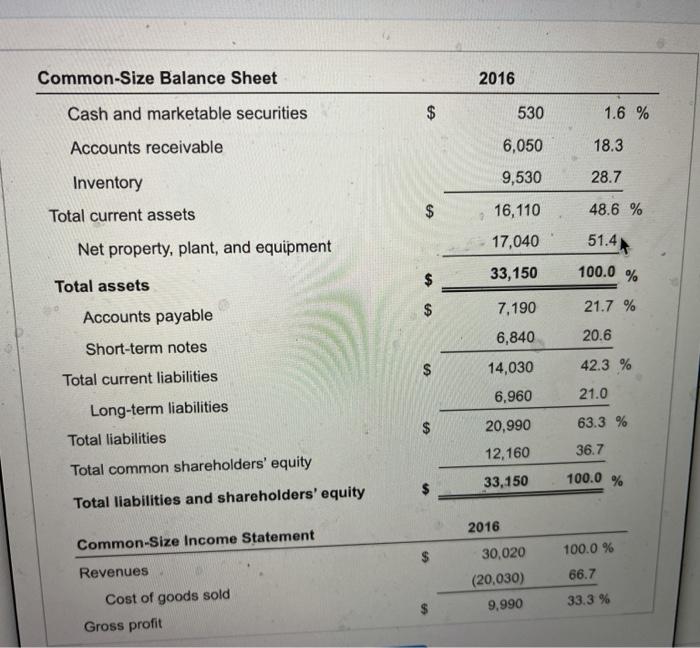

Common-Size Balance Sheet 2016 Cash and marketable securities 530 1.6 % Accounts receivable 6,050 18.3 Inventory 28.7 9,530 Total current assets $ 16,110 48.6 % 17,040 51.4 Net property, plant, and equipment 33,150 100.0 % Total assets $ $ 7,190 21.7 % Accounts payable 6,840 20.6 Short-term notes $ 42.3 % Total current liabilities 14,030 6,960 21.0 Long-term liabilities $ 63.3 % Total liabilities 20,990 12,160 36.7 Total common shareholders' equity 33,150 100.0 % Total liabilities and shareholders' equity 2016 100.0 % Common-Size Income Statement Revenues Cost of goods sold Gross profit 30,020 (20,030) 9.990 66.7 33.3 % Hinclal statements Use the common size francie statements found here respond to your bou' request that you write we your eneste omsc.. narrative that responds to the following questions a. How much cash does Patterson have on hand tells total? b. What proportion of Patterson's assets has the financed using the long termee? c. What percent of Patterson's revene does the firm have over the paying at fining d. Describe the relative importance of Patterson's mense genuing consolering med How much cash does Patterson have on hand rative? The cash Patterson has on hand relative to its lasis Round to one decimal place) Ura e Topo P4-4 (similar to) Questo (Rated to Checkpoint 4.1) (widity analysis) Airpot Motors, Inc. $2.400.000 incent and 2.000 incertis Theory. When et How much can the increase is wory who is current lingo 2.2 here ne des romano Aspe Motors, here on the nearest Common-Size Balance Sheet 2016 Cash and marketable securities 530 1.6 % Accounts receivable 6,050 18.3 Inventory 28.7 9,530 Total current assets $ 16,110 48.6 % 17,040 51.4 Net property, plant, and equipment 33,150 100.0 % Total assets $ $ 7,190 21.7 % Accounts payable 6,840 20.6 Short-term notes $ 42.3 % Total current liabilities 14,030 6,960 21.0 Long-term liabilities $ 63.3 % Total liabilities 20,990 12,160 36.7 Total common shareholders' equity 33,150 100.0 % Total liabilities and shareholders' equity 2016 100.0 % Common-Size Income Statement Revenues Cost of goods sold Gross profit 30,020 (20,030) 9.990 66.7 33.3 % Hinclal statements Use the common size francie statements found here respond to your bou' request that you write we your eneste omsc.. narrative that responds to the following questions a. How much cash does Patterson have on hand tells total? b. What proportion of Patterson's assets has the financed using the long termee? c. What percent of Patterson's revene does the firm have over the paying at fining d. Describe the relative importance of Patterson's mense genuing consolering med How much cash does Patterson have on hand rative? The cash Patterson has on hand relative to its lasis Round to one decimal place) Ura e Topo P4-4 (similar to) Questo (Rated to Checkpoint 4.1) (widity analysis) Airpot Motors, Inc. $2.400.000 incent and 2.000 incertis Theory. When et How much can the increase is wory who is current lingo 2.2 here ne des romano Aspe Motors, here on the nearest