Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comments: Please solve as soon as possible and only show the option of the mcq Question and solve in 30 minute 9. Points are also

Comments:

Comments:

Please solve as soon as possible and only show the option of the mcq Question and solve in 30 minute

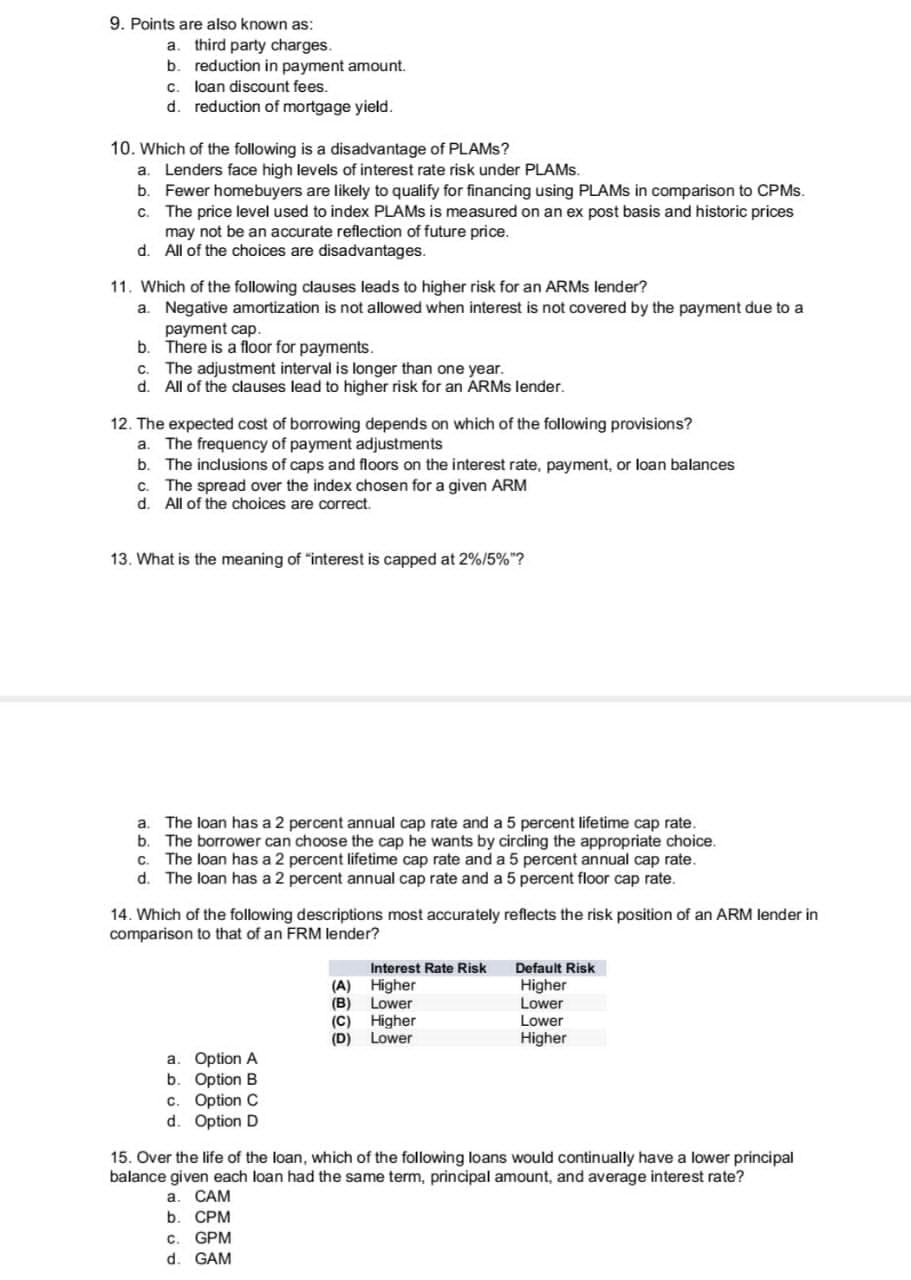

9. Points are also known as: a third party charges. b. reduction in payment amount. cloan discount fees. d. reduction of mortgage yield. a 10. Which of the following is a disadvantage of PLAMs? Lenders face high levels of interest rate risk under PLAMS. b. Fewer homebuyers are likely to qualify for financing using PLAMs in comparison to CPMs. C. The price level used to index PLAMs is measured on an ex post basis and historic prices may not be an accurate reflection of future price. d. All of the choices are disadvantages. 11. Which of the following clauses leads to higher risk for an ARMs lender? a Negative amortization is not allowed when interest is not covered by the payment due to a payment cap b. There is a floor for payments. c. The adjustment interval is longer than one year. d. All of the clauses lead to higher risk for an ARMs lender. 12. The expected cost of borrowing depends on which of the following provisions? a. The frequency of payment adjustments b. The inclusions of caps and floors on the interest rate, payment, or loan balances C. The spread over the index chosen for a given ARM d. All of the choices are correct. 13. What is the meaning of interest is capped at 2%/5%"? a b The loan has a 2 percent annual cap rate and a 5 percent lifetime cap rate. The borrower can choose the cap he wants by circling the appropriate choice. C. The loan has a 2 percent lifetime cap rate and a 5 percent annual cap rate. d. The loan has a 2 percent annual cap rate and a 5 percent floor cap rate. 14. Which of the following descriptions most accurately reflects the risk position of an ARM lender in comparison to that of an FRM lender? (A) (B) (C) (D) s@ce Interest Rate Risk Higher Lower Higher Lower Default Risk Higher Lower Lower Higher a. Option A b. Option B c. Option C d. Option D 15. Over the life of the loan, which of the following loans would continually have a lower principal balance given each loan had the same term. principal amount, and average interest rate? a. CAM b. CPM c. GPM d. GAMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started