Question

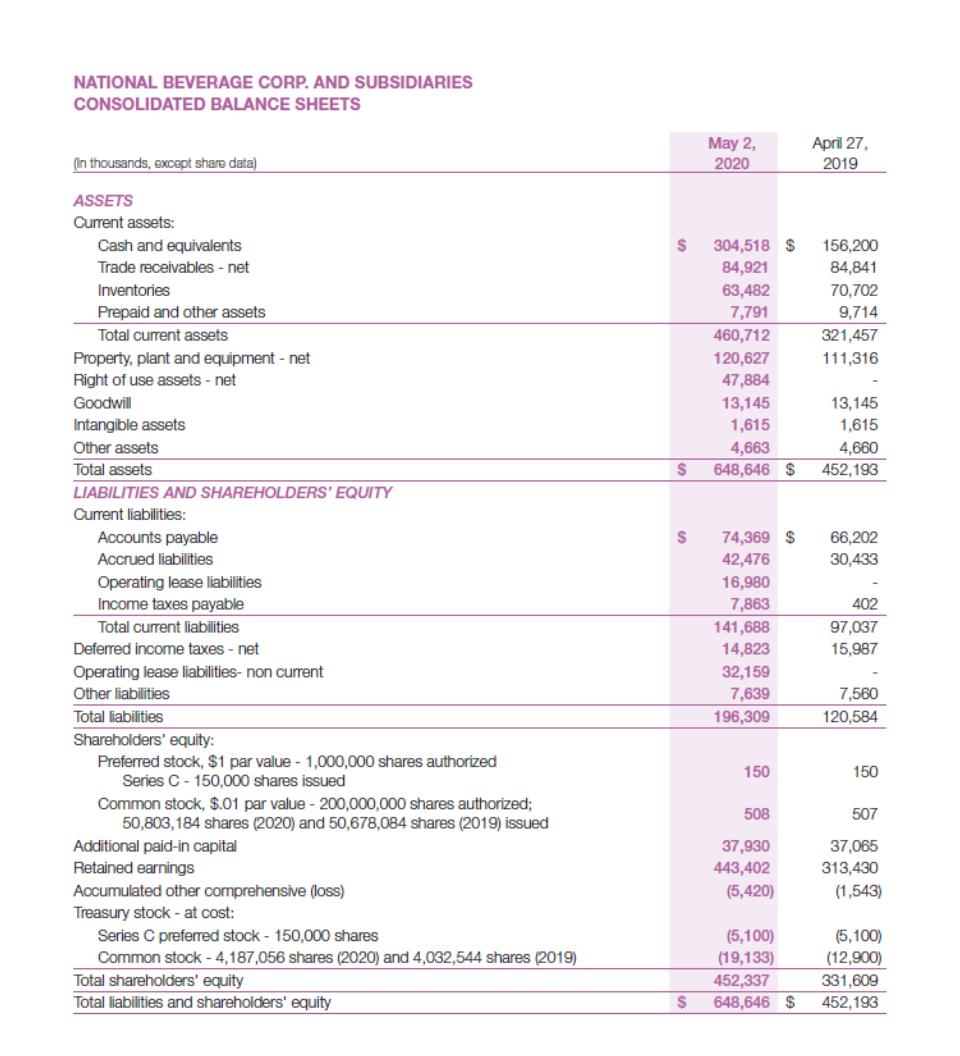

Common Stock A) What is the par value of each share of common stock issued? B) How much money in excess of the par value

Common Stock

A) What is the par value of each share of common stock issued?

B) How much money in excess of the par value of the stock had been contributed by common shareholders by the end of 2020?

C) How much did National Beverage pay for Treasury Stock of all common shares it held at fiscal year-end 2020?

