Answered step by step

Verified Expert Solution

Question

1 Approved Answer

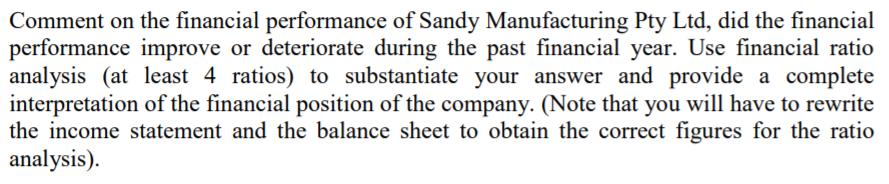

Comment on the financial performance of Sandy Manufacturing Pty Ltd, did the financial performance improve or deteriorate during the past financial year. Use financial

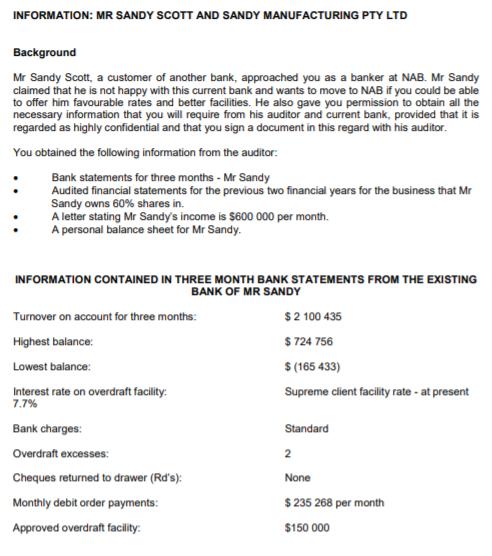

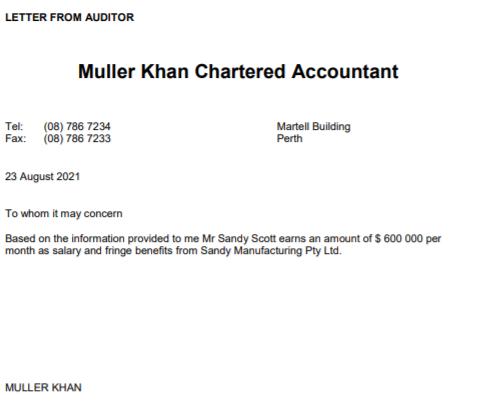

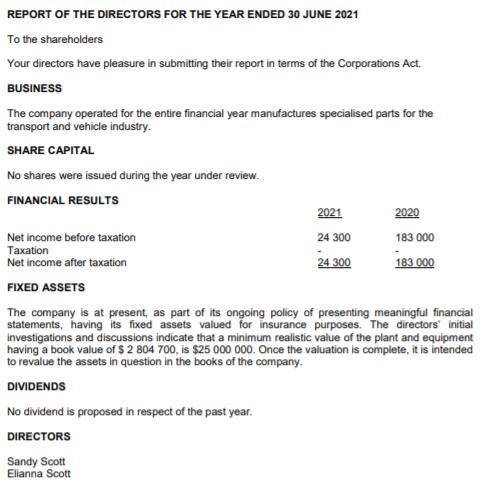

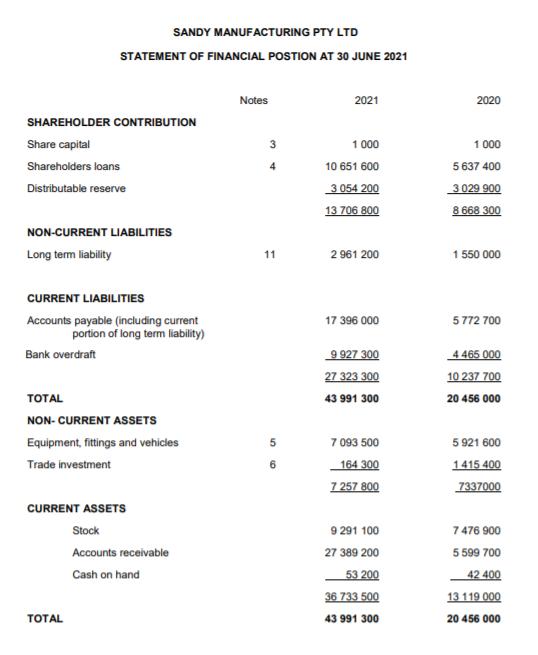

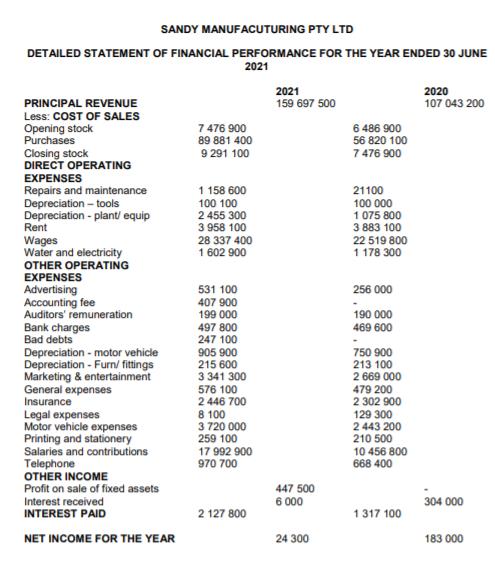

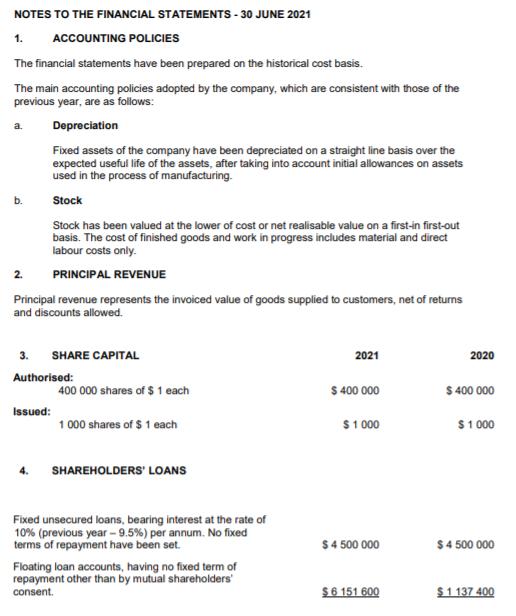

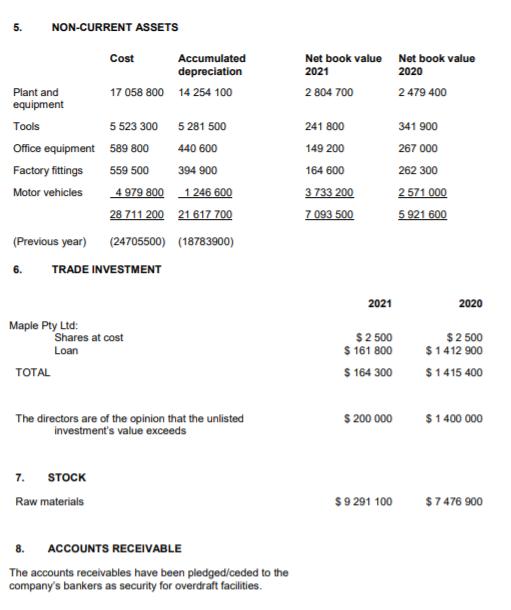

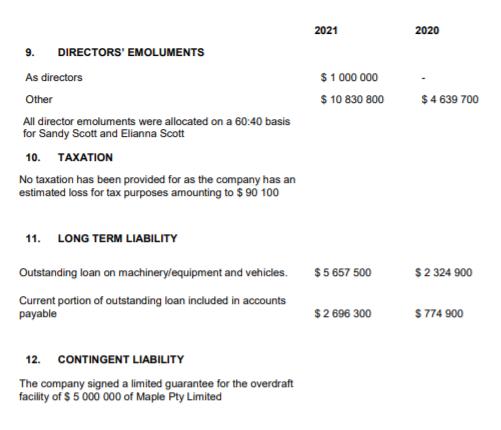

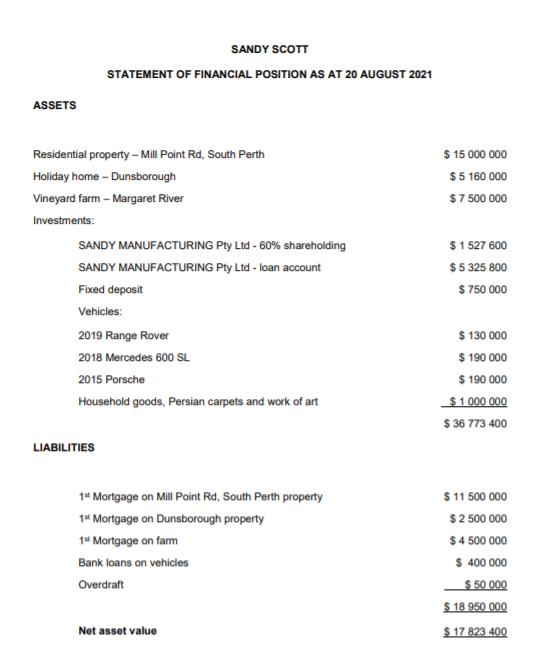

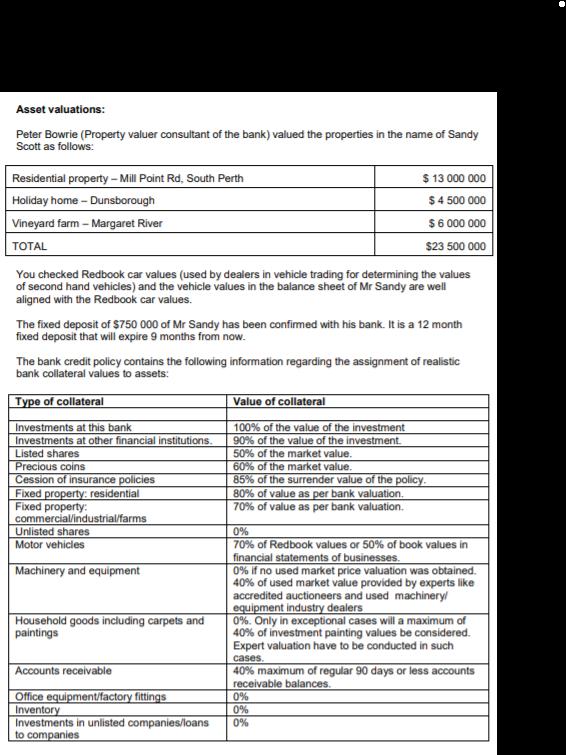

Comment on the financial performance of Sandy Manufacturing Pty Ltd, did the financial performance improve or deteriorate during the past financial year. Use financial ratio analysis (at least 4 ratios) to substantiate your answer and provide a complete interpretation of the financial position of the company. (Note that you will have to rewrite the income statement and the balance sheet to obtain the correct figures for the ratio analysis). INFORMATION: MR SANDY SCOTT AND SANDY MANUFACTURING PTY LTD Background Mr Sandy Scott, a customer of another bank, approached you as a banker at NAB. Mr Sandy claimed that he is not happy with this current bank and wants to move to NAB if you could be able to offer him favourable rates and better facilities. He also gave you permission to obtain all the necessary information that you will require from his auditor and current bank, provided that it is regarded as highly confidential and that you sign a document in this regard with his auditor. You obtained the following information from the auditor: Bank statements for three months - Mr Sandy Audited financial statements for the previous two financial years for the business that Mr Sandy owns 60% shares in. A letter stating Mr Sandy's income is $600 000 per month. A personal balance sheet for Mr Sandy. INFORMATION CONTAINED IN THREE MONTH BANK STATEMENTS FROM THE EXISTING BANK OF MR SANDY $2 100 435 $ 724 756 $ (165 433) Supreme client facility rate - at present Turnover on account for three months: Highest balance: Lowest balance: Interest rate on overdraft facility: 7.7% Bank charges: Overdraft excesses: Cheques returned to drawer (Rd's): Monthly debit order payments: Approved overdraft