Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Common stock valuation) Assume the following: - the investor's required rate of return is 12.5 percent, - the expected level of earnings at the end

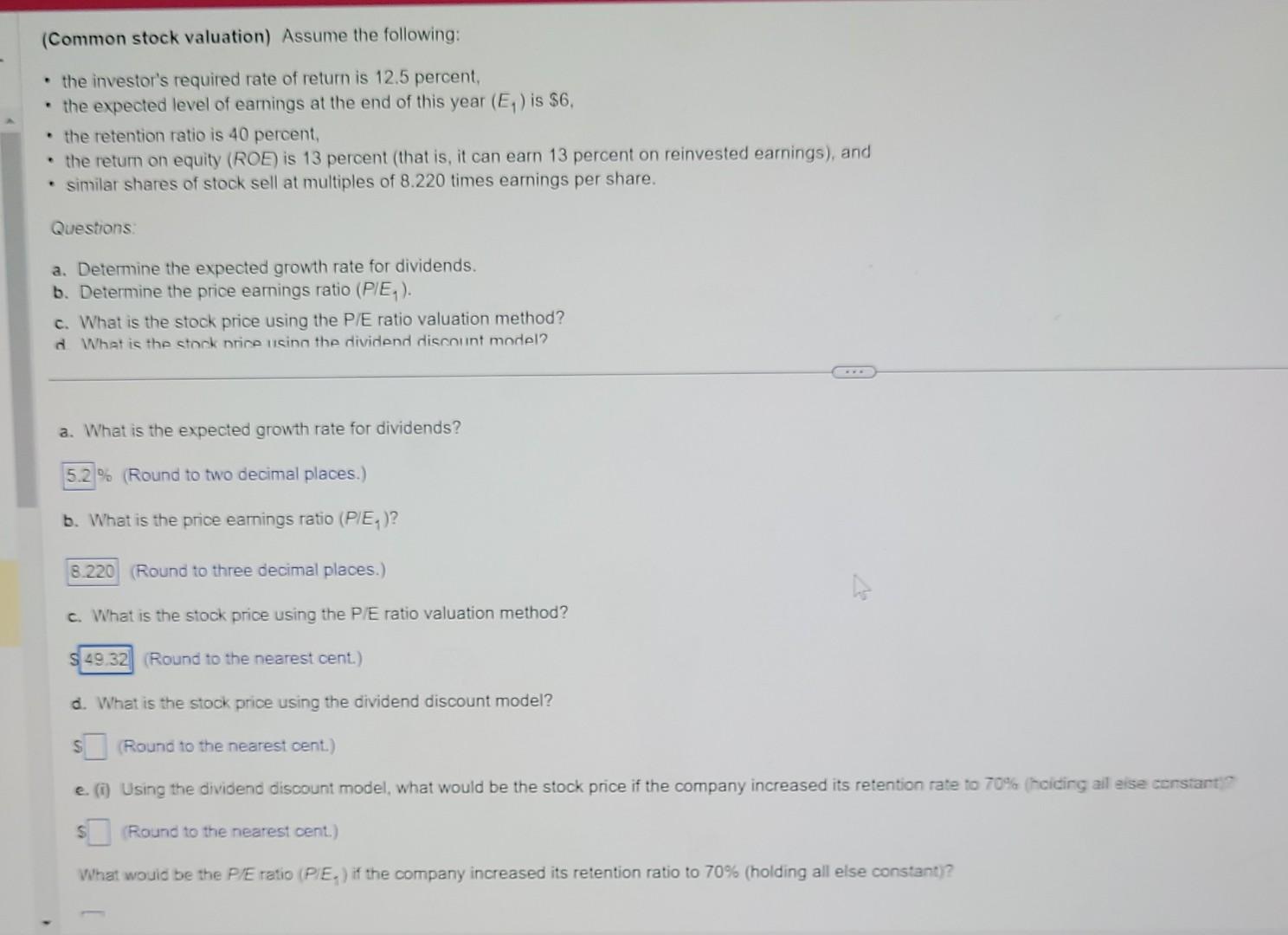

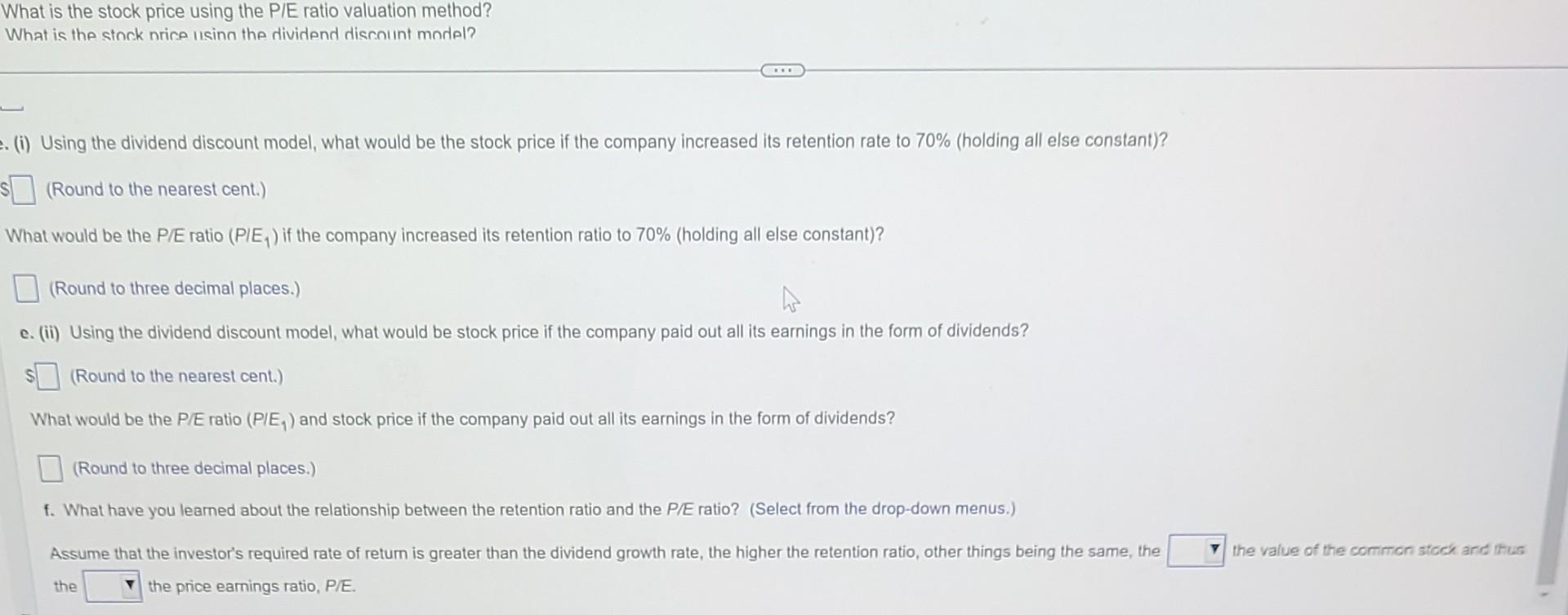

(Common stock valuation) Assume the following: - the investor's required rate of return is 12.5 percent, - the expected level of earnings at the end of this year (E1) is $6, - the retention ratio is 40 percent, - the return on equity (ROE) is 13 percent (that is, it can earn 13 percent on reinvested earnings), and - similar shares of stock sell at multiples of 8.220 times earnings per share. Questions: a. Determine the expected growth rate for dividends. b. Determine the price earnings ratio (P(E1). c. What is the stock price using the P/E ratio valuation method? d. What is the cinck nrine 1 cinn the dividend disonunt modol? a. What is the expected growth rate for dividends? \% (Round to two decimal places.) b. What is the price earnings ratio (P(E1) ? (Round to three decimal places.) c. What is the stock price using the P/E ratio valuation method? (Round to the nearest cent) d. What is the stock price using the dividend discount model? (Round to the nearest oent) e. (i) Using the dividend discount model, what would be the stock price if the company increased its retention rate to 70% (hcicirg ail eise censtant (Round to the nearest oent.) What wouid be the P/E ratio (PIE ) if the company increased its retention ratio to 70% (holding all else constant)? What is the stock price using the P/E ratio valuation method? What is the stnok nrire usinn the dividend disronnt mondel? (i) Using the dividend discount model, what would be the stock price if the company increased its retention rate to 70% (holding all else constant)? (Round to the nearest cent.) What would be the P/E ratio (PIE1 ) if the company increased its retention ratio to 70% (holding all else constant)? (Round to three decimal places.) c. (ii) Using the dividend discount model, what would be stock price if the company paid out all its earnings in the form of dividends? S (Round to the nearest cent.) What would be the PIE ratio (PIE1) and stock price if the company paid out all its earnings in the form of dividends? (Round to three decimal places.) f. What have you learned about the relationship between the retention ratio and the P/E ratio? (Select from the drop-down menus.) Assume that the investor's required rate of return is greater than the dividend growth rate, the higher the retention ratio, other things being the same, the the value of the comimon stick and thus the the price earnings ratio, P/E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started