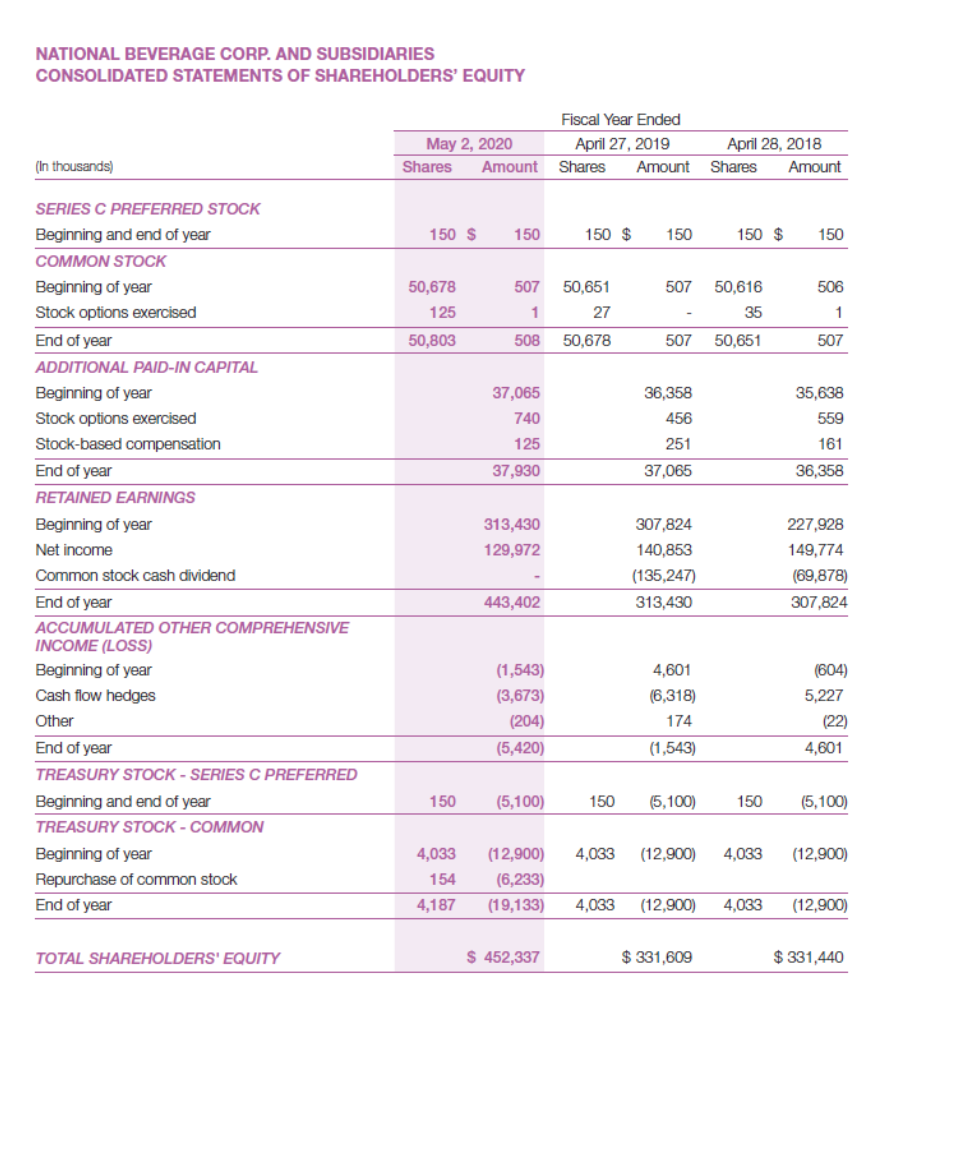

Transactions related to Shareholders Equity

For each activity below, provide the accounting entry made by National Beverage (with amounts):