facility: Standard 2 None $ 235 268 per month $150 000 LETTER FROM AUDITOR Muller Khan Chartered Accountant Tel: (08) 786 7234 Fax: (08) 786 7233 23 August 2021 Martell Building Perth To whom it may concern Based on the information provided to me Mr Sandy Scott earns an amount of $ 600 000 per month as salary and fringe benefits from Sandy Manufacturing Pty Ltd. MULLER KHAN Muller Khan Chartered Accountant Tel: (08) 786 7234 Fax: (08) 786 7233 Martell Building Perth REPORT FROM THE AUDITORS To the shareholders of Sandy Manufacturing Pty Ltd We have examined the financial statements set out on the following pages. In our opinion these financial statements fairly present the financial position of the company at 30 June 2021 and the results of its operations for the year then ended in the manner required by the Corporations Act. MULLER KHAN Perth 23 August 2021 REPORT OF THE DIRECTORS FOR THE YEAR ENDED 30 JUNE 2021 To the shareholders Your directors have pleasure in submitting their report in terms of the Corporations Act. BUSINESS The company operated for the entire financial year manufactures specialised parts for the transport and vehicle industry. SHARE CAPITAL No shares were issued during the year under review. FINANCIAL RESULTS No dividend is proposed in respect of the past year. DIRECTORS 2021 Net income before taxation Taxation Net income after taxation FIXED ASSETS The company is at present, as part of its ongoing policy of presenting meaningful financial statements, having its fixed assets valued for insurance purposes. The directors initial investigations and discussions indicate that a minimum realistic value of the plant and equipment having a book value of $ 2 804 700, is $25 000 000. Once the valuation is complete, it is intended to revalue the assets in question in the books of the company. DIVIDENDS Sandy Scott Elianna Scott 24 300 2020 183 000 183 000 24 300 SHAREHOLDER CONTRIBUTION Share capital Shareholders loans Distributable reserve SANDY MANUFACTURING PTY LTD STATEMENT OF FINANCIAL POSTION AT 30 JUNE 2021 NON-CURRENT LIABILITIES Long term liability CURRENT LIABILITIES Accounts payable (including current portion of long term liability) Bank overdraft TOTAL NON-CURRENT ASSETS Equipment, fittings and vehicles Trade investment CURRENT ASSETS Stock Accounts receivable Cash on hand TOTAL Notes 3 4 11 5 6 2021 1 000 10 651 600 3 054 200 13 706 800 2961 200 17 