Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comments: - Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2019. - Note the list

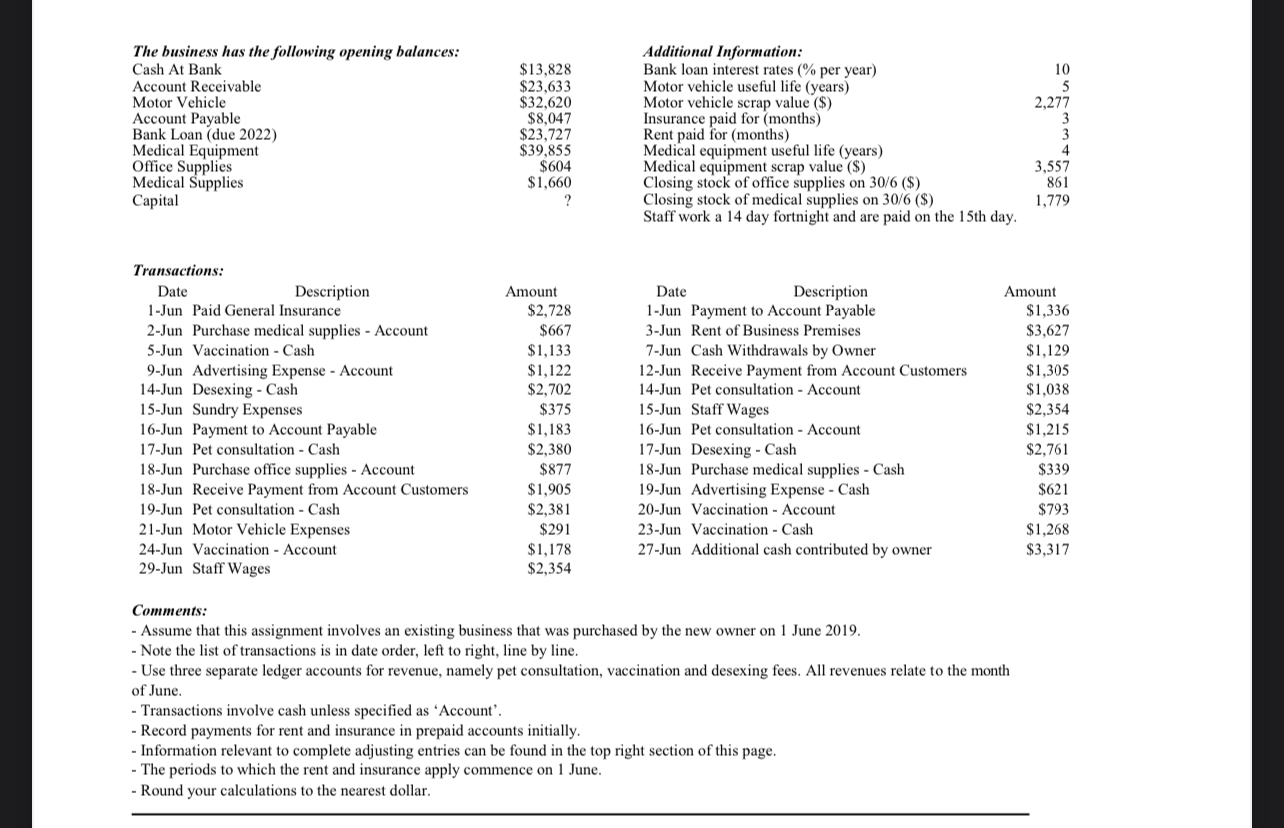

Comments: - Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2019. - Note the list of transactions is in date order, left to right, line by line. - Use three separate ledger accounts for revenue, namely pet consultation, vaccination and desexing fees. All revenues relate to the month of June. - Transactions involve cash unless specified as 'Account'. - Record payments for rent and insurance in prepaid accounts initially. - Information relevant to complete adjusting entries can be found in the top right section of this page. - The periods to which the rent and insurance apply commence on 1 June. - Round your calculations to the nearest dollar. Comments: - Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2019. - Note the list of transactions is in date order, left to right, line by line. - Use three separate ledger accounts for revenue, namely pet consultation, vaccination and desexing fees. All revenues relate to the month of June. - Transactions involve cash unless specified as 'Account'. - Record payments for rent and insurance in prepaid accounts initially. - Information relevant to complete adjusting entries can be found in the top right section of this page. - The periods to which the rent and insurance apply commence on 1 June. - Round your calculations to the nearest dollar

Comments: - Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2019. - Note the list of transactions is in date order, left to right, line by line. - Use three separate ledger accounts for revenue, namely pet consultation, vaccination and desexing fees. All revenues relate to the month of June. - Transactions involve cash unless specified as 'Account'. - Record payments for rent and insurance in prepaid accounts initially. - Information relevant to complete adjusting entries can be found in the top right section of this page. - The periods to which the rent and insurance apply commence on 1 June. - Round your calculations to the nearest dollar. Comments: - Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2019. - Note the list of transactions is in date order, left to right, line by line. - Use three separate ledger accounts for revenue, namely pet consultation, vaccination and desexing fees. All revenues relate to the month of June. - Transactions involve cash unless specified as 'Account'. - Record payments for rent and insurance in prepaid accounts initially. - Information relevant to complete adjusting entries can be found in the top right section of this page. - The periods to which the rent and insurance apply commence on 1 June. - Round your calculations to the nearest dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started