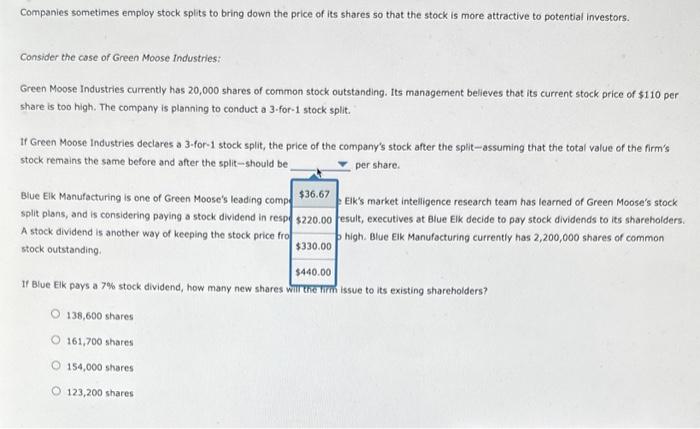

Companies sometimes employ stock splits to bring down the price of its shares so that the stock is more attractive to potential investors. Consider the case of Green Moose Industries: Green Moose Industries currently has 20,000 shares of common stock outstanding. Its management believes that its current stock price of $110 per share is too high. The company is planning to conduct a 3 -for-1 stock split. If Green Moose Industries declares a 3-for-1 stock split, the price of the company's stock after the split-assuming that the total value of the firm's stock remains the same before and after the split-should be per share. Blue Elk Manufacturing is one of Green Moose's leading competitors. Blue Elk's market intelligence research team has learned of Green Moose's stock split plans, and is considering paying a stock dividend in response. As a result, executives at Blue Elik decide to pay stock dividends to its shareholders. A stock dividend is another way of keeping the stock price from going too high. Blue Elk Manufacturing currently has 2,200,000 shares of common stock outstanding. If Blue Elk pays a 7% stock dividend, how many new shares will the firm issue to its existing shareholders? 138,600 shares 161,700 shares 154,000 shares 123,200 shares Companies sometimes employ stock splits to bring down the price of its shares so that the stock is more attractive to potential investors. Consider the cose of Green Moose Industries: Green Moose Industries currently has 20,000 shares of common stock outstanding. Its management believes that its current stock price of $110 per share is too high. The company is planning to conduct a 3-for-1 stock split. If Green Moose Industries declares a 3 -for-1 stock split, the price of the company's stock after the split-assuming that the total value of the firm's stock remains the same before and after the split-should be per share. Blue Elk Manufacturing is one of Green Moose's leading comp $36.67 split plans, and is considering paying a stock dividend in resp $220.00 besult, executives at Blue Elk decide to pay stock dividends to its shareholders. A stock dividend is another way of keeping the stock price fro $330.00 stock outstanding. 138,600 shares 161,700 shares 154,000 shares 123,200 shares