Answered step by step

Verified Expert Solution

Question

1 Approved Answer

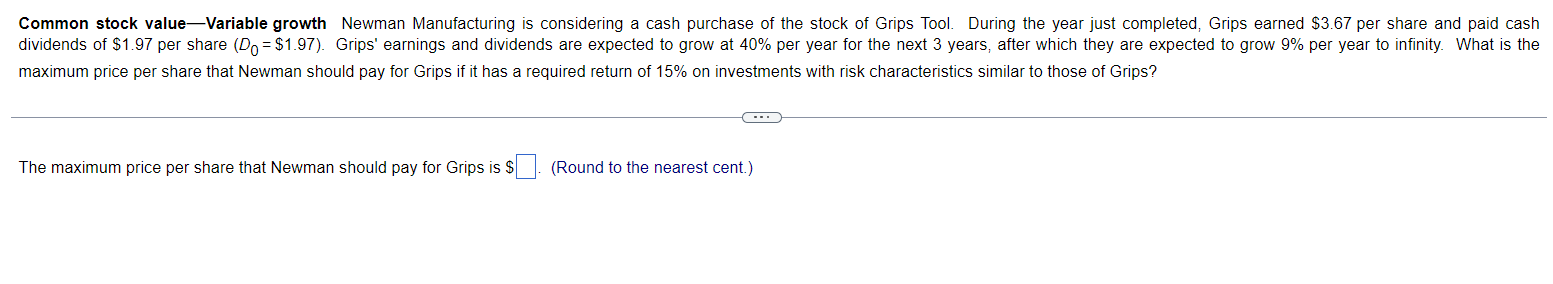

Common stock value - Variable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips

Common stock valueVariable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips earned $ per share and paid cash

dividends of $ per share $ Grips' earnings and dividends are expected to grow at per year for the next years, after which they are expected to grow per year to infinity. What is the

maximum price per share that Newman should pay for Grips if it has a required return of on investments with risk characteristics similar to those of Grips?

The maximum price per share that Newman should pay for Grips is $

Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started