396 000 9 927 300 27 323 300 43 991 300 7 093 500 164 300 7 257 800 9 291 100 27 389 200 53 200 36 733 500 43 991 300 2020 1.000 5 637 400 3 029 900 8 668 300 1 550 000 5772 700 4 465 000 10 237 700 20 456 000 5 921 600 1415 400 7337000 7476 900 5 599 700 42 400 13 119 000 20 456 000 SANDY MANUFACUTURING PTY LTD DETAILED STATEMENT OF FINANCIAL PERFORMANCE FOR THE YEAR ENDED 30 JUNE 2021 PRINCIPAL REVENUE Less: COST OF SALES Opening stock Purchases Closing stock DIRECT OPERATING EXPENSES Repairs and maintenance Depreciation - tools Depreciation - plant/ equip Rent Wages Water and electricity OTHER OPERATING EXPENSES Advertising Accounting fee Auditors' remuneration Bank charges Bad debts Depreciation - motor vehicle Depreciation - Furn/ fittings Marketing & entertainment General expenses Insurance Legal expenses Motor vehicle expenses Printing and stationery Salaries and contributions Telephone OTHER INCOME Profit on sale of fixed assets Interest received INTEREST PAID NET INCOME FOR THE YEAR 7 476 900 89 881 400 9 291 100 1 158 600 100 100 2 455 300 3 958 100 28 337 400 1 602 900 531 100 407 900 199 000 497 800 247 100 905 900 215 600 3 341 300 576 100 2 446 700 8 100 3 720 000 259 100 17 992 900 970 700 2 127 800 2021 159 697 500 447 500 6 000 24 300 6 486 900 56 820 100 7 476 900 21100 100 000 1 075 800 3 883 100 22 519 800 1 178 300 256 000 190 000 469 600 750 900 213 100 2 669 000 479 200 2 302 900 129 300 2 443 200 210 500 10 456 800 668 400 1 317 100 2020 107 043 200 304 000 183 000 NOTES TO THE FINANCIAL STATEMENTS - 30 JUNE 2021 1. ACCOUNTING POLICIES The financial statements have been prepared on the historical cost basis. The main accounting policies adopted by the company, which are consistent with those of the previous year, are as follows: Depreciation a. b. 2. PRINCIPAL REVENUE Principal revenue represents the invoiced value of goods supplied to customers, net of returns and discounts allowed. Fixed assets of the company have been depreciated on a straight line basis over the expected useful life of the assets, after taking into account initial allowances on assets used in the process of manufacturing. Stock Stock has been valued at the lower of cost or net realisable value on a first-in first-out basis. The cost of finished goods and work in progress includes material and direct labour costs only. 3. SHARE CAPITAL Authorised: Issued: 4. 