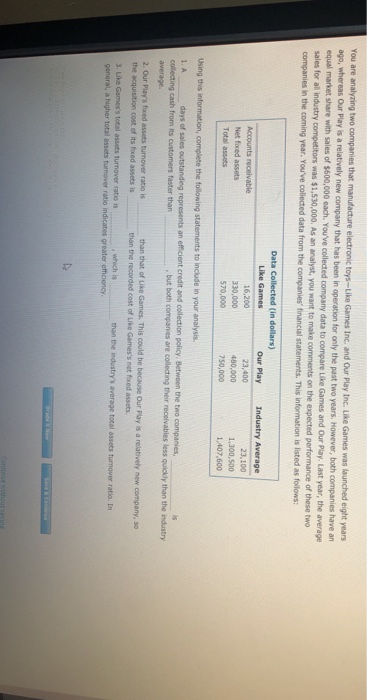

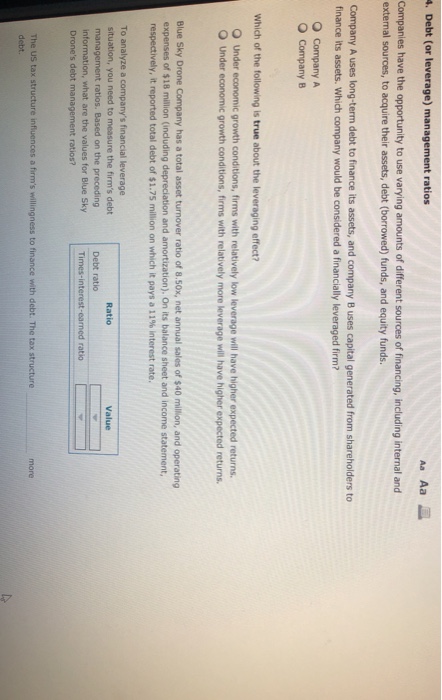

companies that manufacture electronic toys-Like Games Inc. and Our Play Inc. Like Games was launched eight years for only the past two years. However, both companies have an data to compare Like Games and Our Play Last year, the average You are analyzing two that whereas Our Play is a rela equal market share with sales of $600,000 each. You've collected compan sales for all industry competitors was $1,530,000. As an analyst, you want t companies in the coming year. You've collected data from the companies tinancial statements. This information is listed that has been in to make comments on the expected performance of these two Data Collected (in dollars) Our Play 23,400 480,000 750,000 Industry Average 23,100 1,300,500 1,407,600 16,200 330,000 Net foxed assets Total assets using this information, complete the following statements to include in your analysis. but both companies are collecting their receivables less quickly than the industry 2. Our Play's fixed assets turnover ratio is the acquisition cost of its fixed assets is 3. Like Games's total assets turnover ratio is general, a higher total assets tunover ratio indicates greater efficioncy than that of Lke Games. This could be because Our Play is a relatively new company, so companies that manufacture electronic toys-Like Games Inc. and Our Play Inc. Like Games was launched eight years for only the past two years. However, both companies have an data to compare Like Games and Our Play Last year, the average You are analyzing two that whereas Our Play is a rela equal market share with sales of $600,000 each. You've collected compan sales for all industry competitors was $1,530,000. As an analyst, you want t companies in the coming year. You've collected data from the companies tinancial statements. This information is listed that has been in to make comments on the expected performance of these two Data Collected (in dollars) Our Play 23,400 480,000 750,000 Industry Average 23,100 1,300,500 1,407,600 16,200 330,000 Net foxed assets Total assets using this information, complete the following statements to include in your analysis. but both companies are collecting their receivables less quickly than the industry 2. Our Play's fixed assets turnover ratio is the acquisition cost of its fixed assets is 3. Like Games's total assets turnover ratio is general, a higher total assets tunover ratio indicates greater efficioncy than that of Lke Games. This could be because Our Play is a relatively new company, so