Answered step by step

Verified Expert Solution

Question

1 Approved Answer

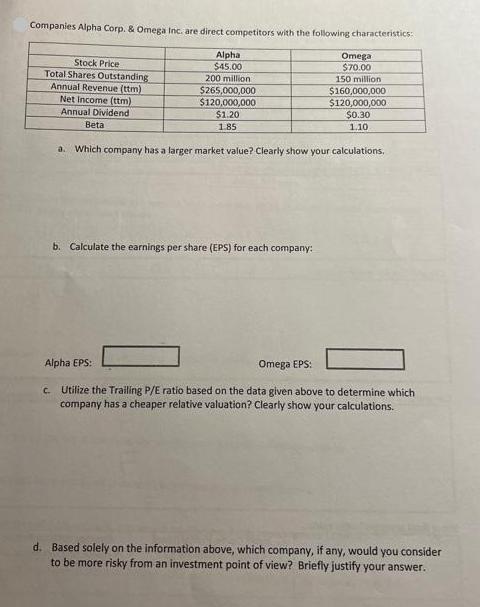

Companies Alpha Corp. & Omega Inc. are direct competitors with the following characteristics: Alpha $45.00 200 million $265,000,000 $120,000,000 $1.20 1.85 Stock Price Total

Companies Alpha Corp. & Omega Inc. are direct competitors with the following characteristics: Alpha $45.00 200 million $265,000,000 $120,000,000 $1.20 1.85 Stock Price Total Shares Outstanding Annual Revenue (ttm) Net Income (ttm) Annual Dividend Beta Omega $70.00 150 million $160,000,000 $120,000,000 $0.30 1.10 a. Which company has a larger market value? Clearly show your calculations, b. Calculate the earnings per share (EPS) for each company: Alpha EPS: Omega EPS: c. Utilize the Trailing P/E ratio based on the data given above to determine which company has a cheaper relative valuation? Clearly show your calculations. d. Based solely on the information above, which company, if any, would you consider to be more risky from an investment point of view? Briefly justify your answer.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the market value of each company we need to multiply the stock price by the total sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started