Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comment on your findings on the previous page (remember, this is the actual Netflix option data). Question 1 (35 points) Below is some actual data

Comment on your findings on the previous page (remember, this is the actual Netflix option data).

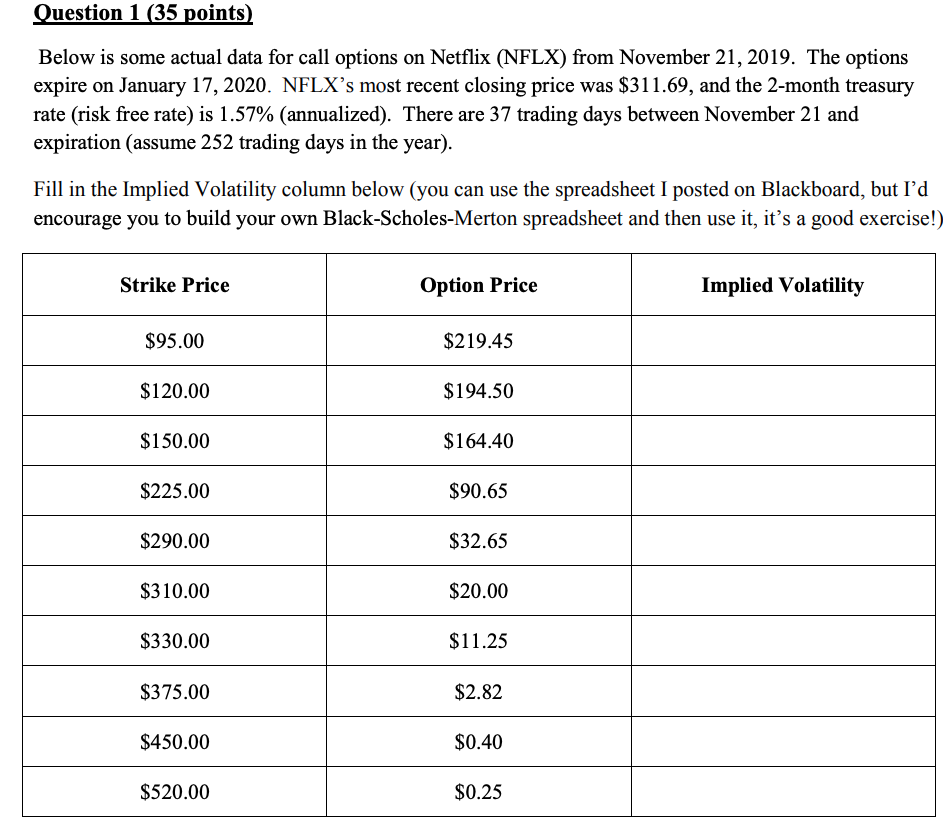

Question 1 (35 points) Below is some actual data for call options on Netflix (NFLX) from November 21, 2019. The options expire on January 17, 2020. NFLX's most recent closing price was $311.69, and the 2-month treasury rate (risk free rate) is 1.57% (annualized). There are 37 trading days between November 21 and expiration (assume 252 trading days in the year). Fill in the Implied Volatility column below (you can use the spreadsheet I posted on Blackboard, but I'd encourage you to build your own Black-Scholes-Merton spreadsheet and then use it, it's a good exercise!) Strike Price Option Price Implied Volatility $95.00 $219.45 $120.00 $194.50 $150.00 $164.40 $225.00 $90.65 $290.00 $32.65 $310.00 $20.00 $330.00 $11.25 $375.00 $2.82 $450.00 $0.40 $520.00 $0.25 Question 1 (35 points) Below is some actual data for call options on Netflix (NFLX) from November 21, 2019. The options expire on January 17, 2020. NFLX's most recent closing price was $311.69, and the 2-month treasury rate (risk free rate) is 1.57% (annualized). There are 37 trading days between November 21 and expiration (assume 252 trading days in the year). Fill in the Implied Volatility column below (you can use the spreadsheet I posted on Blackboard, but I'd encourage you to build your own Black-Scholes-Merton spreadsheet and then use it, it's a good exercise!) Strike Price Option Price Implied Volatility $95.00 $219.45 $120.00 $194.50 $150.00 $164.40 $225.00 $90.65 $290.00 $32.65 $310.00 $20.00 $330.00 $11.25 $375.00 $2.82 $450.00 $0.40 $520.00 $0.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started