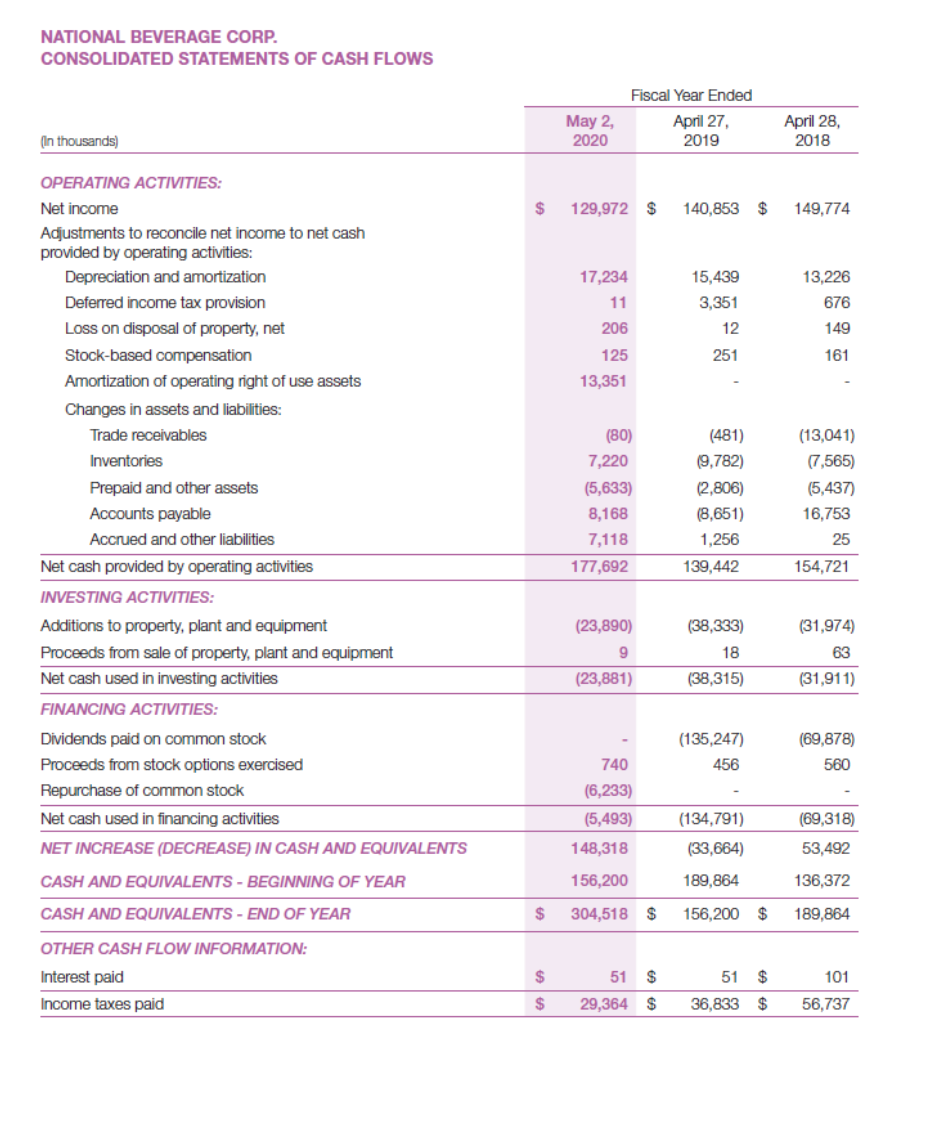

D) Record the declaration and payment of dividends for the fiscal year ended April 27, 2019.

E) Record the purchase of common shares for the fiscal year ended May 2, 2020.

4. Preferred Stock

F) What is the par value of each share of preferred stock issued?

G) How much did National Beverage pay for Treasury Stock of preferred shares it held at fiscal year-end 2020?

