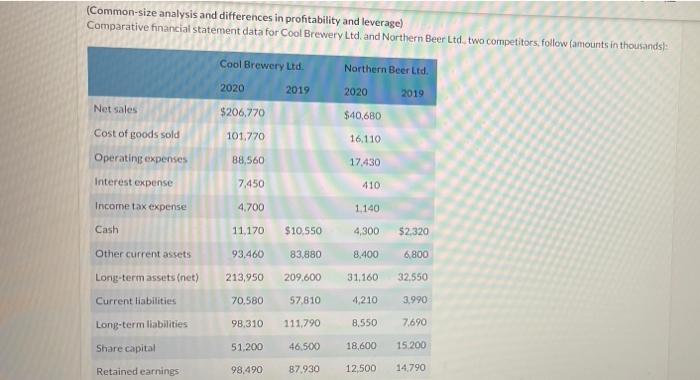

(Common-size analysis and differences in profitability and leverage) Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd., two competitors, follow (amounts

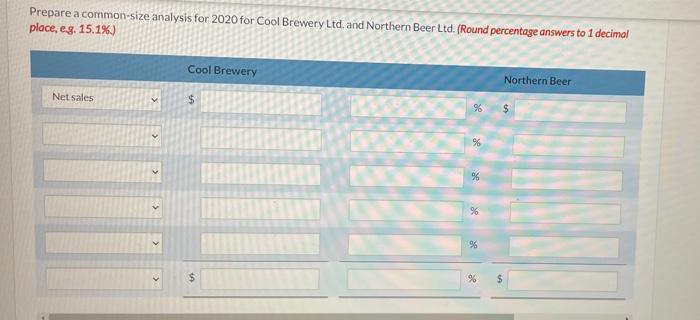

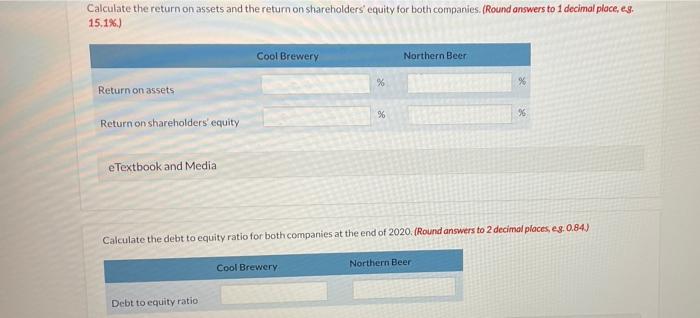

(Common-size analysis and differences in profitability and leverage) Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd., two competitors, follow (amounts in thousands): Cool Brewery Ltd. Northern Beer Ltd. 2020 2019 2020 2019 Net sales $206,770 $40,680 Cost of goods sold 101.770 16.110 Operating expenses 88,560 17,430 Interest expense 7,450 410 Income tax expense 4,700 1.140 Cash 11,170 $10,550 4,300 $2,320 Other current assets 93,460 83,880 8,400 6.800 Long-term assets (net) 213,950 209.600 31,160 32,550 Current liabilities 70,580 57.810 4,210 3,990 Long-term liabilities 98,310. 111,790 8,550 7,690 Share capital 51,200 46,500 18,600 15.200 Retained earnings 98,490 87,930 12,500 14,790 Prepare a common-size analysis for 2020 for Cool Brewery Ltd. and Northern Beer Ltd. (Round percentage answers to 1 decimal place, e.g. 15.1%) Cool Brewery Net sales $ Northern Beer % $ % % % % % Calculate the return on assets and the return on shareholders' equity for both companies. (Round answers to 1 decimal place, e.g. 15.1%) Return on assets. Return on shareholders' equity eTextbook and Media Cool Brewery Northern Beer % % % Calculate the debt to equity ratio for both companies at the end of 2020. (Round answers to 2 decimal places, eg. 0.84) Cool Brewery. Northern Beer Debt to equity ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To begin lets prepare the commonsize analysis return on assets return on shareholders equity and debt to equity ratio for Cool Brewery Ltd and Northern Beer Ltd for the year 2020 CommonSize Analysis I...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started