400 000 shares of $ 1 each 1 000 shares of $ 1 each SHAREHOLDERS' LOANS Fixed unsecured loans, bearing interest at the rate of 10% (previous year-9.5%) per annum. No fixed terms of repayment have been set. Floating loan accounts, having no fixed term of repayment other than by mutual shareholders' consent. 2021 $ 400 000 $ 1000 $4500 000 $6 151 600 2020 $ 400 000 $ 1.000 $4 500 000 $1 137 400 5. NON-CURRENT ASSETS Plant and equipment Tools Office equipment Factory fittings Motor vehicles 5 523 300 589 800 559 500 4 979 800 1 246 600 28 711 200 21 617 700 (Previous year) (24705500) (18783900) 6. TRADE INVESTMENT Maple Pty Ltd: TOTAL Accumulated depreciation 17 058 800 14 254 100 Cost Shares at cost Loan 7. STOCK Raw materials 5 281 500 440 600 394 900 The directors are of the opinion that the unlisted investment's value exceeds 8. ACCOUNTS RECEIVABLE The accounts receivables have been pledged/ceded to the company's bankers as security for overdraft facilities. Net book value Net book value 2021 2020 2 804 700 2 479 400 241 800 149 200 164 600 3 733 200 7.093 500 2021 $2500 $ 161 800 $ 164 300 $ 200 000 $9 291 100 341 900 267 000 262 300 2.571 000 5 921 600 2020 $2.500 $1412 900 $1415 400 $ 1400 000 $7476 900 9. DIRECTORS' EMOLUMENTS As directors Other All director emoluments were allocated on a 60:40 basis for Sandy Scott and Elianna Scott 10. TAXATION No taxation has been provided for as the company has an estimated loss for tax purposes amounting to $ 90 100 11. LONG TERM LIABILITY Outstanding loan on machinery/equipment and vehicles. Current portion of outstanding loan included in accounts payable 12. CONTINGENT LIABILITY The company signed a limited guarantee for the overdraft facility of $ 5 000 000 of Maple Pty Limited 2021 $ 1 000 000 $ 10 830 800 $5657 500 $2696 300 2020 $ 4 639 700 $ 2 324 900 $ 774 900 ASSETS SANDY SCOTT STATEMENT OF FINANCIAL POSITION AS AT 20 AUGUST 2021 Residential property - Mill Point Rd, South Perth Holiday home- Dunsborough Vineyard farm - Margaret River Investments: SANDY MANUFACTURING Pty Ltd -60% shareholding SANDY MANUFACTURING Pty Ltd - loan account Fixed deposit Vehicles: LIABILITIES 2019 Range Rover 2018 Mercedes 600 SL 2015 Porsche Household goods, Persian carpets and work of art 1st Mortgage on Mill Point Rd, South Perth property 1st Mortgage on Dunsborough property 1st Mortgage on farm Bank loans on vehicles Overdraft Net asset value $ 15 000 000 $5 160 