Answered step by step

Verified Expert Solution

Question

1 Approved Answer

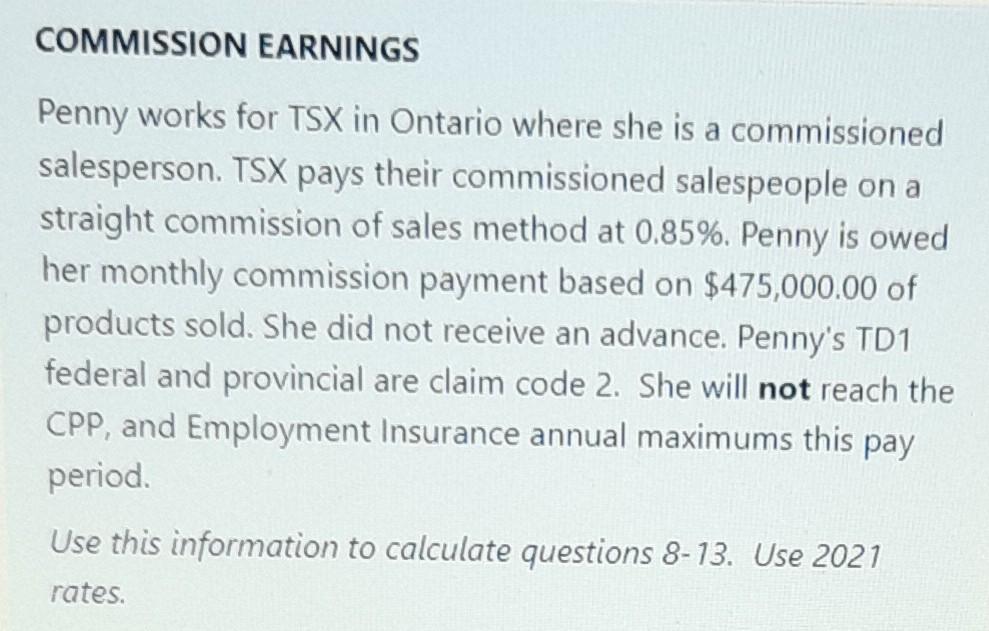

COMMISSION EARNINGS Penny works for TSX in Ontario where she is a commissioned salesperson. TSX pays their commissioned salespeople on a straight commission of sales

COMMISSION EARNINGS Penny works for TSX in Ontario where she is a commissioned salesperson. TSX pays their commissioned salespeople on a straight commission of sales method at 0.85%. Penny is owed her monthly commission payment based on $475,000.00 of products sold. She did not receive an advance. Penny's TD1 federal and provincial are claim code 2. She will not reach the CPP, and Employment Insurance annual maximums this pay period. Use this information to calculate questions 8-13. Use 2021 rates. Calculate the Federal income tax using the CRA payroll deduction tables. Answer: Calculate the Provincial income tax using the CRA payroll deduction tables. Answer: Calculate Penny's net commission pay. COMMISSION EARNINGS Penny works for TSX in Ontario where she is a commissioned salesperson. TSX pays their commissioned salespeople on a straight commission of sales method at 0.85%. Penny is owed her monthly commission payment based on $475,000.00 of products sold. She did not receive an advance. Penny's TD1 federal and provincial are claim code 2. She will not reach the CPP, and Employment Insurance annual maximums this pay period. Use this information to calculate questions 8-13. Use 2021 rates. Calculate the Federal income tax using the CRA payroll deduction tables. Answer: Calculate the Provincial income tax using the CRA payroll deduction tables. Answer: Calculate Penny's net commission pay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started