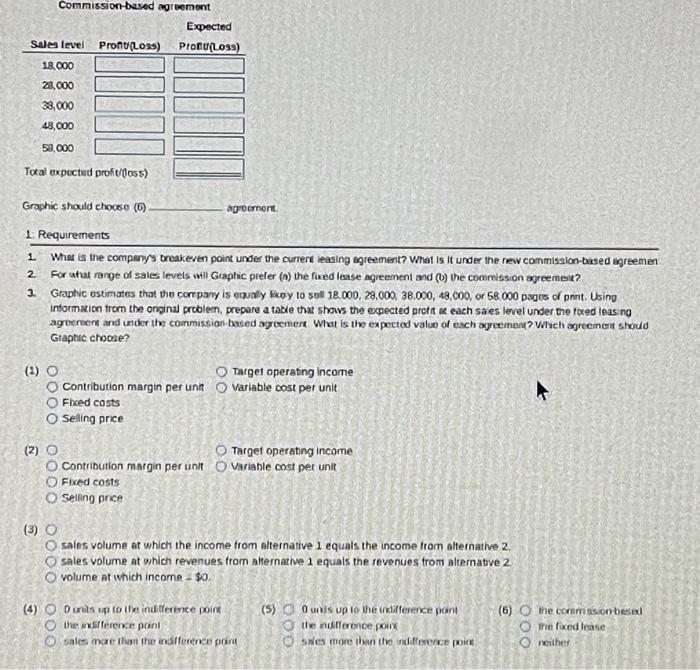

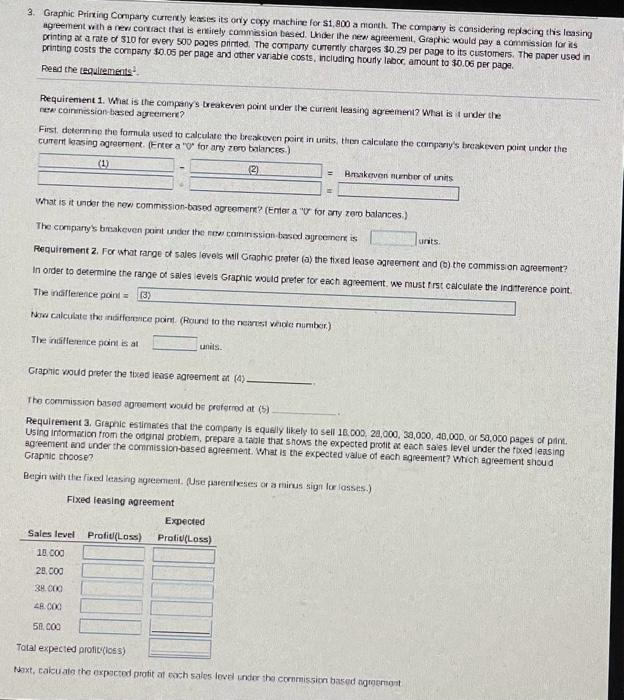

Commission-besed orienont Graphic should choose (6) apooment. 1: Requirements 2. For utat range of sales levels will Gaptic prefer (a) the fixed lease agreenenl and (0) the commission apreemeit? 3. Graphic estimates that the corrpany is equally beoy to soll 18.000,28,000,38.000,48,000, or 58,000 pages of print. Using intormation trom the onginal problem, prepare a table that shows the expected prott as each saes level under the foxed leas ng ageerient and under the commissian based ayoemer. What is the expectod value of exch agrement? Which agreeinent should Graphic chocse? (1) Contribution margin per ung Fbeed costs Selling price (2) Contribution margin per unit Ficed costs Selling price Target operating income Variable cost per unit (3) sales volume at which the income from alternative 1 equals the income from alternative 2 . sales volume at which revenues from ahternative 1 equals the revenues from alternative 2. volume at which income - so. (4) D unis up to ile indifference poin the oxsifterence pont gales mae then the indference point Target operating income variable cost per unit 3. Graphic Prirxing Compary currenty keases its orry copry machire for $1,800 a month. The compary is considering replacing this lassing printine ac a rate of $10 for every 500 poges primed. The comparny curremly charges 30 , 29 per pape to its customers. The paper used in printing costs the company \$0.05 per peQe and other variabie costs, including hourly leboc, amcunt to $0.06 per page. Reed the tequicements: Requirement 1. What is the company's treakever point under the current leasing agreement? What is it under the rew coinenission-based ayneinere? First, doternne the formula used to calculate the breakewen peire in urits, then calculare the cainpery's breakeven paint under the curem kasing agtemerne. (Freer a " 0 " for arty' zero balances.) What is it under the new commission-based agremere? (Enier a " O " for arly zero balances.) Requirement 2. For what rarge of sales levels will Grapho preter (a) the tixed lease agreement and (o) the commission agreement? The inaflesence pain : The intafference poin is at Graphic would preter the tixed lease nareement af (4) The commission based aoresment would be proferrod at (s) Requirement 3. Graphic estimstes that the company is equaly likely to sell 18,002,20,000,39,020,40,000, or 5a,000 papes cr pint. Using intomacion from the catprat probiem, prepare a tabie that shows the expected protit a each sales level under the tored leasing ageenient wo inder the commis sion-based agreement. What is the expected value of ebch sgreement? Which agreement shou d Graptic choose? Flxed leasing agreement 1. What is the company's breakeven point under the current leasing agreement? What is it under the new commission-based agreement? 2. For what range of sales levels] will Graphic prefer (a) the fixed lease agreement and (b) the commission agreement? 3. Graphic estimates that the company is equally likely to sell 18,000,28,000,38,000, 48,000 , or 58,000 pages of print. Using information from the original problem, prepare a table that shows the expected profit at each sales level under the fixed leasing agreement and under the commission-based agreement. What is the expected value of each agreement? Which agreement should Graphic choose