Answered step by step

Verified Expert Solution

Question

1 Approved Answer

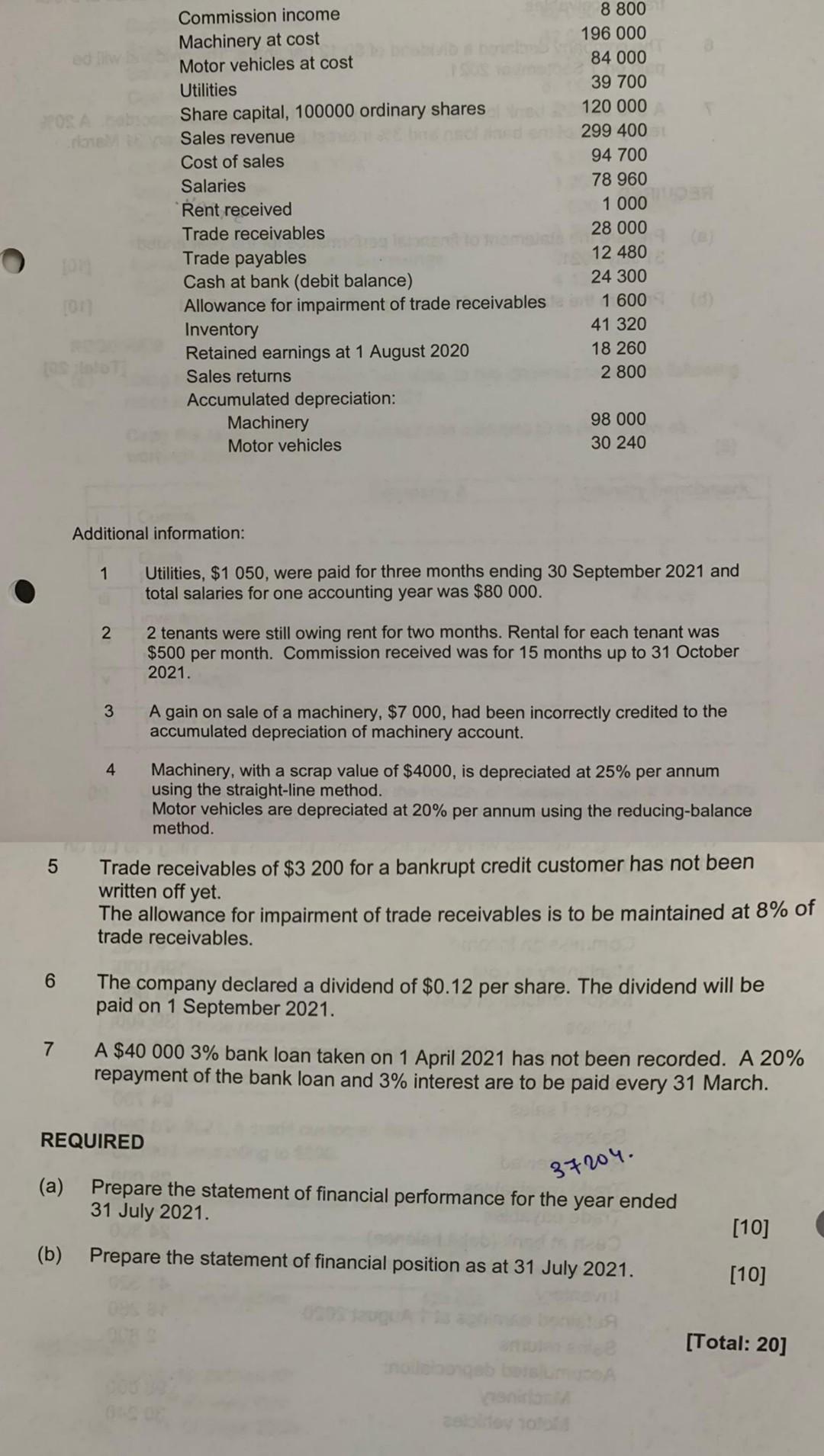

Commission income Machinery at cost Motor vehicles at cost Utilities Share capital, 100000 ordinary shares Sales revenue Cost of sales Salaries Rent received Trade receivables

Commission income Machinery at cost Motor vehicles at cost Utilities Share capital, 100000 ordinary shares Sales revenue Cost of sales Salaries Rent received Trade receivables Trade payables Cash at bank (debit balance) Allowance for impairment of trade receivables Inventory Retained earnings at 1 August 2020 Sales returns Accumulated depreciation: Machinery Motor vehicles 8 800 196 000 84 000 39 700 120 000 299 400 94 700 78 960 1 000 28 000 12 480 24 300 1 600 41 320 18 260 2 800 100 98 000 30 240 Additional information: 1 Utilities, $1 050, were paid for three months ending 30 September 2021 and total salaries for one accounting year was $80 000. 2 2 tenants were still owing rent for two months. Rental for each tenant was $500 per month. Commission received was for 15 months up to 31 October 2021. 3 A gain on sale of a machinery, $7 000, had been incorrectly credited to the accumulated depreciation of machinery account. 4 Machinery, with a scrap value of $4000, is depreciated at 25% per annum using the straight-line method. Motor vehicles are depreciated at 20% per annum using the reducing-balance method. Trade receivables of $3 200 for a bankrupt credit customer has not been written off yet. The allowance for impairment of trade receivables is to be maintained at 8% of trade receivables. 5 6 The company declared a dividend of $0.12 per share. The dividend will be paid on 1 September 2021. 7 A $40 000 3% bank loan taken on 1 April 2021 has not been recorded. A 20% repayment of the bank loan and 3% interest are to be paid every 31 March. REQUIRED 37204. (a) Prepare the statement of financial performance for the year ended 31 July 2021. [10] (b) Prepare the statement of financial position as at 31 July 2021. [10] [Total: 20]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started