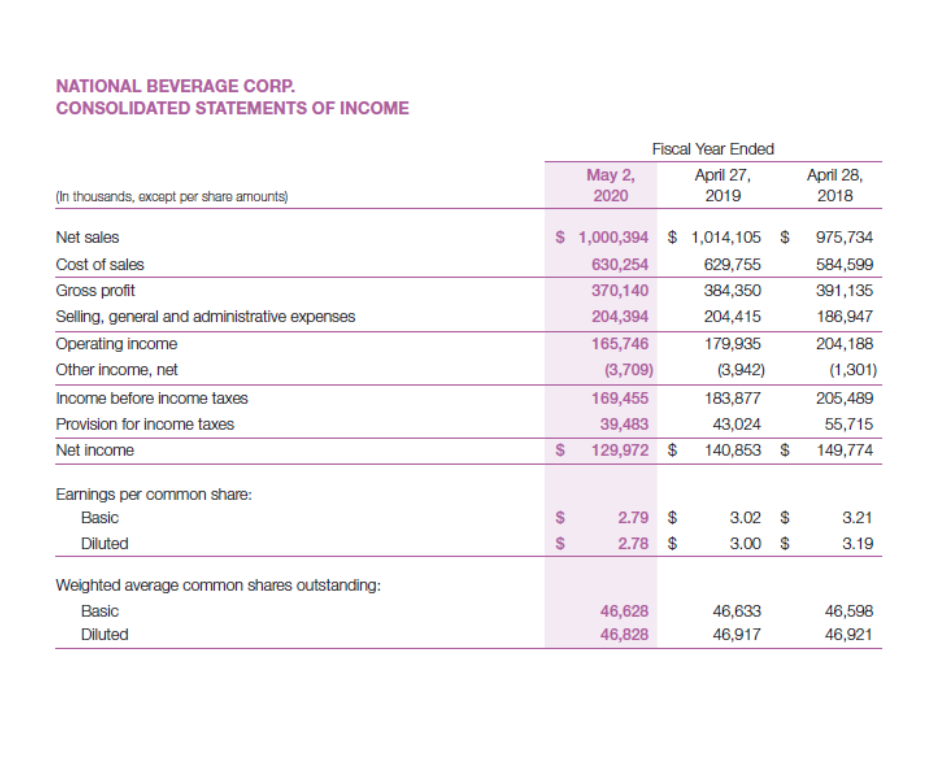

5. Earnings per Share

H) What is Basic Earnings per Share for 2020?

I) What is Diluted Earnings per Share for 2020?

