Question

Companies in the biotechnology industry can have significant valuations even though they have no revenue stream. Their value comes from their future cash flow opportunities,

Companies in the biotechnology industry can have significant valuations even though they have no revenue stream. Their value comes from their future cash flow opportunities, because their products are in early stages of development.

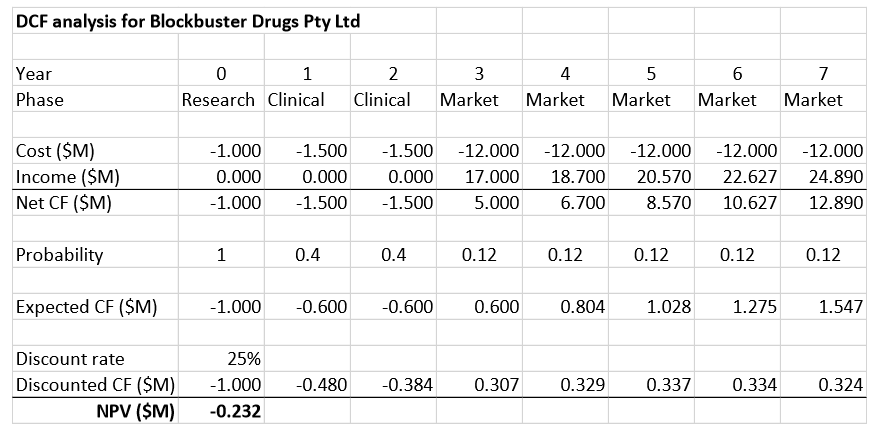

Your challenge is to value Blockbuster Drugs Pty Ltd which is about to conduct preliminary research about the viability of an idea. Their initial research will take 1 year and cost $1M, and there is a 40% probability that it will deliver results that are good enough to justify proceeding. The next step would be clinical trials which will take 2 years at a cost of $1.5M per year, with a probability of 30% of success. If the trials succeed, the drug can proceed to market. In the marketing phase, there is a $12M cost of marketing each year, and the sales can continue for up to five years. A successful drug will earn a net profit of $17M in its first year on market, and this figure can be expected to grow at 10% per year but a standard deviation of 100%.

Your company requires a rate of return of 25% for this kind of risky project, so a straight DCF analysis of the expected cash flows produces the following disappointing result:

You need to find a better way to value Blockbuster Drugs Pty Ltd. You realise that the weakness of this simple DCF approach is that is does not consider the real options to abandon the project at many points along the way. It is as if the DCF has a European style of not contemplating early exercise of abandonment, whereas in reality we can exercise that option early if things go bad.

Your task is to build a binomial tree model to value Blockbuster Drugs Pty Ltd. If your model is correct, you should get the same valuation as this simple DCF model when your model is in European style (no early exercise). You will then be able to estimate the true value by allowing early abandonment at particular nodes, and updating the probabilities accordingly.

For this part you will need to submit your binomial tree showing how you value the company.

DCF analysis for Blockbuster Drugs Pty Ltd Year Phase 0 1 Research Clinical 2 Clinical 3 Market 4 Market 5 Market 6 Market 7 Market Cost ($M) Income ($M) Net CF ($M) -1.000 0.000 -1.000 -1.500 0.000 -1.500 -1.500 0.000 -1.500 -12.000 17.000 5.000 -12.000 18.700 6.700 -12.000 20.570 8.570 -12.000 22.627 10.627 -12.000 24.890 12.890 Probability 1 0.4 0.4 0.12 0.12 0.12 0.12 0.12 Expected CF ($M) -1.000 -0.600 -0.600 0.600 0.804 1.028 1.275 1.547 Discount rate Discounted CF ($M) NPV ($M) 25% -1.000 -0.232 -0.480 -0.384 0.307 0.329 0.337 0.334 0.324Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started