000 $7 500 000 $1527 600 $5 325 800 $ 750 000 $ 130 000 $ 190 000 $ 190 000 $ 1 000 000 $36 773 400 $ 11 500 000 $2 500 000 $4 500 000 $ 400 000 $ 50 000 $18 950 000 $ 17 823 400 Asset valuations: Peter Bowrie (Property valuer consultant of the bank) valued the properties in the name of Sandy Scott as follows: Residential property - Mill Point Rd, South Perth Holiday home - Dunsborough Vineyard farm - Margaret River TOTAL You checked Redbook car values (used by dealers in vehicle trading for determining the values of second hand vehicles) and the vehicle values in the balance sheet of Mr Sandy are well aligned with the Redbook car values. The fixed deposit of $750 000 of Mr Sandy has been confirmed with his bank. It is a 12 month fixed deposit that will expire 9 months from now. The bank credit policy contains the following information regarding the assignment of realistic bank collateral values to assets: Type of collateral Investments at this bank Investments at other financial institutions. Listed shares Precious coins Cession of insurance policies Fixed property: residential Fixed property: commercial/industrial/farms Unlisted shares Motor vehicles Machinery and equipment $ 13 000 000 $ 4 500 000 $ 6 000 000 $23 500 000 Household goods including carpets and paintings Accounts receivable Office equipment/factory fittings Inventory Investments in unlisted companies/loans to companies Value of collateral 100% of the value of the investment 90% of the value of the investment. 50% of the market value. 60% of the market value. 85% of the surrender value of the policy. 80% of value as per bank valuation. 70% of value as per bank valuation. 0% 70% of Redbook values or 50% of book values in financial statements of businesses. 0% if no used market price valuation was obtained. 40% of used market value provided by experts like accredited auctioneers and used machinery/ equipment industry dealers 0%. Only in exceptional cases will a maximum of 40% of investment painting values be considered. Expert valuation have to be conducted in such cases. 40% maximum of regular 90 days or less accounts receivable balances. 0% 0% 0%

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Financial Performance of Sandy Manufacturing Pty Ltd Based on the provided information I can analyze Sandy Manufacturing Pty Ltds financial performanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started