Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales Net operating income Average operating assets $

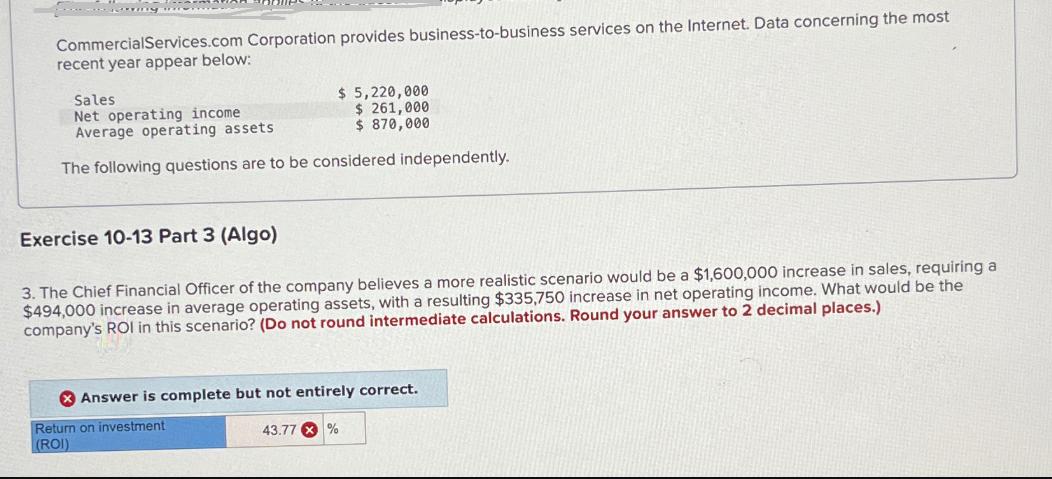

CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales Net operating income Average operating assets $ 5,220,000 $ 261,000 $870,000 The following questions are to be considered independently. Exercise 10-13 Part 3 (Algo) 3. The Chief Financial Officer of the company believes a more realistic scenario would be a $1,600,000 increase in sales, requiring a $494,000 increase in average operating assets, with a resulting $335,750 increase in net operating income. What would be the company's ROI in this scenario? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Return on investment (ROI) 43.77%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Return on Investment ROI for the scenario provided by the Chief Financial Off...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d9ddf1aa4e_964391.pdf

180 KBs PDF File

663d9ddf1aa4e_964391.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started