Question

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $55 per unit. The company, which is currently

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $55 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 37% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows:

| Direct materials | $29 |

| Direct labor | 16 |

| Factory overhead (37% of direct labor) | 5.92 |

| Total cost per unit | $50.92 |

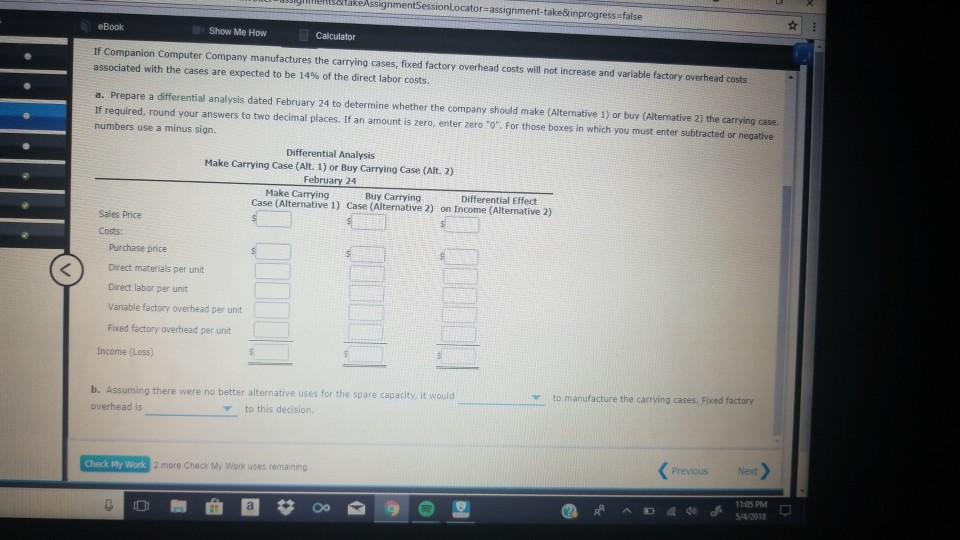

If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 14% of the direct labor costs.

takeAssignmentSessionLocator-assignment-take&inprogress false eBook Show Me How Calculator If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 14% of the direct labor costs a. Prepare a differential analysis dated February 24 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the carrying case. If required, round your answers to two decimal places. If an amount is zero, enter zero "O". For those boxes in which you must enter subtracted or negative numbers use a minus sign Differential Analysis Make Carrying Case (Alt. 1) or Buy Carrying Case (Alt. 2) February 24 Make Carrying Case (Alternative 1) Buy Carrying Case (Alternative 2) Differential Effect on Income (Alternative 2) Sales Price Costs Purchase price KDrect materials per unit Direct labor per unit Variable factory overhead per unit Fixed factory overhead per unit Income (Loss) to manufacture the carrying cases. Fixed factory b. Assuming there were no better alternative uses for the spare capacity, it would overhead is v to this decision Previous Next Check hy Wark2 more Check My won more Check My Work uses remaining 11:05 PMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started