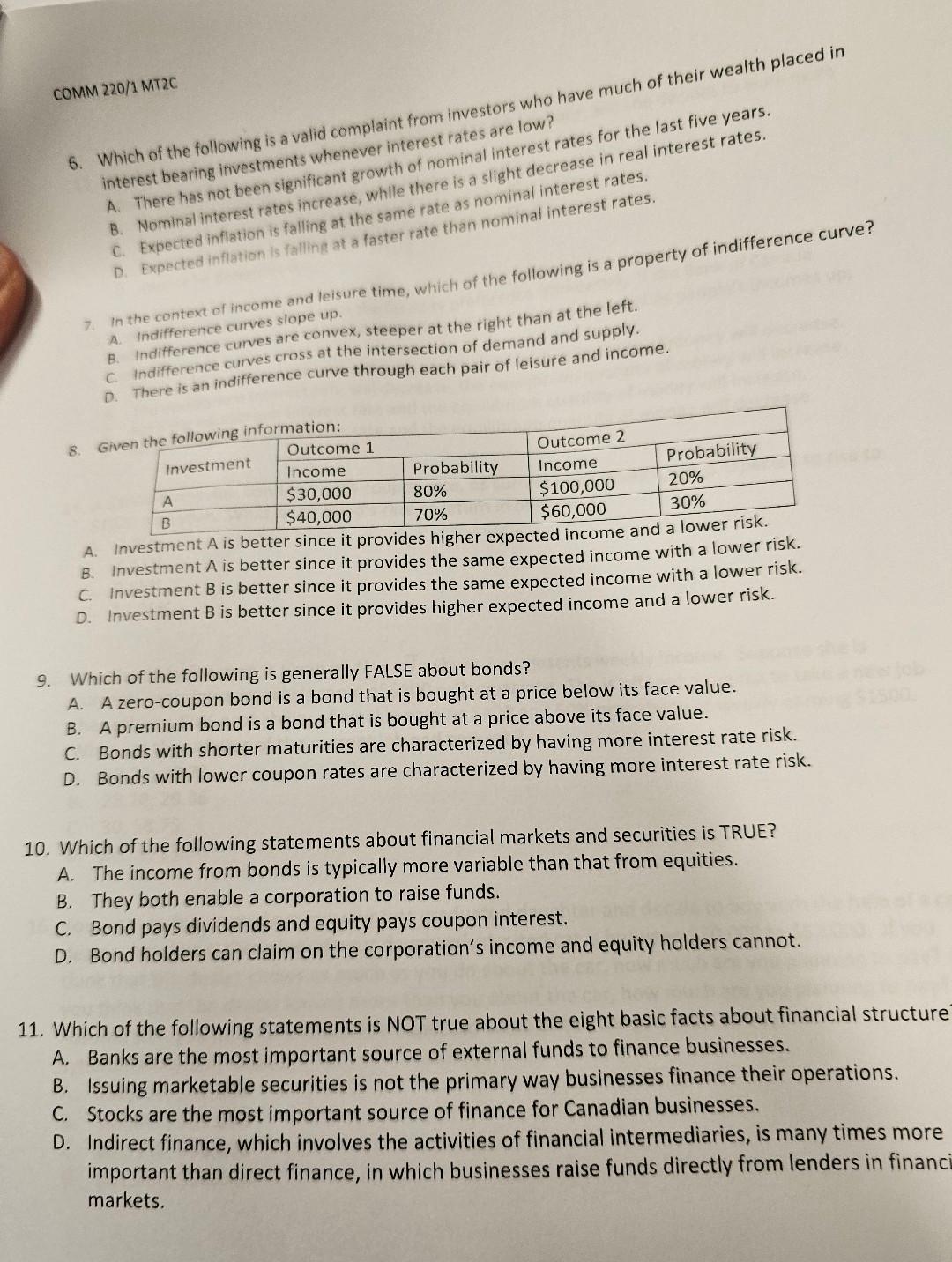

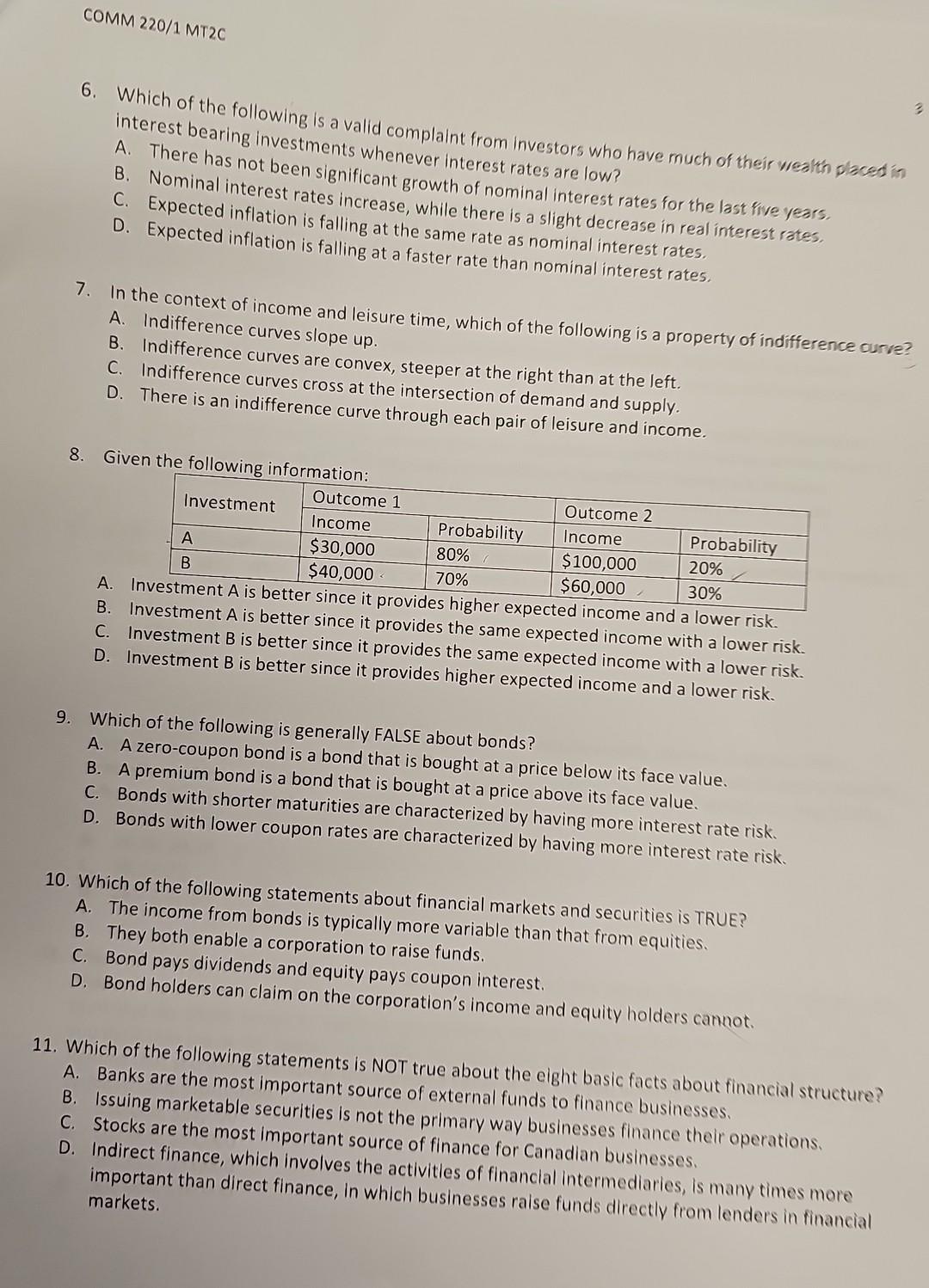

COMM220/1 MT2C 6. Which of the following is a valid complaint from investors who have much of their wealth placed in interest bearing investments whenever

COMM220/1 MT2C 6. Which of the following is a valid complaint from investors who have much of their wealth placed in interest bearing investments whenever interest rates are low? A. There has not been significant growth of nominal interest rates for the last five years. B. Nominal interest rates increase, while there is a slight decrease in real interest rates. C. Expected inflation is falling at the same rate as nominal interest rates. 7. In the context of income and leisure time, which of the following is a prope up. A. Indifference curves slope convex, steeper at the ince cight thand and supply. C. Indifference curves cross at the intersection of demand leisure and income. D. There is an indifference curve through 8. G A. Investment A is better since it provides higher expectea incums und with a lower risk. B. Investment A is better since it provides the same expected income with a lower risk. C. Investment B is better since it provides the same expected income wis a lower risk. D. Investment B is better since it provides higher expected income and a lower risk. 9. Which of the following is generally FALSE about bonds? A. A zero-coupon bond is a bond that is bought at a price below its face value. B. A premium bond is a bond that is bought at a price above its face value. C. Bonds with shorter maturities are characterized by having more interest rate risk. D. Bonds with lower coupon rates are characterized by having more interest rate risk. 0. Which of the following statements about financial markets and securities is TRUE? A. The income from bonds is typically more variable than that from equities. B. They both enable a corporation to raise funds. C. Bond pays dividends and equity pays coupon interest. D. Bond holders can claim on the corporation's income and equity holders cannot. 1. Which of the following statements is NOT true about the eight basic facts about financial structure? A. Banks are the most important source of external funds to finance businesses. B. Issuing marketable securities is not the primary way businesses finance their operations. C. Stocks are the most important source of finance for Canadian businesses. D. Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets. COMM220/1MT2C 6. Which of the following is a valid complaint from investors who have much of their wealth placed in interest bearing investments whenever interest rates are low? A. There has not been significant growth of nominal interest rates for the last five years. B. Nominal interest rates increase, while there is a slight decrease in real interest rates. C. Expected inflation is falling at the same fate as nominal interest rates. D. Expected inflation is falling at a faster 7. In the context of income and leisure time, which of the following is a prope slope up. A. Indifference curves slope up. B. Indifference curves are convex, steeper at the right than at the intersection of demand and supply. C. Indiference curvescress is an indifference curve through each pair of leisure and income. 8. Give A. Investment A is better since it provides higher expected incuire B. Investment A is better since it provides the same expected income with a lower risk. C. Investment B is better since it provides the same expected income with a lower risk. D. Investment B is better since it provides higher expected income and a lower risk. 9. Which of the following is generally FALSE about bonds? A. A zero-coupon bond is a bond that is bought at a price below its face value. B. A premium bond is a bond that is bought at a price above its face value. C. Bonds with shorter maturities are characterized by having more interest rate risk. D. Bonds with lower coupon rates are characterized by having more interest rate risk. 10. Which of the following statements about financial markets and securities is TRUE? A. The income from bonds is typically more variable than that from equities. B. They both enable a corporation to raise funds. C. Bond pays dividends and equity pays coupon interest. D. Bond holders can claim on the corporation's income and equity holders cannot. 11. Which of the following statements is NOT true about the eight basic facts about financial structure A. Banks are the most important source of external funds to finance businesses. B. Issuing marketable securities is not the primary way businesses finance their operations. C. Stocks are the most important source of finance for Canadian businesses. D. Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financ markets. 6. Which of the following is a valid complaint from investors who have much of their wealth placed in interest bearing investments whenever interest rates are low? A. There has not been significant growth of nominal interest rates for the last five years. B. Nominal interest rates increase, while there is a slight decrease in real interest rates. D. Expected inflation is falling at the same rate as nominal interest rates. 3 7. In the context of income and leisure time, which of the following is a property of indifference curve? A. Indifference curves slope up. B. Indifference curves are convex, steeper at the right than at the left. C. Indifference curves cross at the intersection of demand and supply. D. There is an indifference curve through each pair of leisure and income. 8. Given the fnlla...:... A. Ins B. Investment A is better since it provides the same expected income with a lower risk. D. Investment B is better since it provides the same expected income with a lower risk. D. Investmer since it provides higher expected income and a lower risk. 9. Which of the following is generally FALSE about bonds? A. A zero-coupon bond is a bond that is bought at a price below its face value. B. A premium bond is a bond that is bought at a price above its face value. C. Bonds with shorter maturities are characterized by having more interest rate risk. D. Bonds with lower coupon rates are characterized by having more interest rate risk. 10. Which of the following statements about financial markets and securities is TRUE? A. The income from bonds is typically more variable than that from equities. B. They both enable a corporation to raise funds. C. Bond pays dividends and equity pays coupon interest. D. Bond holders can claim on the corporation's income and equity holders cannot. 11. Which of the following statements is NOT true about the eight basic facts about financial structure? A. Banks are the most important source of external funds to finance businesses. B. Issuing marketable securities is not the primary way businesses finance their operations. C. Stocks are the most important source of finance for Canadian businesses. D. Indirect finance, which involves the activitles of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started