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS \begin{tabular}{|c|c|c|c|c|} \hline (In thousands, except share data) & & May2,2020 & & April27,2019 \\ \hline \multicolumn{5}{|l|}{ ASSETS } \\ \hline \multicolumn{5}{|l|}{ Current assets: } \\ \hline Cash and equivalents & $ & 304,518 & $ & 156,200 \\ \hline Trade receivables - net & & 84,921 & & 84,841 \\ \hline Inventories & & 63,482 & & 70,702 \\ \hline Prepaid and other assets & & 7,791 & & 9,714 \\ \hline Total current assets & & 460,712 & & 321,457 \\ \hline Property, plant and equipment - net & & 120,627 & & 111,316 \\ \hline Right of use assets - net & & 47,884 & & - \\ \hline Goodwill & & 13,145 & & 13,145 \\ \hline Intangible assets & & 1,615 & & 1,615 \\ \hline Other assets & & 4,663 & & 4,660 \\ \hline Total assets & $ & 648,646 & $ & 452,193 \\ \hline \multicolumn{5}{|l|}{ LIABILITIES AND SHAREHOLDERS' EQUITY } \\ \hline \multicolumn{5}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $ & 74,369 & $ & 66,202 \\ \hline Accrued liabilities & & 42,476 & & 30,433 \\ \hline Operating lease liabilities & & 16,980 & & - \\ \hline Income taxes payable & & 7,863 & & 402 \\ \hline Total current liabilities & & 141,688 & & 97,037 \\ \hline Deferred income taxes - net & & 14,823 & & 15,987 \\ \hline Operating lease liabilities- non current & & 32,159 & & - \\ \hline Other liabilities & & 7,639 & & 7,560 \\ \hline Total liabilities & & 196,309 & & 120,584 \\ \hline \multicolumn{5}{|l|}{ Shareholders' equity: } \\ \hline Preferredstock,$1parvalue-1,000,000sharesauthorizedSeriesC-150,000sharesissued & & 150 & & 150 \\ \hline Commonstock,$.01parvalue-200,000,000sharesauthorized;50,803,184shares(2020)and50,678,084shares(2019)issued & & 508 & & 507 \\ \hline Additional paid-in capital & & 37,930 & & 37,065 \\ \hline Retained earnings & & 443,402 & & 313,430 \\ \hline Accumulated other comprehensive (loss) & & (5,420) & & (1,543) \\ \hline \multicolumn{5}{|l|}{ Treasury stock - at cost: } \\ \hline Series C preferred stock - 150,000 shares & & (5,100) & & (5,100) \\ \hline Common stock - 4,187,056 shares (2020) and 4,032,544 shares (2019) & & (19,133) & & (12,900) \\ \hline Total shareholders' equity & & 452,337 & & 331,609 \\ \hline Total liabilities and shareholders' equity & $ & 648,646 & $ & 452,193 \\ \hline \end{tabular} NATIONAL BEVERAGE CORP. CONSOLIDATED STATEMENTS OF INCOME NATIONAL BEVERAGE CORP. CONSOLIDATED STATEMENTS OF CASH FLOWS \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ (In thousands) } & \multicolumn{6}{|c|}{ Fiscal Year Ended } \\ \hline & & May2,2020 & & April27,2019 & & April28,2018 \\ \hline \multicolumn{7}{|l|}{ OPERATING ACTIVITIES: } \\ \hline Net income & $ & 129,972 & $ & 140,853 & $ & 149,774 \\ \hline \multicolumn{7}{|l|}{Adjustmentstoreconcilenetincometonetcashprovidedbyoperatingactivities:} \\ \hline Depreciation and amortization & & 17,234 & & 15,439 & & 13,226 \\ \hline Deferred income tax provision & & 11 & & 3,351 & & 676 \\ \hline Loss on disposal of property, net & & 206 & & 12 & & 149 \\ \hline Stock-based compensation & & 125 & & 251 & & 161 \\ \hline Amortization of operating right of use assets & & 13,351 & & - & & - \\ \hline \multicolumn{7}{|l|}{ Changes in assets and liabilities: } \\ \hline Trade receivables & & (80) & & (481) & & (13,041) \\ \hline Inventories & & 7,220 & & (9,782) & & (7,565) \\ \hline Prepaid and other assets & & (5,633) & & (2,806) & & (5,437) \\ \hline Accounts payable & & 8,168 & & (8,651) & & 16,753 \\ \hline Accrued and other liabilities & & 7,118 & & 1,256 & & 25 \\ \hline Net cash provided by operating activities & & 177,692 & & 139,442 & & 154,721 \\ \hline \multicolumn{7}{|l|}{ INVESTING ACTIVITIES: } \\ \hline Additions to property, plant and equipment & & (23,890) & & (38,333) & & (31,974) \\ \hline Proceeds from sale of property, plant and equipment & & 9 & & 18 & & 63 \\ \hline Net cash used in investing activities & & (23,881) & & (38,315) & & (31,911) \\ \hline \multicolumn{7}{|l|}{ FINANCING ACTIVITIES: } \\ \hline Dividends paid on common stock & & - & & (135,247) & & (69,878) \\ \hline Proceeds from stock options exercised & & 740 & & 456 & & 560 \\ \hline Repurchase of common stock & & (6,233) & & - & & - \\ \hline Net cash used in financing activities & & (5,493) & & (134,791) & & (69,318) \\ \hline NET INCREASE (DECREASE) IN CASH AND EQUIVALENTS & & 148,318 & & (33,664) & & 53,492 \\ \hline CASH AND EQUIVALENTS - BEGINNING OF YEAR & & 156,200 & & 189,864 & & 136,372 \\ \hline CASH AND EQUIVALENTS - END OF YEAR & $ & 304,518 & $ & 156,200 & $ & 189,864 \\ \hline \multicolumn{7}{|l|}{ OTHER CASH FLOW INFORMATION: } \\ \hline Interest paid & $ & 51 & $ & 51 & $ & 101 \\ \hline Income taxes paid & $ & 29,364 & $ & 36,833 & $ & 56,737 \\ \hline \end{tabular} NATIONAL BEVERAGE CORP. AND SUBSIDIARIES CONSOI INATE STATEMENTS OF SHADEHOI REDS' FOIIITV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started