Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Companies reward their shareholders in two main ways-by paying dividends or by buying back shares of stock. An increasing number of blue chips, or

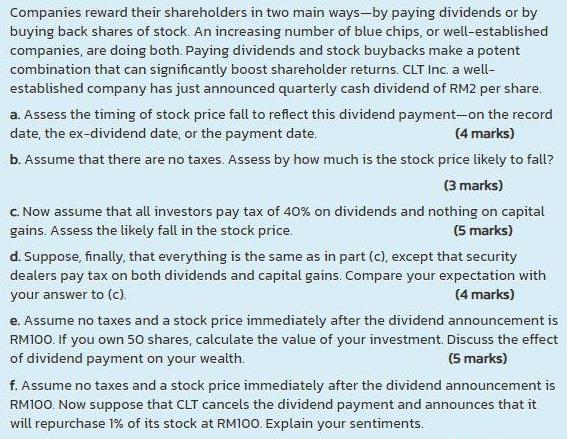

Companies reward their shareholders in two main ways-by paying dividends or by buying back shares of stock. An increasing number of blue chips, or well-established companies, are doing both. Paying dividends and stock buybacks make a potent combination that can significantly boost shareholder returns. CLT Inc. a well- established company has just announced quarterly cash dividend of RM2 per share. a. Assess the timing of stock price fall to reflect this dividend payment-on the record date, the ex-dividend date, or the payment date. (4 marks) b. Assume that there are no taxes. Assess by how much is the stock price likely to fall? (3 marks) c. Now assume that all investors pay tax of 40% on dividends and nothing on capital gains. Assess the likely fall in the stock price. (5 marks) d. Suppose, finally, that everything is the same as in part (c), except that security dealers pay tax on both dividends and capital gains. Compare your expectation with your answer to (c). (4 marks) e. Assume no taxes and a stock price immediately after the dividend announcement is RM100. If you own 50 shares, calculate the value of your investment. Discuss the effect of dividend payment on your wealth. (5 marks) f. Assume no taxes and a stock price immediately after the dividend announcement is RM100. Now suppose that CLT cancels the dividend payment and announces that it will repurchase 1% of its stock at RM100. Explain your sentiments.

Step by Step Solution

★★★★★

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a The timing of the stock price fall to reflect this dividend payment is on the record date The stock price will fall on the record date to reflect th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started