Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Commercial real estate leases known as gross leases often have a so-called expense stop. The expense stop determines the amount of operating expense per

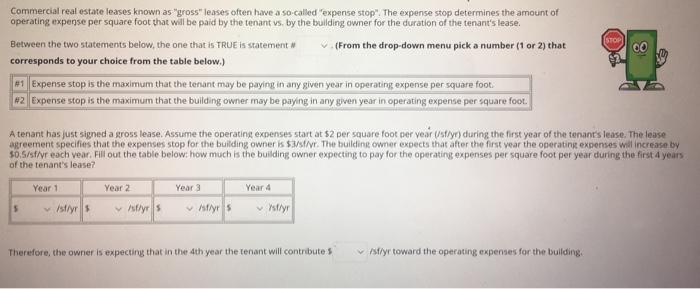

Commercial real estate leases known as "gross" leases often have a so-called "expense stop". The expense stop determines the amount of operating expense per square foot that will be paid by the tenant vs. by the building owner for the duration of the tenant's lease. Between the two statements below, the one that is TRUE is statement # corresponds to your choice from the table below.) (From the drop-down menu pick a number (1 or 2) that #1 Expense stop is the maximum that the tenant may be paying in any given year in operating expense per square foot. #2 Expense stop is the maximum that the building owner may be paying in any given year in operating expense per square foot. STOP A tenant has just signed a gross lease. Assume the operating expenses start at $2 per square foot per year (/sf/yr) during the first year of the tenant's lease. The lease agreement specifies that the expenses stop for the building owner is $3/sf/yr. The building owner expects that after the first year the operating expenses will increase by $0.5/sf/yr each year. Fill out the table below: how much is the building owner expecting to pay for the operating expenses per square foot per year during the first 4 years of the tenant's lease? Year 1 Year 2 Year 3 Year 4 /st/yr $ /sf/yr s /sf/yr $ st/yr Therefore, the owner is expecting that in the 4th year the tenant will contribute /sf/yr toward the operating expenses for the building.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the correct interpretation of the expense s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started