Question

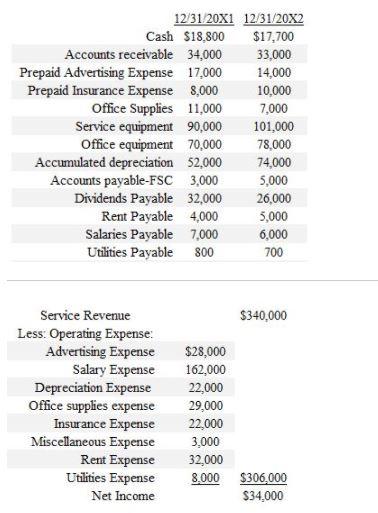

Community Co. needs help calculating the cash flows for its 20X2 Statement of Cash Flows. Services provides you with the asset and liability section from

Community Co. needs help calculating the cash flows for its 20X2 Statement of Cash Flows. Services provides you with the asset and liability section from the company's comparative balance sheet and the 20X2 income statement . All account balances provided have normal balances.

a. Understanding that all sales to customers are made on account, please select the answer choice below that shows the correct combined net cash inflow during 20X2 for the following two items: (i) cash collected from customers and (ii) cash paid for utilities.

Group of answer choices

$333,000

$331,900

$332,000

None of the answers provided are correct.

$331,100

$332,900

b. Community Inc. needs help calculating the cash flows for its 20X2 Statement of Cash Flows. Services provides you with the asset and liability section from the company's comparative balance sheet and the 20X2 income statement . All account balances provided have normal balances. Understanding that all purchases of office supplies are made on account, from vendor FSC please select the answer choice below that shows the correct combined net cash outflow during 20X2 for the following two items: (i) cash paid for purchases of office supplies and (ii) cash paid for insurance.

Group of answer choices

a. $49,000

b. $47,000

c. $45,000

d. $51,000

e. $43,000

f. None of the answers provided are correct.

c. Community Co provides you with the asset and liability balances from the company's comparative balance sheet as well as the income statement for the 12 months ended 12/31/20X2.

Using only the information provided in this question's fact pattern: if the Community owner's contributed $15,000 of capital during the twelve months ended 12/31/20X2, what was the value of dividends declared during this same time period?

a. $9,000

b. $6,000

c. $43,000

d. $49,000

e. None of the answer choices provided are correct.

f. $50,000

g. $19,000

12/31/20X1 12/31/20X2 Cash $18.800 $17,700 Accounts receivable 34,000 33,000 Prepaid Advertising Expense 17.000 14,000 Prepaid Insurance Expense 8,000 10.000 Office Supplies 11,000 7,000 Service equipment 90,000 101,000 Office equipment 70.000 78,000 Accumulated depreciation 52,000 74.000 Accounts payable-FSC 3,000 5,000 Dividends Payable 32,000 26,000 Rent Payable 4,000 5,000 Salaries Payable 7.000 6,000 Utilities Payable 800 700 $340,000 Service Revenue Less. Operating Expense: Advertising Expense Salary Expense Depreciation Expense Office supplies expense Insurance Expense Miscellaneous Expense Rent Expense Utilities Expense Net Income $28,000 162,000 22,000 29,000 22,000 3,000 32,000 8.000 $306,000 $34.000 12/31/20X1 12/31/20X2 Cash $18.800 $17,700 Accounts receivable 34,000 33,000 Prepaid Advertising Expense 17.000 14,000 Prepaid Insurance Expense 8,000 10.000 Office Supplies 11,000 7,000 Service equipment 90,000 101,000 Office equipment 70.000 78,000 Accumulated depreciation 52,000 74.000 Accounts payable-FSC 3,000 5,000 Dividends Payable 32,000 26,000 Rent Payable 4,000 5,000 Salaries Payable 7.000 6,000 Utilities Payable 800 700 $340,000 Service Revenue Less. Operating Expense: Advertising Expense Salary Expense Depreciation Expense Office supplies expense Insurance Expense Miscellaneous Expense Rent Expense Utilities Expense Net Income $28,000 162,000 22,000 29,000 22,000 3,000 32,000 8.000 $306,000 $34.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started