Answered step by step

Verified Expert Solution

Question

1 Approved Answer

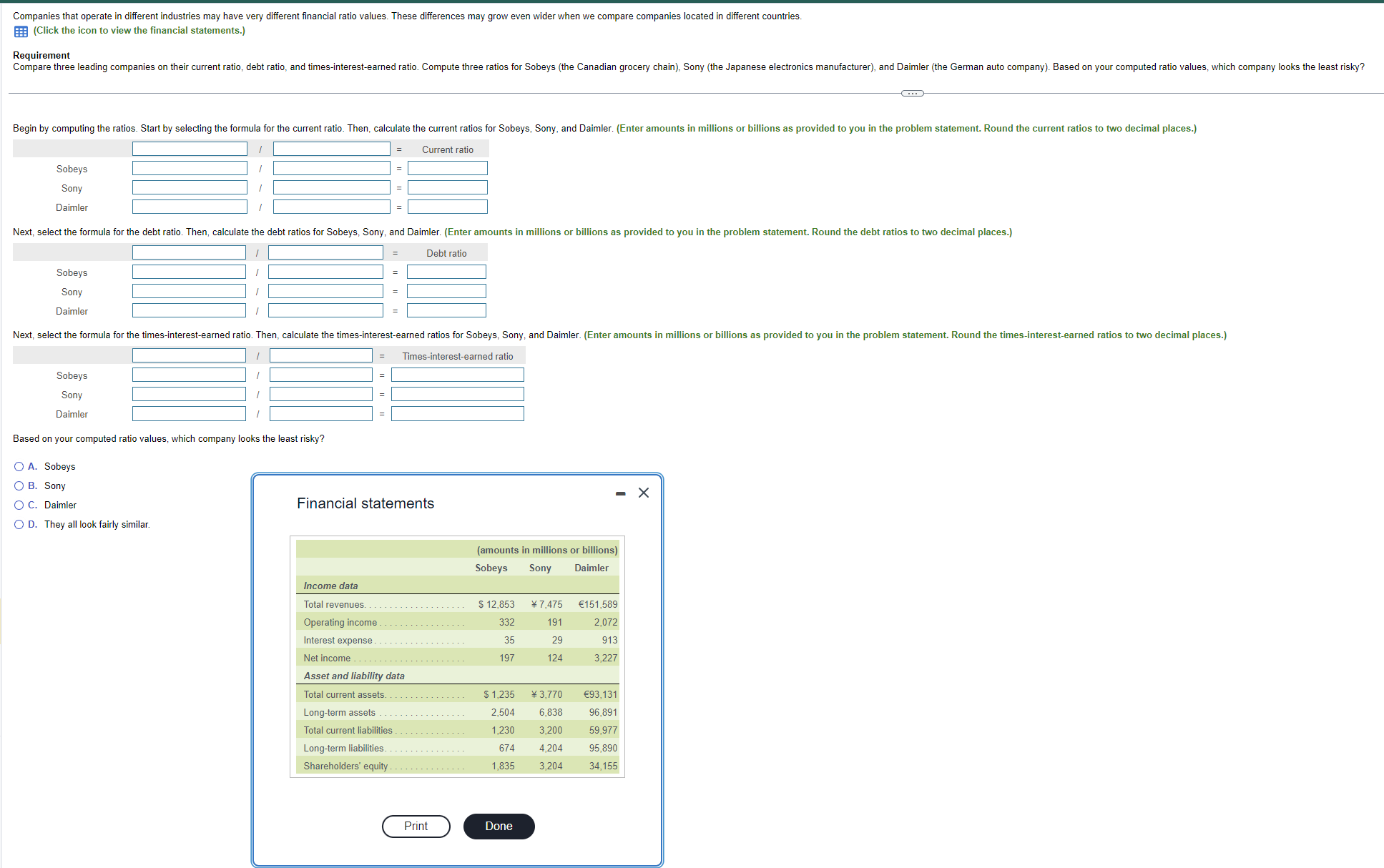

Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located

Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. (Click the icon to view the financial statements.) Requirement Compare three leading companies on their current ratio, debt ratio, and times-interest-earned ratio. Compute three ratios for Sobeys (the Canadian grocery chain), Sony (the Japanese electronics manufacturer), and Daimler (the German auto company). Based on your computed ratio values, which company looks the least risky? Begin by computing the ratios. Start by selecting the formula for the current ratio. Then, calculate the current ratios for Sobeys, Sony, and Daimler. (Enter amounts in millions or billions as provided to you in the problem statement. Round the current ratios to two decimal places.) Sobeys Sony = Current ratio Daimler Next, select the formula for the debt ratio. Then, calculate the debt ratios for Sobeys, Sony, and Daimler. (Enter amounts in millions or billions as provided to you in the problem statement. Round the debt ratios to two decimal places.) Sobeys Debt ratio Sony Daimler Next, select the formula for the times-interest-earned ratio. Then, calculate the times-interest-earned ratios for Sobeys, Sony, and Daimler. (Enter amounts in millions or billions as provided to you in the problem statement. Round the times-interest-earned ratios to two decimal places.) Times-interest-earned ratio Sobeys Sony Daimler Based on your computed ratio values, which company looks the least risky? O A. Sobeys B. Sony C. Daimler OD. They all look fairly similar. = = Financial statements Sony (amounts in millions or billions) Sobeys Daimler Income data Total revenues. Operating income............... Interest expense. Net income $ 12,853 7,475 151,589 332 191 2,072 35 197 29 913 124 3,227 Asset and liability data Total current assets. $ 1,235 Long-term assets 2,504 3,770 6,838 93,131 96,891 Total current liabilities 1,230 3,200 59,977 Long-term liabilities. 674 4,204 95,890 Shareholders' equity 1,835 3,204 34,155 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the current ratio debt ratio and timesinterestearned ratio for Sobeys Sony and Daimler ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started