Answered step by step

Verified Expert Solution

Question

1 Approved Answer

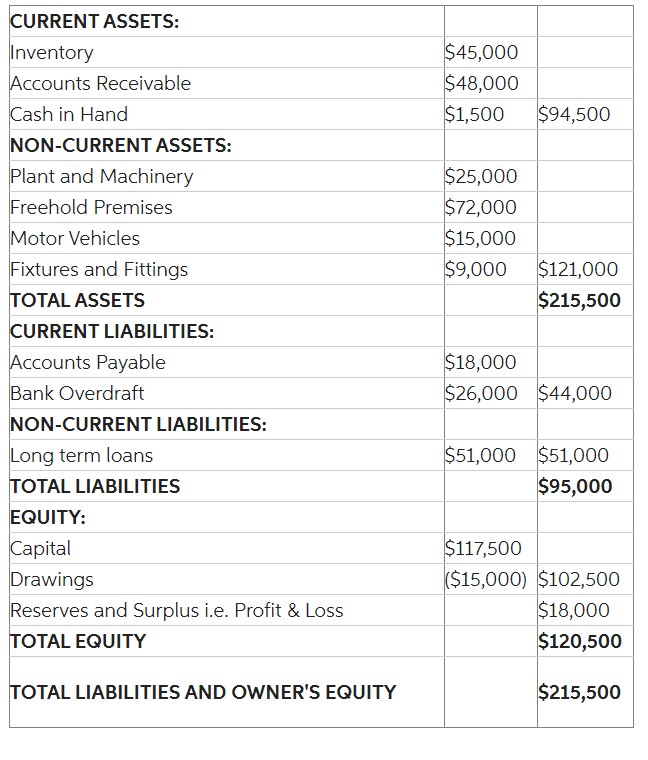

Comment on the financial position of the business based on the statement prepared in above also Show the effect on the statement of financial position

Comment on the financial position of the business based on the statement prepared in above also Show the effect on the statement of financial position shown in (a) of a decision to revalue the property to 115,000 and to recognise that the net realisable value of inventories at the year end is 38,000.

\begin{tabular}{|l|l|l|} \hline CURRENT ASSETS: & & \\ \hline Inventory & $45,000 & \\ \hline Accounts Receivable & $48,000 & \\ \hline Cash in Hand & $1,500 & $94,500 \\ \hline NON-CURRENT ASSETS: & & \\ \hline Plant and Machinery & $25,000 & \\ \hline Freehold Premises & $72,000 & \\ \hline Motor Vehicles & $15,000 & \\ \hline Fixtures and Fittings & $9,000 & $121,000 \\ \hline TOTAL ASSETS & & $215,500 \\ \hline CURRENT LIABILITIES: & & \\ \hline Accounts Payable & $18,000 & \\ \hline Bank Overdraft & $26,000 & $44,000 \\ \hline NON-CURRENT LIABILITIES: & & \\ \hline Long term loans & $51,000 & $51,000 \\ \hline TOTAL LIABILITIES & & $95,000 \\ \hline EQUITY: & & \\ \hline Capital & $117,500 & \\ \hline Drawings & ($15,000) & $102,500 \\ \hline Reserves and Surplus i.e. Profit \& Loss & & $18,000 \\ \hline TOTAL EQUITY & & $120,500 \\ \hline TOTAL LIABILITIES AND OWNER'S EQUITY & & $215,500 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started